Core Mechanics of Hong Kong Limited Partnerships Understanding the foundational structure of a Hong Kong......

📋 Key Facts at a Glance Stock Transfer Stamp Duty: 0.1% per party (0.2% total)......

How Family Offices Can Optimize Wealth Preservation Through Hong Kong's Tax Laws Key Facts: Hong......

Understanding Eligibility for Single Parent Status in Hong Kong Tax Claiming the single parent allowance......

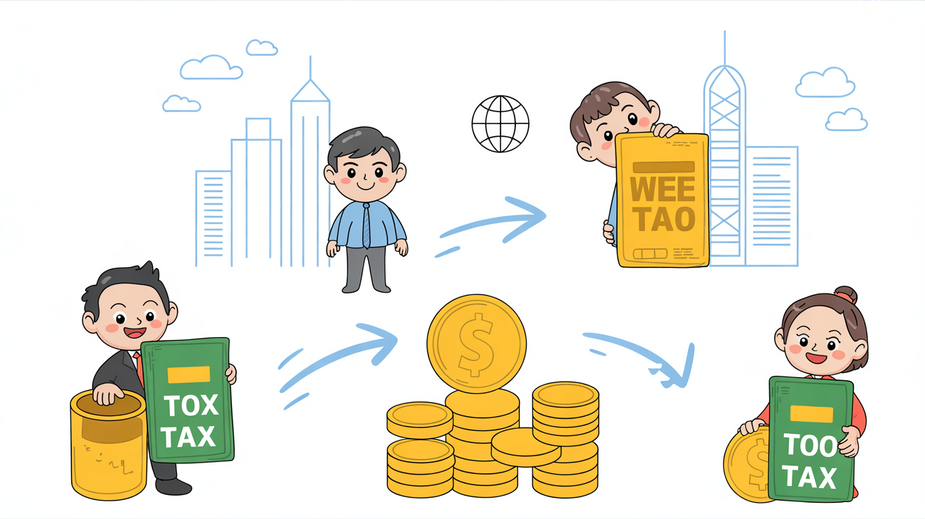

Hong Kong vs. Singapore: Positioning as Global Wealth Hubs Hong Kong and Singapore have long......

Hong Kong's Distinctive Unit Trust Environment Hong Kong's strategic location and robust financial infrastructure create......

📋 Key Facts at a Glance 15% IIT Cap: Hong Kong residents working in the......

Hong Kong’s Tax Framework for Trusts and Estates Hong Kong operates under a territorial basis......

Understanding Hong Kong Salaries Tax Fundamentals Navigating tax obligations in any jurisdiction requires a clear......

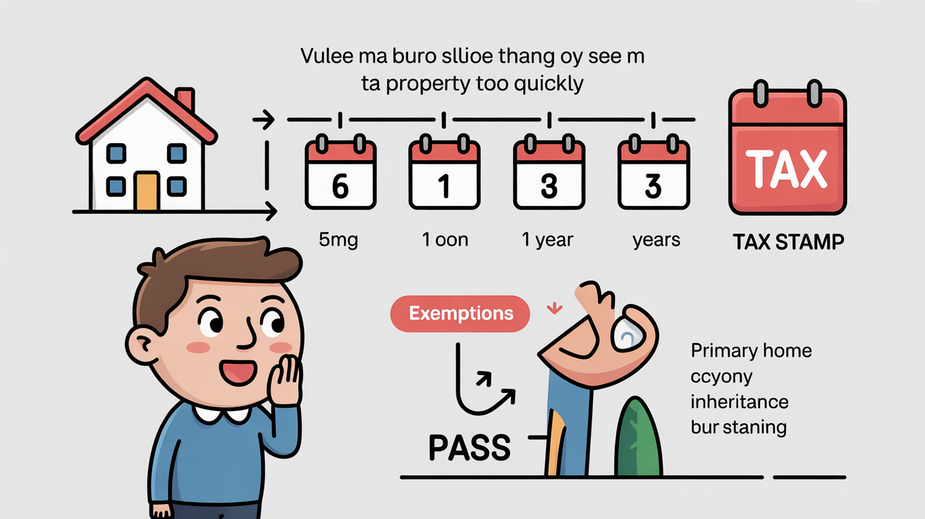

📋 Key Facts at a Glance Complete Abolition: Special Stamp Duty (SSD) was abolished on......

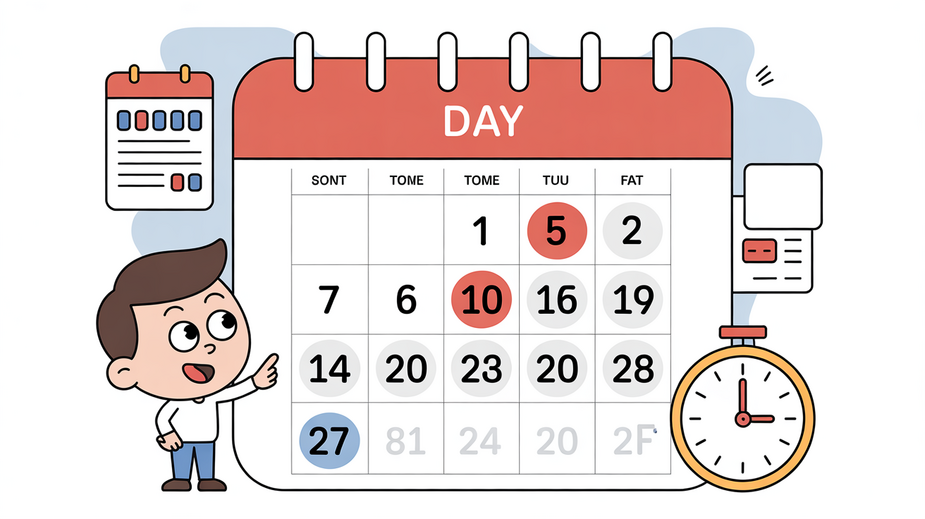

📋 Key Facts at a Glance 1-Month Deadline: All tax appeals in Hong Kong must......

Understanding Transfer Pricing Fundamentals Transfer pricing is a crucial component of international taxation, specifically governing......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308