📋 Key Facts at a Glance 15% IIT Cap: Hong Kong residents working in the......

Navigating the Cross-Border Tax Challenges for Startups For a burgeoning startup based in the United......

Hong Kong's Distinct Tax Framework Hong Kong operates under a highly distinct and globally recognized......

📋 Key Facts at a Glance Comprehensive Treaty Network: Hong Kong has signed comprehensive Double......

📋 Key Facts at a Glance Universal Application: Hong Kong applies property rates equally to......

📋 Key Facts at a Glance Section 80 Penalties: Fines up to HK$10,000 plus up......

📋 Key Facts at a Glance Basic Personal Allowance: HK$132,000 for 2024/25 tax year Home......

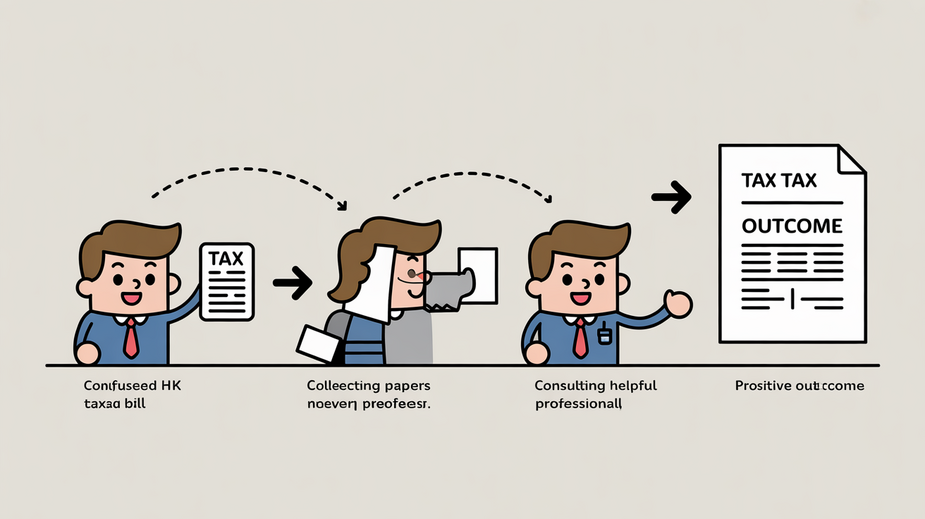

Understanding Hong Kong Profits Tax Assessments Receiving a profits tax assessment from the Inland Revenue......

📋 Key Facts at a Glance Objection Deadline: One month from the date of issue......

📋 Key Facts at a Glance MPF Early Access: You can withdraw MPF funds from......

MPF vs Traditional Pension Plans: Key Differences Understanding the nature of your retirement savings scheme......

📋 Key Facts at a Glance Professional Qualifications: Only CPAs (HKICPA) and Chartered Tax Advisers......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308