Understanding Provisional Tax in Hong Kong Hong Kong's tax system incorporates Provisional Tax, a mechanism......

Navigating Hong Kong's Tax Documentation Essentials Understanding and adhering to Hong Kong's tax documentation standards......

Hong Kong’s Territorial Tax System Explained Hong Kong operates under a distinctive territorial basis of......

Understanding Taxable Income from Side Hustles in Hong Kong Navigating the tax implications of a......

Navigating Cross-Border Wealth Complexity Managing wealth across the dynamic border between Hong Kong and Mainland......

📋 Key Facts at a Glance Current Rate: 0.1% per party (0.2% total) on stock......

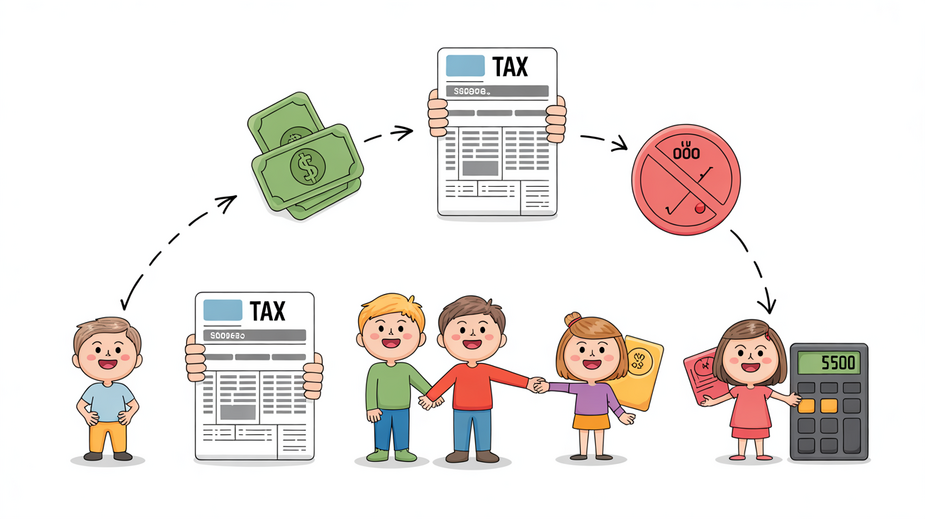

Tax Filing Implications of Marriage in Hong Kong Getting married in Hong Kong is a......

📋 Key Facts at a Glance Free Port Status: Hong Kong maintains zero import duties......

Understanding Hong Kong Tax Audit Triggers Preparing for a potential tax audit by the Hong......

📋 Key Facts at a Glance Professional Qualifications: Only CPAs (HKICPA) and Chartered Tax Advisers......

Hong Kong's Territorial Tax System Explained Hong Kong operates a territorial tax system, a fundamental......

Current State of Hong Kong's Tax Treaty Landscape Hong Kong's extensive network of Double Taxation......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308