Understanding the Disability Tax Allowance in Hong Kong Navigating personal finances while managing the challenges......

📋 Key Facts at a Glance Tax System Fundamentals: Hong Kong operates a territorial tax......

Understanding Hong Kong’s Two-Tiered Tax System for High Earners Hong Kong features a distinctive tax......

Understanding Transfer Pricing Fundamentals in Hong Kong For multinational enterprises (MNEs) operating across borders, managing......

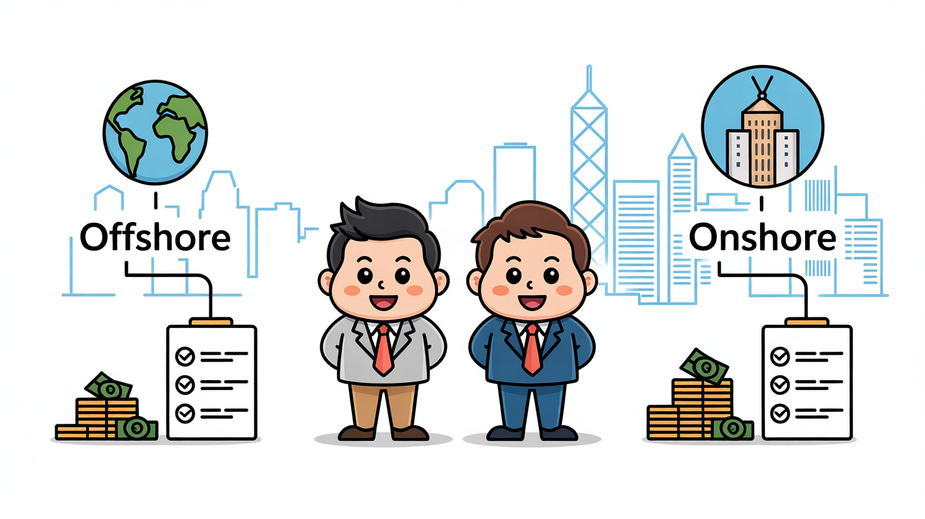

Offshore vs. Onshore Business Structures in Hong Kong: A Detailed Guide Understanding the fundamental distinctions......

Global Royalty Income: A Core Component of Modern Business In today's hyper-connected global economy, income......

📋 Key Facts at a Glance Automatic Extension: eTAX filers receive an automatic 1-month filing......

📋 Key Facts at a Glance Fact 1: Hong Kong has Comprehensive Double Taxation Agreements......

Understanding Joint Tenancy vs. Tenancy in Common in Hong Kong When acquiring property with another......

📋 Key Facts at a Glance Right to Representation: Hong Kong taxpayers have statutory rights......

📋 Key Facts at a Glance Primary Audit Focus: Offshore claims remain the IRD's top......

Understanding Eligibility for Single Parent Status in Hong Kong Tax Claiming the single parent allowance......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308