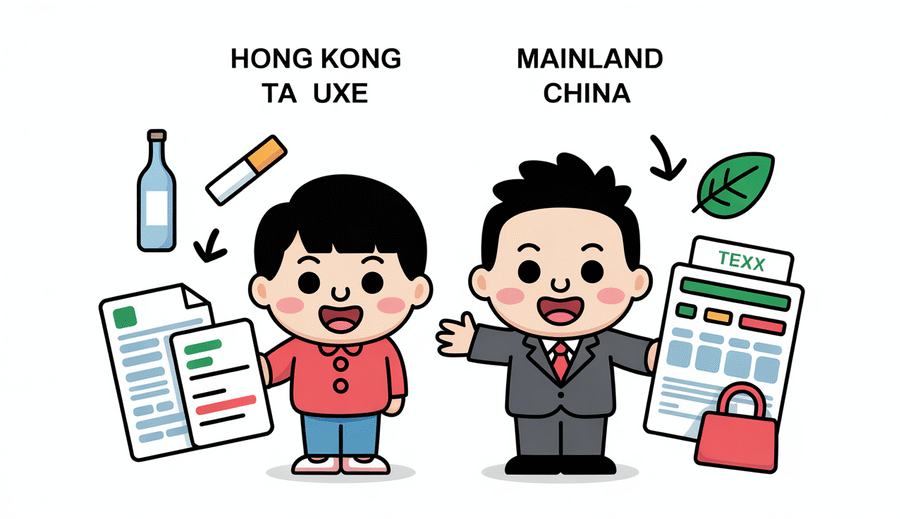

Scope of Taxable Goods

Excise duties constitute a notable element of indirect taxation in both Hong Kong and Mainland China. However, the selection of goods subject to these duties distinctly reflects their differing policy priorities and economic structures. A primary shared characteristic is the taxation of alcohol and tobacco products. Both jurisdictions impose excise duties on these items, aligning with a common global approach intended to influence consumption, address public health concerns, and generate fiscal revenue.

Beyond these standard categories, the range of excisable goods diverges significantly. Hong Kong, leveraging its status as a free port, applies excise duty to a very narrow list of items. This policy is strategically designed to minimize impediments to trade. Hong Kong’s core excise focus areas include alcohol, tobacco, and notably, specific fuel products such as light diesel oil and unleaded petrol. In contrast, Mainland China operates with a considerably broader excise tax base. While also encompassing alcohol and tobacco, its system extends to a wider assortment of items, frequently categorized as luxury goods.

This disparity in scope is further emphasized by Mainland China’s integration of taxes directly or indirectly linked to environmental considerations within its overall tax framework. Although not always explicitly labelled ‘excise duty’, taxes aimed at mitigating the environmental impact of certain goods or activities are present. This approach differs from Hong Kong’s, where environmental concerns are typically addressed through separate regulatory mechanisms rather than being embedded within the excise duty system. This difference highlights the Mainland’s inclination to utilize its tax policy for broader social and environmental engineering objectives, alongside revenue generation.

The fundamental difference in the scope of taxable goods clearly illustrates the distinct economic philosophies at play: Hong Kong’s lean, trade-facilitating strategy versus Mainland China’s more extensive system employed for revenue collection, consumption regulation, and the pursuit of diverse policy goals.

| Category | Hong Kong Taxed Items | Mainland China Taxed Items |

|---|---|---|

| Common Excise Items | Alcohol, Tobacco, Methyl Alcohol | Alcohol, Tobacco |

| Specific Goods | Hydrocarbons (e.g., Light Diesel Oil, Unleaded Petrol) | Luxury Goods (e.g., high-end cosmetics, jewelry, firecrackers) |

| Policy-Driven Taxes | (Limited scope under direct ‘excise’) | Environmental Protection Tax (pollutants/activities), Vehicle Purchase Tax, etc. |

Tax Rate Structures

A significant point of divergence in the excise duty regimes of Hong Kong and Mainland China lies in their fundamental tax rate structures. While both regions levy duties on specified goods, the methodologies for calculating these taxes present clear contrasts. Hong Kong primarily employs an ad valorem system for many items, meaning the duty is computed as a percentage of the product’s value. This method directly ties the tax burden to the cost of the goods. Conversely, Mainland China utilizes a mixed approach, frequently combining fixed duties (a set amount per unit, such as per litre or per cigarette) with ad valorem rates, and occasionally implementing tiered systems based on the product category.

This difference is particularly apparent when examining fuel duties. Hong Kong traditionally applies a fixed duty per litre of fuel, ensuring that tax revenue per unit volume remains constant irrespective of price fluctuations. Mainland China also uses fixed rates for certain fuel types, but its overall energy taxation structure is more intricate, incorporating a consumption tax that also operates on a fixed rate per litre or tonne. An analysis of these specific duties underscores the varied approaches to revenue generation and how price volatility affects the effective tax burden in each location.

