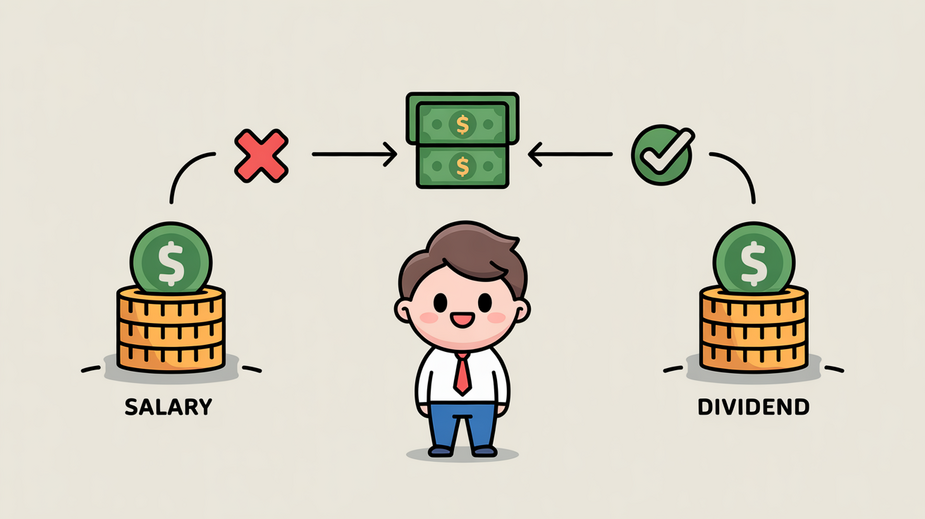

Understanding Hong Kong's Tax System Structure Navigating the tax landscape is fundamental for residents and......

Hong Kong's Evolving Transfer Pricing Enforcement Hong Kong's landscape for transfer pricing compliance has undergone......

Why Traditional Retirement Plans Fall Short for Digital Nomads The conventional approach to retirement planning......

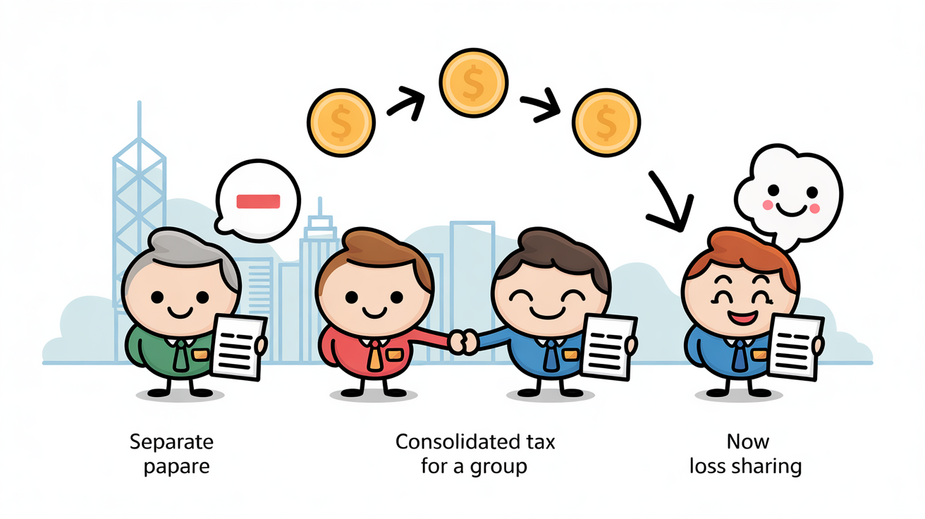

Hong Kong’s Corporate Tax Framework: Separate Entity Principle vs. Consolidated Options Hong Kong operates under......

Understanding Eligibility for Elderly Residential Care Expense Claims in Hong Kong Claiming tax deductions for......

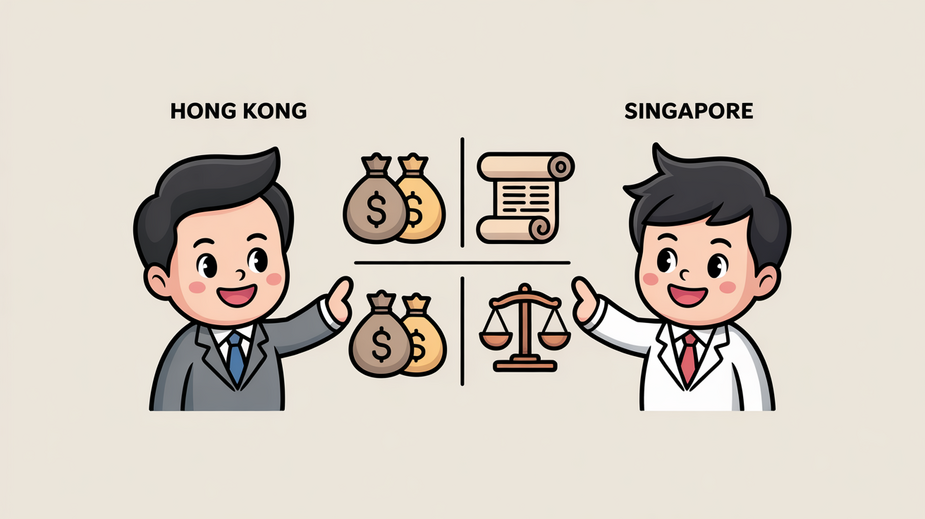

Hong Kong vs. Singapore: Positioning as Global Wealth Hubs Hong Kong and Singapore have long......

Understanding Foreign Tax Credit Basics for Expats in Hong Kong A foreign tax credit (FTC)......

Understanding Hong Kong's Territorial Tax System Hong Kong operates under a distinctive and generally favorable......

Strategic Importance of Jurisdiction Selection for Holding Structures Choosing the optimal jurisdiction for establishing a......

Misclassifying Deductible vs Non-Deductible Expenses in Hong Kong Accurately classifying business expenses is a critical......

📋 Key Facts at a Glance Stock Transfer Stamp Duty: Reduced to 0.1% per party......

Hong Kong's Stamp Duty Exemptions for Family Office Transactions: A Detailed Breakdown Hong Kong's Stamp......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308