Regulatory Foundations of Transfer Pricing

Understanding the foundational regulatory approaches is essential when comparing transfer pricing documentation requirements in Hong Kong and Mainland China. While both jurisdictions adhere to the internationally accepted arm’s length principle for related-party transactions, their underlying legal frameworks and the degree of alignment with global standards, particularly those set by the Organisation for Economic Co-operation and Development (OECD), present significant differences.

Hong Kong’s transfer pricing framework demonstrates a strong alignment with the OECD Transfer Pricing Guidelines. Its domestic legislation frequently references and incorporates OECD principles, viewing the guidelines as persuasive authority in interpreting transfer pricing issues. This close adherence provides a degree of predictability and familiarity for multinational enterprises accustomed to OECD standards, directly influencing how documentation requirements are interpreted and applied within the territory.

In contrast, Mainland China places a greater emphasis on its domestic tax laws and regulations as the primary source of authority for transfer pricing matters. While Mainland China acknowledges international norms, including the arm’s length principle, its detailed rules and administrative guidance are predominantly embedded within its own tax system. This domestic focus can lead to unique interpretations or specific requirements that may extend beyond or slightly diverge from a strict application of OECD guidelines, necessitating careful attention to local specifics.

The adoption of recommendations under the OECD/G20 Base Erosion and Profit Shifting (BEPS) project, particularly Action 13 concerning transfer pricing documentation and Country-by-Country Reporting (CbCR), further illustrates these differing regulatory foundations. Both Hong Kong and Mainland China have implemented measures based on Action 13, requiring Master File, Local File, and CbCR submissions. However, the manner of implementation, specific thresholds, and enforcement nuances reflect their respective foundations—Hong Kong integrating them more directly in line with OECD guidance, and Mainland China embedding them within its established domestic administrative processes.

This fundamental difference in approach lays the groundwork for the variations seen in the specific documentation thresholds, content requirements, and compliance procedures that businesses must navigate in each jurisdiction.

| Regulatory Aspect | Hong Kong Approach | Mainland China Approach |

|---|---|---|

| Primary Foundation | Strong OECD Alignment | Domestic Law Emphasis |

| BEPS Action 13 Integration | Direct, OECD-Influenced | Embedded in Domestic Rules |

| Interpretation Authority | OECD Guidelines persuasive | Domestic Regulations primary |

Documentation Thresholds and Triggers

Navigating the specific thresholds and triggers that necessitate transfer pricing documentation is crucial for multinational corporations operating in both Hong Kong and Mainland China. These requirements determine whether a company must prepare detailed Local Files and potentially Master Files, directly impacting the compliance burden. The distinct approaches taken by the two jurisdictions demand careful assessment by taxpayers to ensure obligations are met.

In Hong Kong, the primary trigger for preparing transfer pricing documentation generally revolves around the aggregate value of related-party transactions. Taxpayers typically need to prepare documentation if their total related-party transactions exceed a certain threshold, commonly cited around HK$220 million annually across all transaction types. This broad threshold simplifies the initial assessment but requires diligent tracking of all intercompany dealings throughout the fiscal year.

Mainland China employs a more nuanced system involving various thresholds and specific rules. While general thresholds based on total related-party transaction volume also exist, a particularly notable trigger, distinct from Hong Kong’s general approach, is the rule requiring documentation if annual intercompany loans exceed RMB50 million. This specific loan threshold means that even companies with relatively low volumes of other related-party transactions may still be required to prepare documentation solely due to their financing arrangements. Furthermore, both jurisdictions may impose documentation requirements based on the nature of the transaction or the industry sector, irrespective of these main quantitative thresholds, adding layers of complexity.

