Hong Kong's Distinctive Unit Trust Environment Hong Kong's strategic location and robust financial infrastructure create......

Understanding Hong Kong's Progressive Tax System Navigating the complexities of Hong Kong's salaries tax is......

Key Facts: Property Rates and COVID-19 Relief Pre-pandemic baseline (2019): High property valuations and strong......

Understanding Hong Kong Trust Structures Establishing a trust in Hong Kong offers a sophisticated legal......

Navigating Transfer Pricing Challenges in Global Operations Multinational enterprises operating through Hong Kong face complex......

Defining Family Offices Under Hong Kong Law Navigating tax compliance in Hong Kong begins with......

Hong Kong Trust Framework for Tax-Efficient Financing The strategic utilization of a Hong Kong trust......

Understanding Hong Kong's Trust Law Framework Navigating the landscape of Hong Kong's trust laws is......

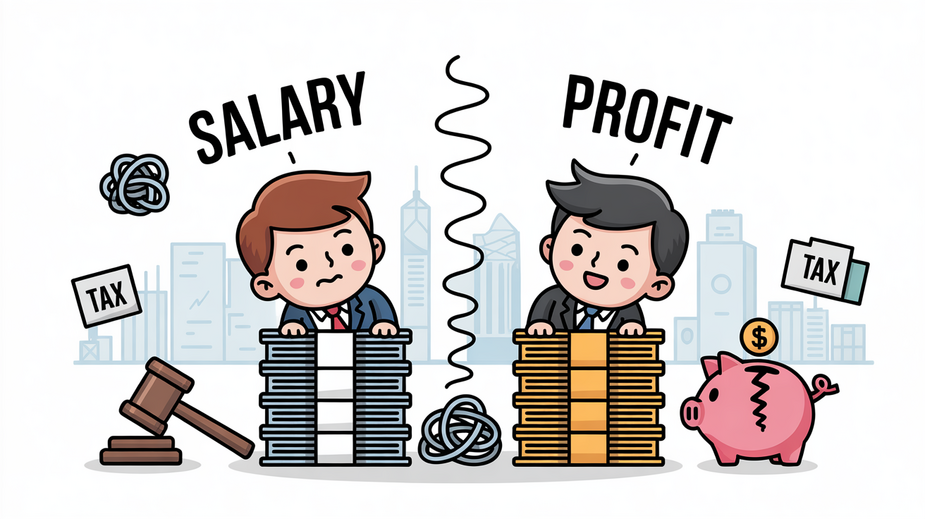

The Crucial Distinction: Director Remuneration vs. Profit Distribution in Hong Kong In Hong Kong corporate......

Navigating Liquidity Events for Family Offices in Hong Kong: Strategies for Tax Deferral For family......

Understanding Hong Kong's Profits Tax Framework Navigating business taxation is a fundamental aspect for small......

Hong Kong Property Tax Overview Hong Kong maintains a reputation for a simple and low-rate......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308