Understanding Territorial vs. Worldwide Taxation

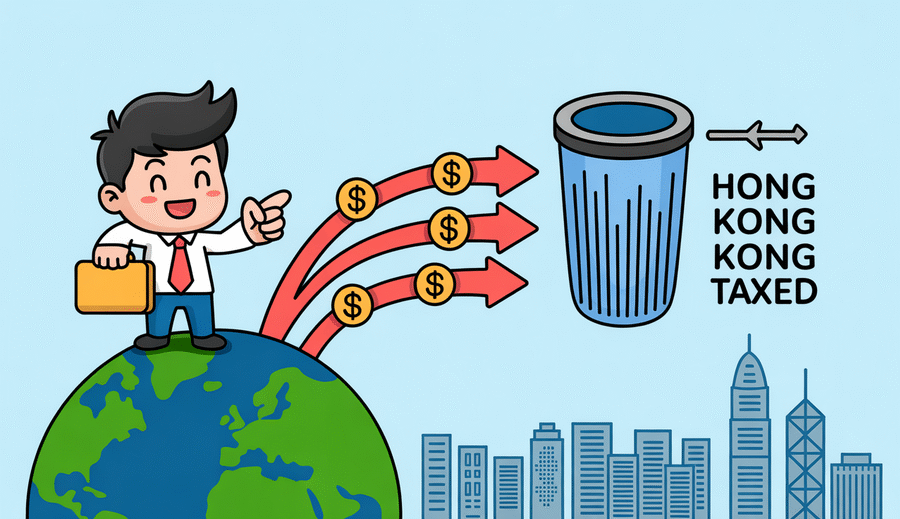

Navigating the intricate landscape of international taxation presents a significant challenge for global entrepreneurs and businesses operating across borders. A fundamental distinction lies between territorial tax systems and worldwide taxation models. Comprehending this core difference is essential for appreciating Hong Kong’s unique advantages as a business hub. At its heart, a territorial tax system posits that income is subject to taxation *only* if it originates from or arises within the geographical boundaries of the taxing jurisdiction. This means profits generated from activities or assets situated entirely outside the territory’s borders are typically exempt from domestic tax.

This principle contrasts sharply with worldwide taxation, a model prevalent in many Western economies, including those adhering to OECD guidelines. Under a worldwide system, residents and corporations are generally taxed on their entire global income, regardless of where it is earned. While mechanisms like foreign tax credits or double taxation treaties exist to mitigate the issue of being taxed twice on the same income, the default principle is broad-based taxation encompassing all global earnings.

Hong Kong stands out globally as a leading example of a pure territorial tax system. The Inland Revenue Department (IRD) imposes Profits Tax exclusively on profits that arise in or are derived from Hong Kong from a trade, profession, or business carried on within Hong Kong. A key pillar of this system is the robust offshore income exemption: if a company incorporated or registered in Hong Kong conducts business, but the genuine source of its profits is located outside of Hong Kong, those foreign-sourced profits are generally not subject to tax in Hong Kong. This strict focus on the *source* of income, rather than the residence of the company, is the defining characteristic that sets Hong Kong apart.

This distinction holds immense importance for businesses with international operations. It simplifies compliance significantly compared to systems requiring comprehensive reporting of global income and complex calculations for foreign tax relief. The principle is clear and predictable: demonstrate that income is sourced offshore according to established tests, and it falls outside the scope of Hong Kong taxation.

To illustrate the core difference between these two approaches:

| Feature | Territorial Taxation (e.g., Hong Kong) | Worldwide Taxation (e.g., OECD-style) |

|---|---|---|

| Basis of Tax | Source of Income (within the jurisdiction) | Residence/Nationality (globally) |

| Foreign Income | Generally Exempt (if genuinely sourced offshore) | Taxable (often with mechanisms like credits for foreign tax paid) |

| Complexity for Offshore Income | Lower (primary focus on source determination) | Higher (requires global reporting, credit calculations, complex rules) |

Hong Kong’s system thus cultivates a predictable and advantageous tax environment for businesses conducting significant activities or generating income streams outside its physical borders.