Understanding these differing thresholds and triggers is a fundamental first step in managing transfer pricing compliance effectively in the Greater China region. Companies must carefully monitor their transaction volumes and types, including intercompany financing, against the specific rules of each jurisdiction to accurately determine their documentation obligations and avoid potential non-compliance penalties.

| Jurisdiction | Primary Documentation Trigger/Threshold | Specific Threshold Example |

|---|---|---|

| Hong Kong | Aggregate annual related-party transaction value (approximately HK$220 million) | General threshold applies across transaction types |

| Mainland China | Various thresholds based on transaction type and volume | Annual intercompany loans exceeding RMB50 million trigger documentation |

Core Documentation Components

Compliance with transfer pricing rules necessitates a thorough understanding of the mandatory documentation components within each jurisdiction. Hong Kong and Mainland China, while geographically close, present differing frameworks for what constitutes sufficient transfer pricing documentation. Hong Kong largely aligns with the OECD’s widely accepted 3-tiered structure, promoting consistency with international standards. In contrast, Mainland China places significant emphasis on a comprehensive and detailed Local File, alongside the other standard components, reflecting its specific domestic tax administration needs and requirements. Navigating these distinctions is fundamental for multinational enterprises operating across both regions.

Hong Kong’s approach mandates a three-tiered documentation package for eligible taxpayers. This includes the Master File, which provides a high-level overview of the multinational enterprise’s global business operations and transfer pricing policies. The Local File, required for transactions meeting certain thresholds, details the specific intercompany transactions undertaken by the Hong Kong entity, including functional analysis and transfer pricing methods applied. Finally, the Country-by-Country Report (CbCR) is required for large MNE groups, offering tax authorities insights into the global allocation of income, taxes paid, and economic activities.

Mainland China also requires a Master File and CbCR under specific conditions, mirroring the tiered structure in principle. However, the Local File in Mainland China is notably more extensive and demanding than in many other jurisdictions, including Hong Kong. It often requires significantly more granular detail regarding transaction flows, profit analysis, comparability studies, and specific appendices. Taxpayers must provide detailed functional, asset, and risk analyses for each related-party transaction, supporting documentation for value chain analysis, and comprehensive financial data, making its preparation a considerable undertaking.

The Country-by-Country Report (CbCR), while based on OECD guidelines in both regions, has nuances in application. Submission thresholds for MNE groups typically align globally. However, the deadlines for filing and the specific requirements for notification can vary. Moreover, the depth of detail and the method of reporting may differ. Understanding these distinct requirements for each component, particularly the enhanced detail required for the Local File in Mainland China, is vital for ensuring compliance.

| Documentation Component | Hong Kong Approach | Mainland China Approach |

|---|---|---|

| Master File | Required above threshold. High-level group overview. | Required above threshold. Global business context. |

| Local File | Required above transaction threshold. Specific transaction details. | Required above threshold. Enhanced detail on transactions, functions, risks, financials. |

| Country-by-Country Report (CbCR) | Required above MNE group revenue threshold. Standard OECD format, specific deadline. | Required above MNE group revenue threshold. Standard format, potentially different deadlines/notifications. |

Successfully navigating transfer pricing documentation requirements across Hong Kong and Mainland China demands a clear understanding of their distinct approaches. Hong Kong’s tiered system offers clarity based on OECD norms, whereas Mainland China’s emphasis on an exceptionally detailed Local File requires significant preparation. Adhering to these varied requirements is vital for compliance and effective tax risk management.

Compliance Deadlines and Extensions

Navigating the statutory deadlines for transfer pricing documentation submission is critical for multinational enterprises operating in both Hong Kong and Mainland China. While both jurisdictions mandate compliance, the specific timelines and the potential for extensions present notable differences that require careful attention. Missing these deadlines can lead to significant penalties, underscoring the importance of a clear understanding of each region’s requirements.

