📋 Key Facts at a Glance Territorial System: Hong Kong has taxed only locally-sourced profits......

BEPS 2.0: Fundamentals for Global Businesses The Base Erosion and Profit Shifting (BEPS) 2.0 initiative,......

Navigating Hong Kong's Distinctive Tax System: A Guide for Foreign Entrepreneurs Hong Kong operates under......

📋 Key Facts at a Glance Two-tier Profits Tax: 8.25% on first HK$2 million, 16.5%......

📋 Key Facts at a Glance FSIE Regime: Phase 1 effective January 2023, Phase 2......

Understanding Hong Kong's Territorial Tax System Hong Kong operates under a distinctive and generally favorable......

Understanding MPF's Role in Tax Reduction The Mandatory Provident Fund (MPF) System is a cornerstone......

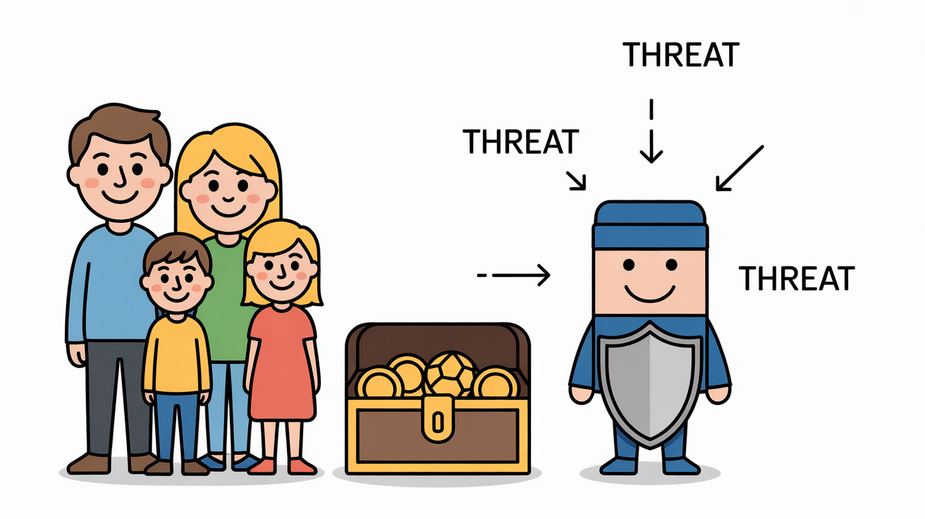

📋 Key Facts at a Glance Legal Separation: Hong Kong trusts create a legal barrier......

Decoding Hong Kong's Partnership Business Framework Hong Kong provides a diverse array of business structures,......

📋 Key Facts at a Glance Family Office Tax Concession: Hong Kong's FIHV regime offers......

Understanding Hong Kong’s Two-Tiered Tax System for High Earners Hong Kong features a distinctive tax......

Optimizing Your Hong Kong Tax Filing: A Guide to Rental Expense Deductions Navigating your personal......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308