Solving Common Entrepreneurial Tax Challenges

Global entrepreneurship inherently involves navigating complex international tax landscapes, often leading to substantial administrative burdens and the perennial concern of double taxation. Hong Kong’s territorial tax system offers a compelling solution to these common pain points. By focusing taxation primarily on income sourced *within* Hong Kong, the system inherently provides a fundamental shield against taxing profits already subject to tax, or potentially taxable, in other jurisdictions. This targeted approach directly mitigates the issues of double taxation that frequently impact businesses operating under worldwide tax models, enabling entrepreneurs to retain more of their foreign-sourced profits.

Tracking and reporting profits earned across multiple countries can be an incredibly intricate and time-consuming task for international businesses. The Hong Kong system simplifies this dramatically. Because the primary focus is on establishing whether income has a Hong Kong source based on specific tests, the extensive global profit consolidation and detailed worldwide reporting required by many other tax authorities are largely bypassed for genuinely foreign-sourced income. This simplified tracking requirement frees up valuable entrepreneurial time and resources that would otherwise be dedicated to intricate cross-border accounting and compliance.

Beyond profit tracking, the broader compliance obligations associated with international operations are also significantly reduced. Complex issues such as navigating intricate transfer pricing documentation for purely offshore transactions or developing complicated strategies solely to leverage tax treaties to avoid double taxation become less critical when that foreign-sourced income falls entirely outside the scope of Hong Kong taxation from the outset. This streamlined approach simplifies annual tax filings and minimizes the significant administrative and professional costs typically associated with maintaining tax compliance in a globalized business environment, making Hong Kong an attractive base for entrepreneurs primarily focused on international markets.

Hong Kong’s Competitive Tax Rate Structure

Hong Kong distinguishes itself with a remarkably straightforward and competitive tax rate structure, serving as a major draw for global entrepreneurs and international businesses. Unlike many jurisdictions burdened by complex multi-tiered rates and surcharges, Hong Kong employs a simple, flat-rate Profits Tax system. The standard rate applied to assessable profits is a modest 16.5%. This single, low rate provides clarity and predictability for businesses calculating their tax liabilities, simplifying financial planning and minimizing administrative overhead for companies of all sizes.

To highlight the competitive edge, comparing Hong Kong’s rate to those in major Western economies underscores its advantage. While rates fluctuate, the average corporate tax rates in the European Union and the federal rate in the United States are typically notably higher. This differential provides a substantial benefit to profitable businesses, allowing for significant tax savings that can be reinvested in growth, research, or retained within the business, offering a tangible financial advantage for operations based in or strategically routed through Hong Kong.

| Jurisdiction | Standard Corporate/Profits Tax Rate (Approx.) |

|---|---|

| Hong Kong | 16.5% |

| EU Average | ~21% |

| US Federal | 21% |

Furthermore, Hong Kong enhances its attractiveness by featuring a two-tiered profits tax system specifically designed to benefit smaller businesses and startups. The first HKD 2 million of assessable profits is taxed at a significantly reduced rate of 8.25% – effectively half the standard rate. Profits exceeding this threshold are then subject to the standard 16.5% rate. This progressive structure substantially lowers the overall tax burden for companies with lower profit levels, providing crucial financial relief during their initial growth phases and actively encouraging new ventures and entrepreneurship.

This combination of a low standard rate and the beneficial two-tiered system creates an exceptionally attractive and supportive tax environment. It empowers businesses to retain a larger portion of their earnings, directly fostering economic activity, stimulating investment, and contributing significantly to Hong Kong’s status as a leading global business and financial hub. The clarity, simplicity, and competitive nature of these rates serve as powerful incentives for international entrepreneurs seeking an efficient and cost-effective base.