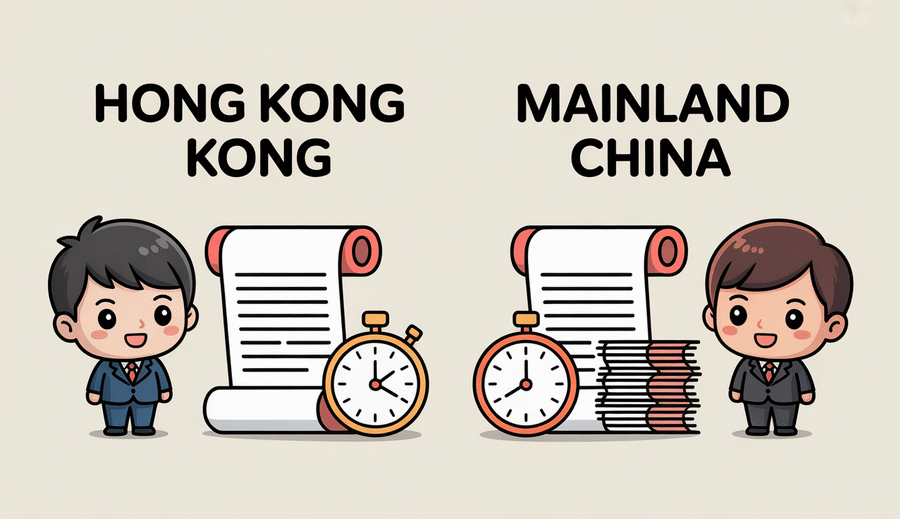

In Hong Kong, the typical timeframe for filing transfer pricing documentation is relatively tight compared to many other jurisdictions. Companies are generally required to have their documentation ready within nine months following the end of their financial year. This nine-month window aligns with the due date for filing the corporate profits tax return. Although the documentation itself isn’t submitted concurrently with the tax return, it must be prepared and available for submission upon request by the Inland Revenue Department (IRD).

Mainland China offers a slightly longer statutory deadline for submitting transfer pricing documentation. Companies there are typically required to file their documentation within twelve months after the end of the fiscal year. This provides an additional three months compared to Hong Kong, offering businesses operating in the mainland a bit more time to finalize complex documentation.

When it comes to extensions, the policies also diverge. Hong Kong’s nine-month deadline is quite strict. While tax return deadlines can sometimes be extended, this does not automatically extend the requirement to have the transfer pricing documentation prepared by the original due date. Mainland China may offer some flexibility or potential for penalty mitigation in certain circumstances, but relying on extensions is generally not advisable. It is crucial for companies to proactively manage their documentation process to ensure readiness by the respective nine-month (Hong Kong) or twelve-month (Mainland China) deadlines to avoid compliance issues.

Understanding these distinct deadlines and the limited scope for penalty-free extensions is fundamental to maintaining good standing with the tax authorities in both Hong Kong and Mainland China. Proactive planning and adherence to the specific timelines are essential elements of effective transfer pricing compliance in these key Asian markets.

| Jurisdiction | Standard Documentation Deadline |

|---|---|

| Hong Kong | 9 months after financial year end |

| Mainland China | 12 months after financial year end |

Penalty Regimes Compared

Understanding the potential consequences of non-compliance is a critical element of effective transfer pricing risk management for multinational enterprises operating in both Hong Kong and Mainland China. While robust documentation is the primary defense, failure to adhere to the specific regulations in each jurisdiction can result in significant financial penalties. These penalty regimes, though serving the same purpose of ensuring compliance, operate under distinct structures.

In Hong Kong, the penalty mechanism is primarily linked to the concept of a “tax shortfall.” If the Inland Revenue Department determines that a related-party transaction was not conducted at arm’s length and this resulted in less tax being paid than should have been, a tax shortfall is calculated. Penalties for this shortfall can be substantial, potentially reaching up to 300% of the amount of the tax shortfall, in addition to the primary tax adjustment and potentially interest.

Mainland China employs a more layered and often graded penalty system. Penalties can arise from documentation failures themselves, regardless of whether a tax adjustment is made, or from tax adjustments resulting from non-arm’s length pricing. The penalties for tax adjustments are typically percentage-based, but the specific rates can vary depending on factors such as the nature of the non-compliance, the amount of the adjustment, whether the taxpayer cooperated, and their prior compliance history. Interest is also routinely charged on any tax adjustments.

While direct criminal liability solely for transfer pricing documentation non-compliance is relatively uncommon as a standard penalty in either region, the risk exists in severe or fraudulent cases. Persistent non-compliance, deliberate evasion of significant tax amounts, or activities that involve broader fraudulent schemes could potentially escalate matters beyond monetary penalties under the general tax or criminal laws applicable in both Hong Kong and Mainland China. Navigating these potential penalties requires diligent compliance efforts and proactive engagement with tax advisors.

