Why SME Owners Face Unique Retirement Challenges For entrepreneurs and small-to-medium enterprise (SME) owners, navigating......

Understanding Hong Kong's Territorial Tax Framework Hong Kong distinguishes itself on the global economic stage......

Hong Kong's Profits Tax Framework and Exemption Principles Navigating Hong Kong's profits tax system effectively......

Understanding Hong Kong's Property Tax Basics Navigating property tax is a fundamental aspect of property......

Understanding the Tribunal's Role in Property Valuation The Hong Kong Property Rates Appeals Tribunal serves......

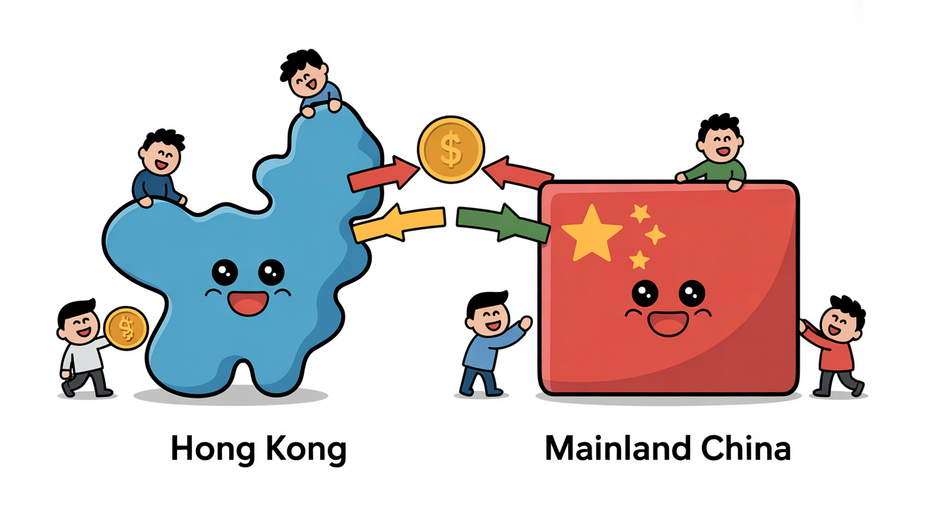

Hong Kong vs Mainland China Tax Systems Compared Navigating the distinct tax landscapes of Hong......

Core Principles of Hong Kong's Profits Tax System Navigating the landscape of business taxation in......

Core Components of the IRD Risk Framework Understanding the Inland Revenue Department's (IRD) approach to......

Is Rental Income from Family Taxable in Hong Kong? Under Hong Kong law, income generated......

Strategic Role of Tax Structures in Business Expansion Embarking on international expansion presents businesses with......

Why SME Training Investments Pay Double Dividends in Hong Kong For Hong Kong's Small and......

Understanding Hong Kong's Territorial Tax Framework and Offshore Exemption Hong Kong's tax system operates on......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308