Understanding Hong Kong's Stamp Duty Basics Stamp duty constitutes a significant transaction cost within the......

Understanding HS Codes: A Global Framework for Trade The Harmonized System (HS) stands as a......

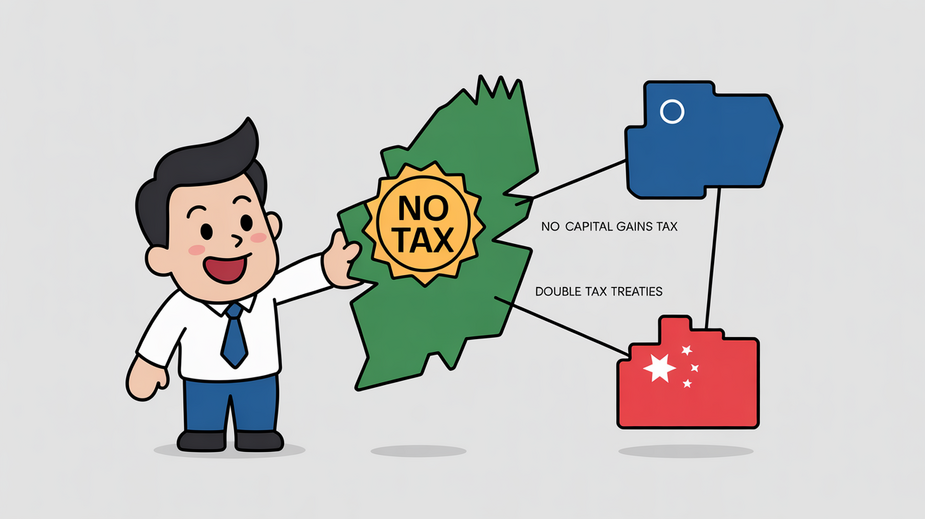

Hong Kong's Core Tax Advantages for Global Operations Hong Kong presents a compelling environment for......

Hong Kong's Approach to Taxing Capital Gains Hong Kong operates under a territorial basis of......

Understanding Hong Kong's Territorial Tax System Hong Kong distinguishes itself with a territorial tax system,......

Recognizing Potential Tax Disputes in Hong Kong For foreign entrepreneurs navigating the Hong Kong tax......

Hong Kong's Territorial Tax System Explained Hong Kong operates a territorial basis of taxation, a......

Hong Kong's Fiscal Year Structure Explained Understanding Hong Kong's fiscal year structure is fundamental for......

Navigating Transfer Pricing Challenges in Global Operations Multinational enterprises operating through Hong Kong face complex......

Defining Deductible Professional Fees in Hong Kong Understanding what constitutes a deductible professional fee is......

Recent Changes in Hong Kong's IP Tax Framework Significant updates have been implemented in Hong......

Understanding Foreign Tax Credit Basics for Expats in Hong Kong A foreign tax credit (FTC)......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308