| Feature | Hong Kong | Mainland China |

|---|---|---|

| Primary Basis | Tax Shortfall Resulting from Non-Arm’s Length Pricing | Documentation Failure and/or Tax Adjustments |

| Maximum Monetary Penalty (Tax-Related) | Up to 300% of Tax Shortfall | Varies; Percentage of Tax Adjustment (Graded System) |

| Interest Charges | May apply to tax adjustments | Applies to tax adjustments |

| Criminal Liability Risk | Possible in severe or fraudulent cases | Possible in severe or fraudulent cases |

Recent Regulatory Updates

Recent years have witnessed notable dynamism in transfer pricing documentation requirements across both Hong Kong and Mainland China. In Hong Kong, regulatory bodies have implemented simplification measures, particularly around 2023. These updates aimed to reduce the compliance burden for multinational enterprises meeting specific criteria. The focus has been on streamlining the preparation and submission of transfer pricing documentation, potentially involving adjustments to existing thresholds or offering reduced reporting obligations for certain types of transactions or entities, thereby enhancing the efficiency and appeal of Hong Kong as a business hub.

Concurrently, Mainland China has actively pursued its modernization strategy, placing a strong emphasis on digital reporting mandates. Chinese tax authorities are increasingly leveraging advanced technology, mandating the electronic submission and digital management of extensive transfer pricing documentation and related financial data. This pronounced shift towards digital platforms necessitates that businesses adopt compliant systems and processes to ensure their documentation is filed electronically and accurately, reflecting the authorities’ drive for enhanced data transparency and more sophisticated, data-driven risk analysis and compliance oversight across the nation.

Moreover, the regulatory landscape has also seen developments pertaining to cross-border audit coordination. With both jurisdictions actively refining their transfer pricing enforcement mechanisms, there is an increasing focus on improving the mechanisms for information exchange and coordinating audit activities, particularly concerning related-party transactions occurring between Hong Kong and Mainland China. Updates in this crucial area aim to bolster the ability of tax administrations to effectively address potential profit shifting issues, while simultaneously influencing the strategies and procedures for businesses navigating complex cross-border arrangements subject to scrutiny. Remaining informed about these evolving coordination efforts is paramount for proactive risk management.

Future-Proofing Compliance Strategies

As businesses navigate the evolving landscape of transfer pricing regulations in both Hong Kong and Mainland China, a proactive approach to compliance is paramount for long-term success. A key element of future-proofing strategies involves anticipating potential shifts in regulatory focus and requirements. For Hong Kong, this includes closely monitoring discussions and developments surrounding the possible implementation of aspects from the OECD’s BEPS 2.0 project. While Hong Kong has historically aligned with OECD principles, the specific timing and scope of incorporating BEPS 2.0 pillars, particularly concerning digital economy taxation and global minimum tax rules, could introduce new layers of compliance complexity for multinational enterprises operating in the region. Proactively assessing how potential changes might impact existing structures and pricing policies, and preparing internal data collection capabilities, are vital steps to stay ahead.

Simultaneously, preparing for Mainland China’s trajectory towards more sophisticated data analysis and potentially real-time data sharing mechanisms is increasingly critical. Chinese tax authorities are rapidly enhancing their use of technology and leveraging big data analytics to identify potential transfer pricing risks and inconsistencies more efficiently. This enhanced focus on data scrutiny means that companies need to ensure their internal systems are robust, their data is accurate, and they are prepared for requests that might require faster and more granular information provision than in the past. Adapting internal data management processes, ensuring data integrity, and understanding how tax authorities might use digital tools to scrutinize intercompany transactions are significant components of future-proofing compliance efforts in the Mainland.

Given the interconnectedness of operations between Hong Kong and Mainland China for many multinational groups, developing a unified and consistent approach to transfer pricing documentation becomes an invaluable future-proofing strategy. While jurisdictional specifics require distinct local files adhering to each region’s precise format and content requirements, a common foundation – potentially a master file approach that covers the group’s global or regional activities relevant to both jurisdictions – can significantly streamline the process. This overarching strategy helps ensure consistency in the narrative descriptions of the business, the functional analysis, the economic analysis, and the intercompany policy descriptions presented to tax authorities in both regions, effectively reducing the risk of conflicting interpretations or challenges during audits. A cohesive documentation strategy simplifies ongoing management, saves resources, and provides a clearer, unified picture of the group’s transfer pricing arrangements, offering greater resilience against future regulatory changes and scrutiny.