Strategic Advantages for Offshore Operations

Hong Kong’s territorial tax system provides profound strategic advantages, particularly for entities conducting substantial operations or generating income outside the physical boundaries of the Special Administrative Region. The underlying principle remains consistent and powerful: only income deemed sourced *within* Hong Kong is subject to Profits Tax. This creates a highly favorable landscape for companies with international activities, allowing them to structure their global businesses efficiently without incurring Hong Kong tax liabilities on their genuinely foreign-sourced earnings.

A major benefit arises in the treatment of foreign-sourced dividends. For companies holding investments in overseas subsidiaries or entities, dividends received from these foreign sources are generally not subject to profits tax in Hong Kong, provided their source is offshore. This contrasts starkly with worldwide tax systems, where such income would typically be taxable, often necessitating complex reliance on tax treaties to mitigate double taxation. This exemption is especially attractive for holding companies and multinational groups managing multi-jurisdictional operations.

Moreover, capital gains realized from the disposal of assets are generally not taxed in Hong Kong, provided these gains are not considered income derived from a trade or business of dealing in such assets. This specific exemption is highly relevant for companies engaged in strategic investments, including gains from the sale of shares or other securities held as long-term investments. This policy significantly enhances Hong Kong’s appeal as a jurisdiction for managing global investment portfolios, facilitating corporate restructuring, and executing divestment strategies without triggering domestic capital gains tax.

The territorial approach also substantially simplifies accounting and compliance related to international supply chains. Businesses with manufacturing, sourcing, or sales activities occurring entirely outside Hong Kong can potentially keep the income generated from these activities outside the scope of Hong Kong Profits Tax. This eliminates the need for complex transfer pricing studies or intricate apportionment rules that are common requirements in worldwide tax systems seeking to allocate global profits back to a domestic entity. The clear distinction between Hong Kong-sourced and foreign-sourced income based on established rules simplifies reporting and reduces administrative burdens associated with global trade.

These advantages are summarized below:

| Area of Operation | Strategic Tax Advantage in Hong Kong |

|---|---|

| Foreign-Sourced Dividends Received | Generally exempt from Hong Kong Profits Tax. |

| Capital Gains (e.g., from long-term stock investments) | Generally exempt from Hong Kong Profits Tax if not trading income. |

| International Supply Chains & Offshore Sales | Income genuinely sourced offshore is not taxable, simplifying accounting and transfer pricing needs related to such income. |

Leveraging these specific benefits allows global entrepreneurs and corporations to manage their offshore income and investments with significantly greater efficiency, predictability, and tax effectiveness.

Streamlined Compliance Requirements

Beyond its appealing tax rates and foundational exemption principles, a significant practical advantage for global entrepreneurs operating from Hong Kong is its streamlined compliance framework. Navigating the complexities of international taxation is notoriously time and resource intensive. Hong Kong’s system is designed to alleviate many common compliance burdens, allowing businesses to dedicate more focus and energy to their core operational activities and growth strategies.

A notable simplification relates to transfer pricing regulations. In worldwide tax systems, extensive documentation is often mandated to justify the pricing of transactions between related entities located in different jurisdictions. This is primarily done to prevent profits from being artificially shifted to lower-tax locations. Under Hong Kong’s territorial system, where genuinely offshore-sourced profits are explicitly *not* subject to tax, the necessity for such detailed and complex transfer pricing documentation concerning these exempted offshore transactions is significantly minimized or eliminated. This represents a substantial reduction in administrative overhead compared to jurisdictions that seek to tax worldwide income and must police cross-border related-party transactions vigilantly.

Furthermore, the inherent clarity of the territorial principle means entrepreneurs can often avoid the need for complex or sometimes precarious “tax treaty shopping” strategies. While Hong Kong possesses an extensive network of Double Taxation Agreements (DTAs), the primary tax benefit for many international businesses flows directly from the territorial principle itself – the exemption of offshore income. This foundational exemption often removes the necessity to structure operations solely to leverage treaty benefits on income that is already not taxable in Hong Kong under domestic law, leading to simpler, more robust, and transparent corporate structures.