For alcoholic beverages, Mainland China implements a more complex tiered taxation system. This system often features different rates based on the type of alcohol (e.g., spirits, beer, wine) and may include further distinctions tied to alcohol content or even price bands. This contrasts with Hong Kong’s approach, which largely relies on an ad valorem rate for most dutiable alcohol, applying a standard percentage regardless of the specific beverage type or strength, although certain categories like beer may have specific volume-based rates. The tiered system in the Mainland permits more detailed policy control, potentially targeting different market segments or consumption patterns.

These structural variations in applying fixed versus ad valorem rates and the use of tiered systems significantly influence the final cost of excisable goods for consumers and reflect differing underlying policy objectives related to revenue generation, price sensitivity, and control over specific product markets.

| Taxation Basis | Hong Kong Approach (Typical) | Mainland China Approach (Typical) |

|---|---|---|

| Primary Calculation | Ad Valorem (percentage of value) | Mix of Fixed (per unit) and Ad Valorem |

| Fuel Duty | Fixed per litre | Fixed per litre/tonne (as part of Consumption Tax) |

| Alcohol Duty | Primarily Ad Valorem (percentage of value) | Tiered (based on type, volume, sometimes value) |

Administrative Compliance Processes

Compliance procedures for excise duty present a significant divergence between Hong Kong and Mainland China, reflecting their distinct regulatory philosophies and administrative frameworks. Hong Kong employs a notably streamlined approach to excise duty declaration systems. Its processes are designed for efficiency and speed, aiming to facilitate trade flows with minimal bureaucratic friction. Businesses handling dutiable goods in Hong Kong benefit from straightforward declaration requirements, which simplify the administrative burden and allow for relatively swift processing. This aligns with the territory’s emphasis on maintaining its status as a major international trading hub, prioritizing ease of doing business while ensuring necessary controls are in place for regulated items like alcohol, tobacco, hydrocarbons, and methyl alcohol.

In stark contrast, navigating excise duty compliance in Mainland China typically involves a considerably more complex and multi-layered process. Unlike Hong Kong’s unified approach, compliance often necessitates securing approvals from various government agencies before dutiable goods can be properly handled or moved within the mainland. This involvement of multiple agencies adds significant complexity and time to the administrative pathway. Businesses must coordinate with diverse bodies, potentially including the General Administration of Customs, the State Administration of Taxation, and relevant ministries depending on the specific goods. This intricate web of requirements demands meticulous planning, detailed documentation, and extensive coordination from businesses seeking compliance, often leading to longer timelines and more potential points of review before necessary approvals are granted.

Furthermore, the structures surrounding penalties for non-compliance exhibit differences. While both jurisdictions enforce their excise duty laws with penalties, the nature and severity can vary based on the specific violation and the broader regulatory environment. Hong Kong’s penalty framework is tailored to its streamlined system, focusing on deterrents within its efficient compliance model, frequently involving fines or suspension of permits for clear breaches of declaration or licensing rules. Mainland China’s penalty structures, potentially reflecting its multi-agency approval process and broader regulatory oversight, may encompass a wider scope of potential consequences tied to non-compliance across different regulatory touchpoints. This could range from higher fines and potential seizure of goods to more severe administrative or legal actions depending on the scale and intent of the non-compliance, making diligent adherence to the complex procedures crucial to avoid significant disruptions and costs.

Policy Objectives and Priorities

The core motivations and strategic goals driving excise duty policies reveal significant distinctions between Hong Kong and Mainland China. Hong Kong’s approach is deeply aligned with its identity as a free port and an international trading hub. Consequently, its excise duties are deliberately minimal, restricted primarily to specific goods like alcohol, tobacco, and hydrocarbons. This minimalist policy is crafted to uphold free trade principles, minimize administrative barriers, and preserve the city’s competitiveness on the global stage. The principal policy objective centers on maintaining economic efficiency and generating a limited, targeted revenue stream without impeding the movement of goods or serving as a broad disincentive to trade.

In clear contrast, Mainland China employs excise duties as a more versatile policy instrument, reflecting a wider spectrum of national objectives. While revenue generation is certainly a component, these duties are frequently leveraged to influence consumer behavior, address public health concerns, and align with environmental policies. For instance, high taxes on tobacco and alcoholic beverages are explicitly intended to discourage consumption for health reasons. Similarly, duties on fuel and the expanding scope of environmental taxes underscore a growing emphasis on sustainability and pollution control. The policy framework aims to balance fiscal needs with social and environmental goals, utilizing taxation as a mechanism to shape market outcomes and promote desired societal behaviors.

