Decoding BEPS Action Plan 13 Requirements Transfer pricing documentation is fundamental to enabling tax administrations......

Understanding CRS & FATCA Reporting Obligations in Hong Kong Financial institutions operating in Hong Kong......

Tax Sparing Credits: Core Concepts Unveiled Tax sparing credits are a fundamental mechanism within international......

📋 Key Facts at a Glance Hong Kong enacted BEPS 2.0 Pillar Two legislation: The......

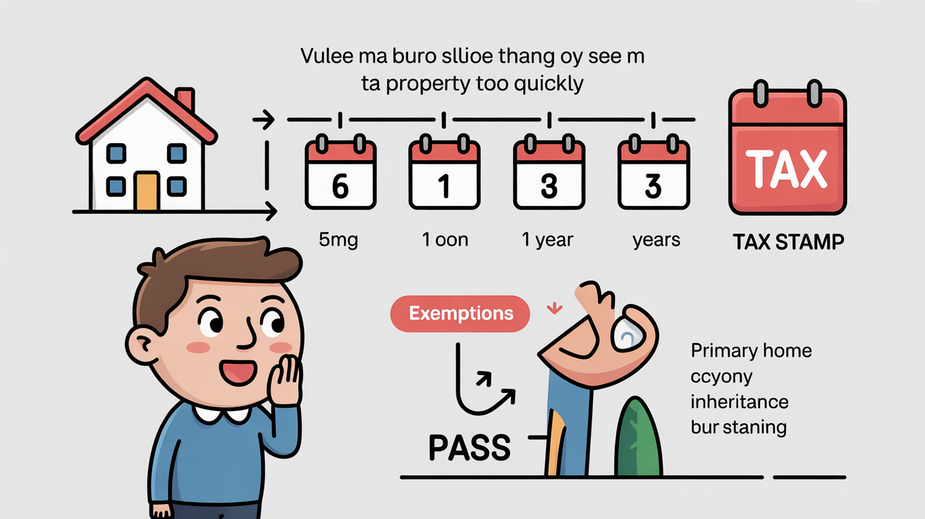

📋 Key Facts at a Glance Complete Abolition: Special Stamp Duty (SSD) was abolished on......

Understanding Hong Kong’s Salaries Tax and Personal Allowances Navigating any tax system begins with understanding......

Understanding Hong Kong's Territorial Tax System and Offshore Income Hong Kong operates under a distinct......

📋 Key Facts at a Glance Free Port Status: Hong Kong maintains duty-free status for......

📋 Key Facts at a Glance Authentication Methods: iAM Smart/iAM Smart+ digital authentication, TIN +......

📋 Key Facts at a Glance No VAT/GST: Hong Kong imposes no Value-Added Tax, Goods......

Hong Kong's Tax Treaty Network: A Strategic Advantage for Global Expansion Establishing a strategic presence......

📋 Key Facts at a Glance Tax Systems: Hong Kong uses territorial taxation (only HK-sourced......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308