Why Self-Education Tax Relief Matters in Hong Kong In today's dynamic professional landscape, continuous learning......

Hong Kong’s Free Port Advantage Explained Hong Kong distinguishes itself as a preeminent free port,......

Understanding Provisional Tax in Hong Kong Hong Kong's tax system incorporates Provisional Tax, a mechanism......

Navigating Hong Kong's Complex Tax Dispute Landscape Hong Kong's tax system, while celebrated for its......

Trust Fundamentals for Wealth Preservation For entrepreneurs in Hong Kong focused on securing their legacy,......

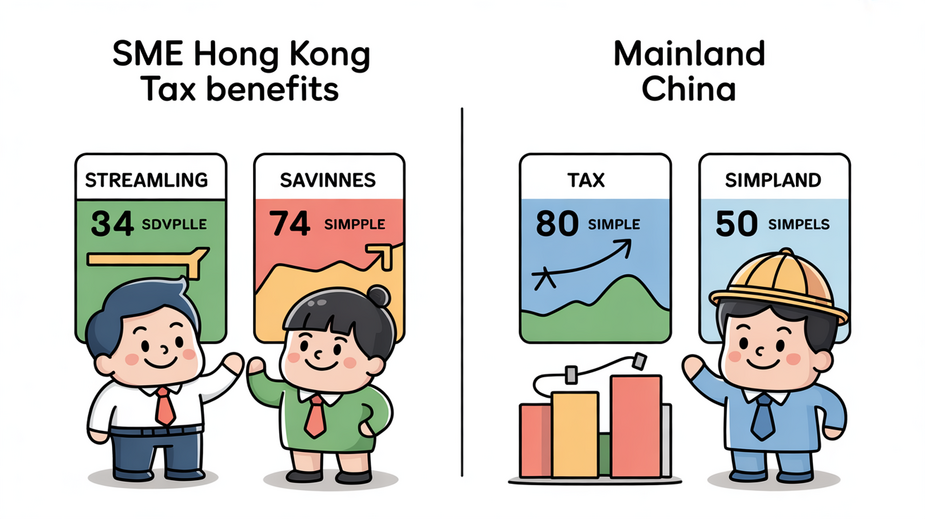

Comparing Hong Kong and Mainland Tax Systems Navigating the tax landscape for businesses operating between......

Understanding Statutory Deadlines for Tax Appeals in Hong Kong Successfully navigating the tax appeal process......

Eligibility Criteria for Marriage-Based Tax Benefits in Hong Kong Accessing the tax benefits available to......

Hong Kong Stamp Duty Fundamentals for Property Transactions Hong Kong's stamp duty system is a......

Understanding Foreign Tax Credit Basics for Expats in Hong Kong A foreign tax credit (FTC)......

Corporate Tax Rates and Structures Compared When evaluating Hong Kong and Singapore as potential homes......

Hong Kong's SME Tax Framework: Key Features Hong Kong presents a highly appealing environment for......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308