Hong Kong's Territorial Tax System Explained Understanding the foundation of Hong Kong's tax framework is......

BEPS Impact on Hong Kong’s Tax Framework The OECD's Base Erosion and Profit Shifting (BEPS)......

Understanding Offshore Trusts in Hong Kong An offshore trust is a sophisticated legal arrangement where......

Key Legal Precedents Reshaping Tax Litigation The period spanning 2022 and 2023 marked a pivotal......

Core Principles of HK-China Transfer Pricing Rules Effective navigation of the transfer pricing landscape between......

Understanding Hong Kong’s Core Tax Principles Hong Kong's tax system is renowned for its simplicity......

Unlocking Duty-Free Temporary Trade Advantages Hong Kong's Temporary Importation Scheme (TIS) offers businesses a significant......

Profits Tax Fundamentals for Hong Kong Businesses Operating a business in Hong Kong requires a......

Recognizing Potential Tax Disputes in Hong Kong For foreign entrepreneurs navigating the Hong Kong tax......

Hong Kong's Inheritance Landscape: Key Advantages and Global Context For entrepreneurs based in Hong Kong,......

Understanding Stock Options vs. Warrants In the realm of financial instruments utilized for compensation, investment,......

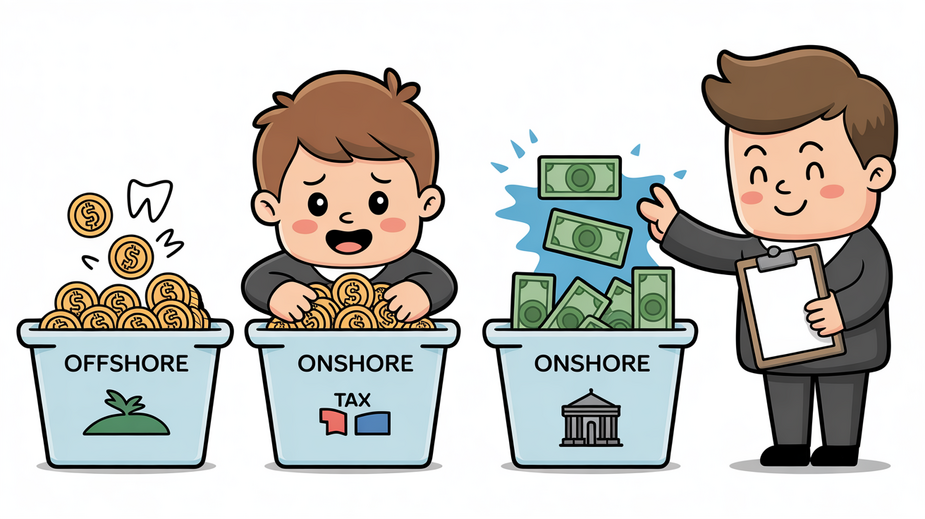

Offshore Income Classification Basics Understanding the fundamental distinction between offshore and onshore income is crucial......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308