Key Facts Proactive internal audits significantly reduce IRD audit risk by identifying and correcting compliance......

Hong Kong's Procurement Appeal Versus Tax Reality Hong Kong has long been a favored location......

Eligibility Criteria for Dependent Parent Allowances Securing dependent parent allowances in Hong Kong requires meeting......

How to Structure a Hong Kong Family Office for Dual Hong Kong-Mainland China Tax Efficiency......

Defining Substance Requirements in Tax Law In international taxation, the concept of "substance" has become......

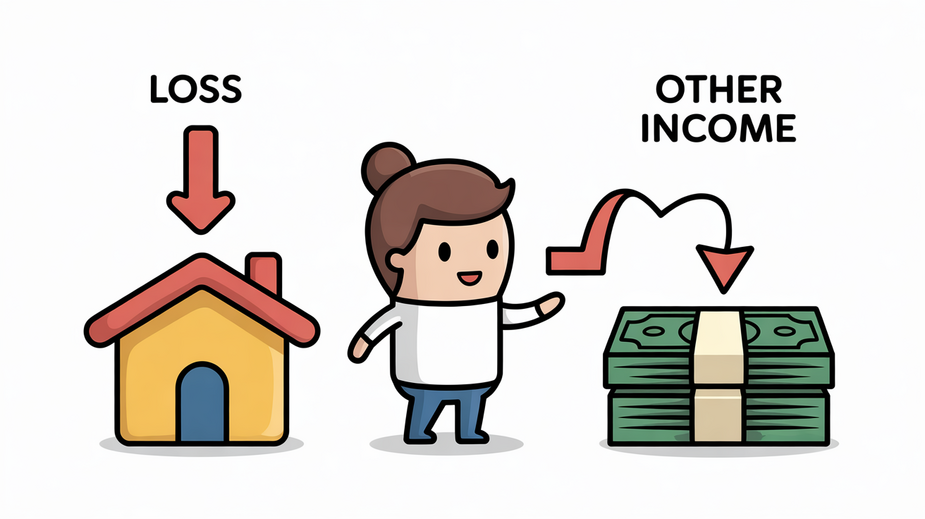

Understanding Rental Losses in Hong Kong Property Tax In Hong Kong's property tax system, a......

Understanding Hong Kong’s Framework for Charitable Trusts Establishing a charitable trust in Hong Kong provides......

The Consequences of Non-Compliance: Real-Life Hong Kong Tax Audit Cases The Consequences of Non-Compliance: Real-Life......

Understanding Hong Kong's Capital Gains Tax Framework Individuals managing investments or operating within Hong Kong......

Understanding Transfer Pricing Fundamentals Transfer pricing is a crucial component of international taxation, specifically governing......

Understanding Hong Kong's Customs Framework Navigating the complexities of international trade requires a firm grasp......

Key Tax Reform Announcements in 2024 Hong Kong's tax landscape is embarking on a significant......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308