Common Misconceptions About Offshore Claims For businesses operating internationally through a Hong Kong entity, the......

Understanding Hong Kong's Unique Territorial Tax System Hong Kong's enduring prominence as a global financial......

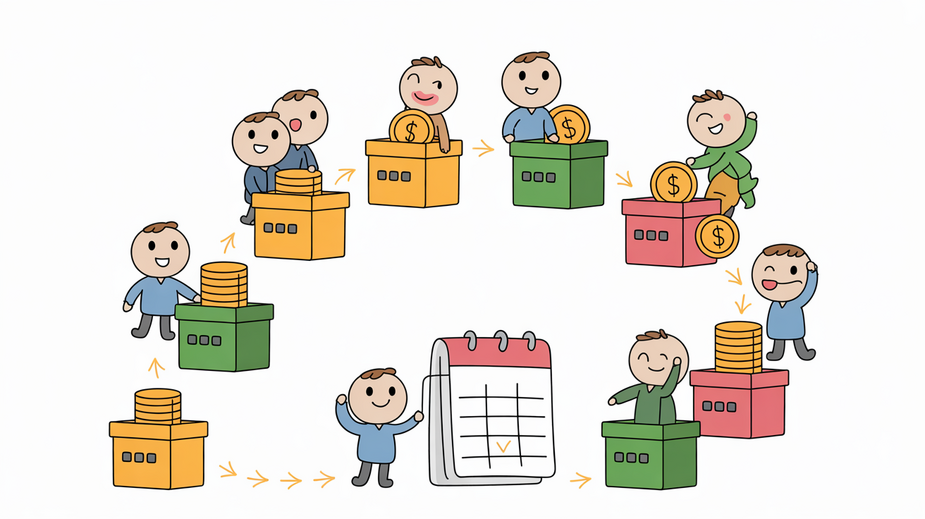

Understanding Hong Kong's MPF Scheme Fundamentals Navigating the Mandatory Provident Fund (MPF) system in Hong......

The Pros and Cons of Mediation in Hong Kong Tax Disputes Key Facts Hong Kong......

Understanding Family Offices in Hong Kong Family offices are sophisticated private wealth management structures designed......

Defining Substance Requirements in Tax Law In international taxation, the concept of "substance" has become......

How Recent Court Rulings Are Shaping Hong Kong's Tax Audit Practices How Recent Court Rulings......

Understanding the Double Taxation Arrangement Framework The Double Taxation Arrangement (DTA) between Hong Kong and......

Key Facts: Hong Kong Property Rates for Small Businesses 📊 Rate Percentage 5% of rateable......

Understanding Eligibility for Dependent Parent and Grandparent Allowances in Hong Kong Claiming dependent parent and......

Understanding Hong Kong's Tax Filing Options for Married Couples Married couples in Hong Kong navigate......

Understanding the Dynasty Trust Structure A dynasty trust represents a sophisticated evolution in wealth planning,......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308