These factors collectively contribute to a demonstrably simpler annual tax filing process for companies with international income. With clearer, source-based rules for determining taxable income and reduced requirements for documenting complex international transactions and treaty positions related to offshore earnings, preparing and submitting tax returns becomes less burdensome and costly. This administrative efficiency translates directly into lower compliance expenses and frees up valuable entrepreneurial capacity that might otherwise be consumed by navigating intricate and evolving tax regulations in other parts of the world. The emphasis shifts from grappling with convoluted international tax reporting to straightforward accountability based on transparent sourcing rules.

Future-Proofing Through Tax Treaties

Complementing its attractive domestic tax regime, a pivotal advantage for entrepreneurs leveraging Hong Kong is its expanding and strategically important network of double taxation agreements (DTAs). These international treaties are fundamental tools for providing predictability and protection against the complexities inherent in cross-border taxation. For businesses aiming for long-term sustainability, expansion, and global reach, understanding and effectively utilizing these agreements is crucial for minimizing international tax risks and ensuring efficient global operations.

Hong Kong has proactively pursued and established comprehensive double taxation agreements with over 45 jurisdictions worldwide, a number that continues to grow steadily. The primary objective of these treaties is to prevent income from being taxed twice – once in Hong Kong and again in the treaty partner jurisdiction. This is achieved by clearly defining taxing rights between the two jurisdictions, reducing or eliminating withholding taxes on cross-border payments such as dividends, interest, and royalties, and establishing mechanisms for mutual agreement procedures to resolve disputes between tax authorities. Such agreements provide a vital layer of tax certainty that is invaluable for companies engaged in international trade, investment, and the provision of services.

These treaties significantly enhance market access and operational efficiency for Hong Kong-based businesses trading or investing abroad. For instance, DTAs with ASEAN member states facilitate smoother trade and investment flows by providing clear tax rules and potentially lower withholding tax rates on payments, making it more tax-efficient for companies to tap into these dynamic Southeast Asian growth markets. Similarly, robust DTAs with major economies in the European Union, North America, and other key regions ensure that businesses maintain flexibility and tax-efficient structures when operating or investing in these traditional key markets, offering benefits like reduced withholding tax rates or exemption from certain taxes on income flows.

The extensive and carefully built nature of Hong Kong’s DTA network allows businesses to plan their international activities with greater confidence and foresight. By providing a clear framework for the tax treatment of cross-border income and offering mechanisms for dispute resolution, these treaties effectively future-proof business structures against potential tax liabilities, uncertainties, and challenges arising from international operations. They represent a cornerstone of Hong Kong’s appeal as a premier platform for global business, empowering entrepreneurs to focus on strategic growth while navigating the international tax landscape securely and predictably.

Asset Protection and Wealth Management Advantages

Hong Kong’s territorial tax system extends its significant advantages beyond core business operations, providing a robust and favorable framework for sophisticated asset protection and wealth management strategies. For global entrepreneurs, high-net-worth individuals, and international families, safeguarding and growing wealth across borders presents unique complexities, often exacerbated by varying international tax regimes and reporting requirements. Hong Kong’s approach simplifies many of these challenges, creating a more predictable and efficient environment for structuring and managing personal and corporate assets.

A key benefit is the simplification of inheritance planning for international assets. By focusing taxation solely on income sourced within its borders, Hong Kong’s system inherently simplifies the disposition of assets located outside the territory. Unlike jurisdictions with worldwide taxation or estate taxes that might impose taxes on foreign inheritances, gifts, or capital gains upon death, Hong Kong’s lack of capital gains tax and its territorial principle on income significantly reduce the potential for domestic taxation related to foreign assets or their transfer upon death. This clarity is invaluable for individuals seeking to ensure a smooth and tax-efficient transfer of wealth to future generations, allowing for greater certainty and effectiveness in estate planning for international portfolios.

