The Rising Tide of ESG Investing in Hong Kong Hong Kong's financial landscape is witnessing......

Understanding Hong Kong's Transfer Pricing Framework in a Global Context Hong Kong has established a......

Addressing Cross-Border Tax Complexities for a Global Entrepreneur International expansion presents significant opportunities for thriving......

Understanding Hong Kong Tax Audit Triggers: Common Red Flags for the IRD Tax audits in......

Leveraging Hong Kong's Strategic Network of Trade and Tax Agreements Hong Kong is globally recognized......

Error: No article content was provided for editing. Please provide the full text of the......

Understanding Hong Kong's Stamp Duty Framework Navigating the Hong Kong property market involves various costs,......

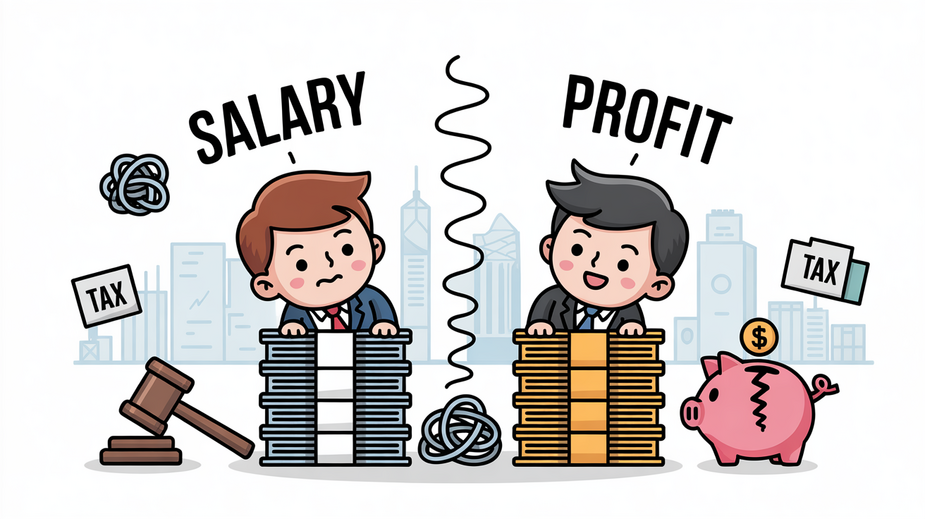

The Crucial Distinction: Director Remuneration vs. Profit Distribution in Hong Kong In Hong Kong corporate......

Current Stamp Duty Policy Landscape in Hong Kong Hong Kong's stamp duty system is a......

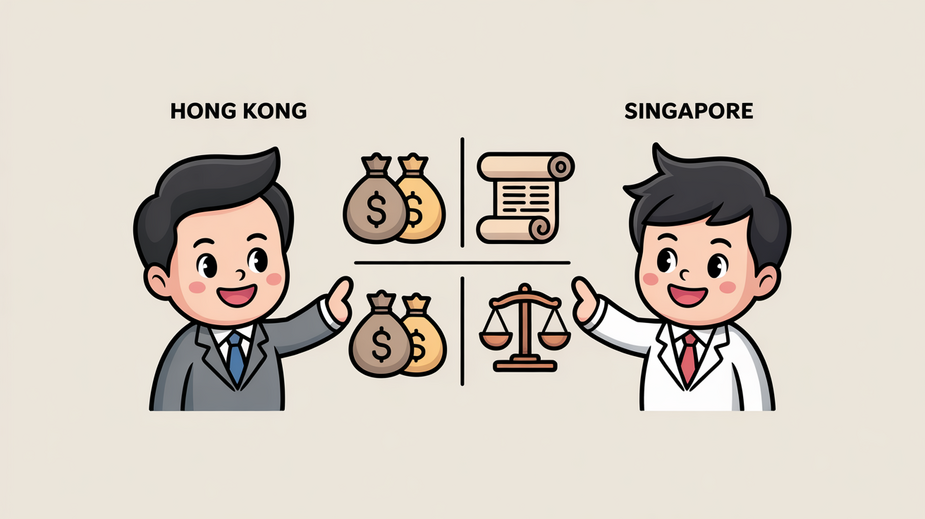

Hong Kong vs. Singapore: Positioning as Global Wealth Hubs Hong Kong and Singapore have long......

Hong Kong Stamp Duty Fundamentals for Inherited Property In Hong Kong, stamp duty is a......

Understanding Receivership and Distressed Property Basics in Hong Kong In the intricate landscape of Hong......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308