Navigating Tax Differences: Hong Kong's Territorial vs. Mainland China's Progressive System Understanding the fundamental differences......

What Are Advance Healthcare Directives (AHDs)? Advance Healthcare Directives (AHDs) are pivotal legal instruments enabling......

Hong Kong's Transfer Pricing Framework for Financial Transactions Hong Kong's transfer pricing regime is firmly......

Hong Kong's Appeal for Expat Asset Management Hong Kong stands as a premier international financial......

Understanding Most Favored Nation (MFN) Clauses in Hong Kong Tax Treaties In the complex realm......

Why Tax Compliance Matters from Day One for Hong Kong Startups Launching a startup in......

Error: No article content was provided for editing. Please provide the full text of the......

Understanding Hong Kong's eTAX System Basics Hong Kong's eTAX system is the official online platform......

Understanding Hong Kong's Tax Treaty Network Hong Kong has cultivated an extensive and strategically important......

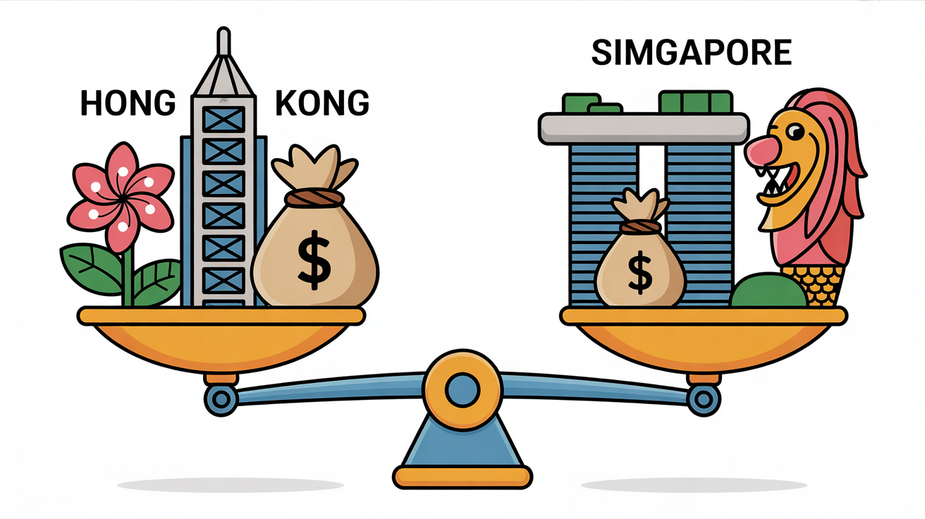

Corporate Tax Rates and Structures Compared When evaluating Hong Kong and Singapore as potential homes......

Optimizing Your Hong Kong Tax Filing: A Guide to Rental Expense Deductions Navigating your personal......

Understanding Hong Kong Property Tax for Non-Resident Landlords Owning rental property in Hong Kong while......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308