The fundamental difference lies in their primary drivers. Hong Kong prioritizes economic liberty and trade facilitation, maintaining a narrow and low excise duty base. Mainland China, while considering economic factors, places greater emphasis on deploying excise duties as levers for public health, environmental protection, and influencing consumption patterns, in addition to revenue collection. This philosophical divide significantly shapes the types of goods taxed and the rates applied in each jurisdiction.

| Policy Objective | Hong Kong | Mainland China |

|---|---|---|

| Revenue Generation | Targeted & Focused | Broader & Significant |

| Behavioral Influence | Minimal Emphasis | Significant Emphasis |

| Health Policy Alignment | Limited Direct Linkage | Strong Direct Linkage |

| Environmental Policy | Addressed Separately | Integrated into Tax Base |

| Free Port Status Alignment | Primary Policy Driver | Not Applicable |

Cross-Border Trade Implications

The differing excise duty rates between Hong Kong and Mainland China inherently lead to significant price disparities for certain goods, creating distinct cross-border trade implications. A direct consequence of these duty gaps is the increased risk of smuggling. When comparable products, such as alcohol or tobacco, are subject to considerably lower taxes in Hong Kong than on the Mainland, it generates a powerful economic incentive for their illicit movement across the border. Individuals and organized groups may attempt to bypass formal import channels to evade higher duties and profit from the resultant price differential.

Beyond outright smuggling, these disparities also contribute to patterns of parallel trading. This involves goods legally acquired in one jurisdiction, typically Hong Kong due to its frequently lower or absent excise duties on many items, being transported into the other, most commonly Mainland China, and resold outside official distribution networks. While not always involving evasion of personal allowances, large-scale parallel trading effectively circumvents the higher duty structures intended by Mainland authorities, impacting the volume of officially imported goods and associated tax revenues.

These trade dynamics directly influence consumer purchasing behavior. Mainland consumers, aware of the lower prices available in Hong Kong due to minimal or absent excise duties on certain items, are motivated to either travel across the border themselves to purchase goods or rely on supplies provided through parallel trading channels. This shift in where and how goods are acquired can affect retail sales and distribution patterns within Mainland China, illustrating how varied tax policies in adjacent regions can fundamentally alter the flow of commerce and the economic landscape for specific products.

Recent Regulatory Updates

Staying informed about changes in excise duty policies is essential, as both Mainland China and Hong Kong periodically update their regulations to align with economic objectives, environmental concerns, and administrative efficiencies. Recent adjustments in these areas underscore their diverging priorities while also revealing convergence in areas like digitalization.

Mainland China has actively expanded the scope of its environmental protection tax. This policy evolution transitioned from administrative pollutant discharge fees to a statutory tax system covering a wider range of pollutants, including air and water pollutants, solid waste, and noise. Recent updates have focused on refining tax rates and collection mechanisms, reinforcing the government’s commitment to utilizing fiscal tools to combat pollution and encourage cleaner industrial practices across various sectors.

In contrast, Hong Kong, maintaining its free port status, has seen less activity in introducing new excise duties, focusing instead on preserving minimal trade barriers. This includes the continued suspension or relaxation of duties on specific commodities. While major changes are infrequent, this emphasis reinforces its trade-friendly environment and low-tax regime, significantly differentiating it from the Mainland’s more interventionist approach.

Furthermore, both regions are increasingly adopting digital solutions for tax administration. Recent mandates and system upgrades aim to streamline reporting and payment processes for excise duties. This involves promoting online portals for declarations, electronic payment methods, and requiring businesses to maintain digital records. This drive towards modernization seeks to enhance compliance efficiency, reduce administrative burdens for both taxpayers and authorities, and improve oversight in the collection of excise revenues.

These recent regulatory updates highlight the distinct fiscal philosophies of Hong Kong and Mainland China, particularly in their application of excise duties, while also indicating a shared direction in leveraging technology for enhanced tax governance.

Future Policy Trajectories

Looking ahead, the excise duty landscapes in both Hong Kong and Mainland China are anticipated to evolve, influenced by regional integration, technological advancements, and ongoing efforts to streamline cross-border interactions. While fundamental differences are likely to persist, several key trends suggest potential shifts in policy and administration.

A significant area of focus for the future is the potential for greater harmonization within the Greater Bay Area (GBA). As economic ties deepen and movement within the GBA increases, the differing excise policies could present challenges. While a complete unification of duty rates or structures is improbable in the near term given their distinct economic models, there is potential for enhanced coordination. This might involve aligning administrative procedures or improving mutual recognition of compliant statuses to facilitate legitimate trade and the movement of goods subject to excise, aiming for smoother operations within the integrated region.

Technology is also poised to play an increasingly crucial role in the administration and compliance of excise duties. Both jurisdictions are likely to leverage digital innovations to enhance efficiency and effectiveness. This could encompass implementing more sophisticated data analytics to identify risks, utilizing digital platforms for duty declarations and payments, and potentially exploring technologies like blockchain for improved tracking and traceability of excise goods. These advancements are intended to simplify reporting for businesses while strengthening authorities’ capacity to monitor and enforce regulations.

Furthermore, anticipated developments include strengthened cross-border enforcement collaboration. The disparity in excise rates between Hong Kong and Mainland China inherently creates incentives for illicit trade. To effectively combat smuggling and ensure equitable compliance, enhanced cooperation between customs and enforcement agencies in both regions is vital. This may involve more frequent intelligence sharing, joint operations, and coordinated strategies to detect and disrupt illegal activities. Such collaboration is essential for maintaining market order and protecting legitimate revenue streams in both jurisdictions as policies continue to evolve.