Furthermore, Hong Kong stands out as a premier location for establishing efficient holding company structures. The application of the territorial tax principle means that dividends received by a Hong Kong holding company from its foreign subsidiaries, or capital gains realized from the disposal of foreign investments (assuming they are not treated as trading income), are typically not subject to profits tax in Hong Kong, provided they are genuinely sourced offshore. This makes it an exceptionally efficient jurisdiction for consolidating international assets, managing global investment portfolios, and facilitating international corporate group structures while minimizing tax leakage at the holding company level and preserving capital.

The seamless integration of Hong Kong’s tax benefits with its world-class private banking and financial services sector offers another compelling advantage. As a major global financial hub, Hong Kong provides unparalleled access to sophisticated banking, investment, trust, and wealth management solutions tailored for international clients. Establishing holding structures or managing wealth through Hong Kong allows individuals and families to leverage these high-level financial services from a tax-efficient base that does not tax their foreign-sourced income or capital gains. This synergy offers a holistic approach to wealth management, combining robust asset protection and efficient structuring with expert financial guidance and access to global markets, all within a predictable and favorable tax environment.

| Wealth Management Aspect | Hong Kong Territorial Tax Benefit |

|---|---|

| International Inheritance Planning | Simplified due to territorial tax system and absence of capital gains/inheritance taxes. |

| Holding Company Efficiency | Foreign-sourced dividends and capital gains (if not trading) often exempt, making it ideal for managing global investments. |

| Integration with Financial Services | Tax-efficient base complements access to world-class private banking and wealth management expertise. |

This unique combination empowers global entrepreneurs and high-net-worth individuals to secure, manage, and optimize their wealth effectively across international borders.

Positioning for Asia-Pacific Expansion

Hong Kong offers a uniquely advantageous strategic position for businesses aiming to expand into or effectively navigate the dynamic Asia-Pacific landscape. Its geographical location, coupled with its distinct economic and legal framework, provides a critical bridge enabling global entrepreneurs to tap into the region’s vast growth opportunities with enhanced efficiency and predictability. This positioning is particularly beneficial for those targeting the massive consumer markets and burgeoning economies of East and Southeast Asia.

A key advantage lies in Hong Kong’s pivotal role and ability to capitalize on initiatives like the Greater Bay Area (GBA). This strategic plan integrates Hong Kong with Macau and nine cities in Guangdong province, creating a powerful, interconnected economic hub. Operating from Hong Kong allows businesses to leverage this connectivity, gaining unparalleled access to the immense consumer base, manufacturing capabilities, and supply chains of mainland China while simultaneously maintaining an international base governed by common law, robust financial systems, and its favorable territorial tax regime.

Crucially, Hong Kong strikes a vital and beneficial balance: it provides direct and unparalleled access to the mainland Chinese market without automatically subjecting a company’s *worldwide* income to mainland tax regulations or even broadening the scope of Hong Kong tax beyond its borders. The territorial principle of taxation ensures that profits genuinely sourced offshore remain outside the Hong Kong tax net, regardless of the company’s engagement with mainland China. This tax neutrality is invaluable for international companies utilizing Hong Kong as a regional headquarters, trading hub, or service center, allowing them to engage deeply with China’s economy while benefiting from tax efficiency on their broader global operations.

Furthermore, Hong Kong’s freely convertible currency, the Hong Kong Dollar, is a significant practical asset for businesses engaged in cross-border trade, investment, and transactions within the Asia-Pacific region. Unlike the regulated currency of mainland China, the HKD’s unrestricted convertibility simplifies international payments, facilitates easy repatriation of profits, and provides greater financial flexibility and predictability for regional operations. This financial openness complements the tax advantages, solidifying Hong Kong’s status as a premier and reliable location for establishing and growing a presence focused on Asia-Pacific expansion.