Understanding Hong Kong's Favorable Tax Landscape Hong Kong is widely recognised for operating one of......

Hong Kong's Strategic Position in Asia-Pacific Trade Hong Kong serves as an indispensable strategic hub......

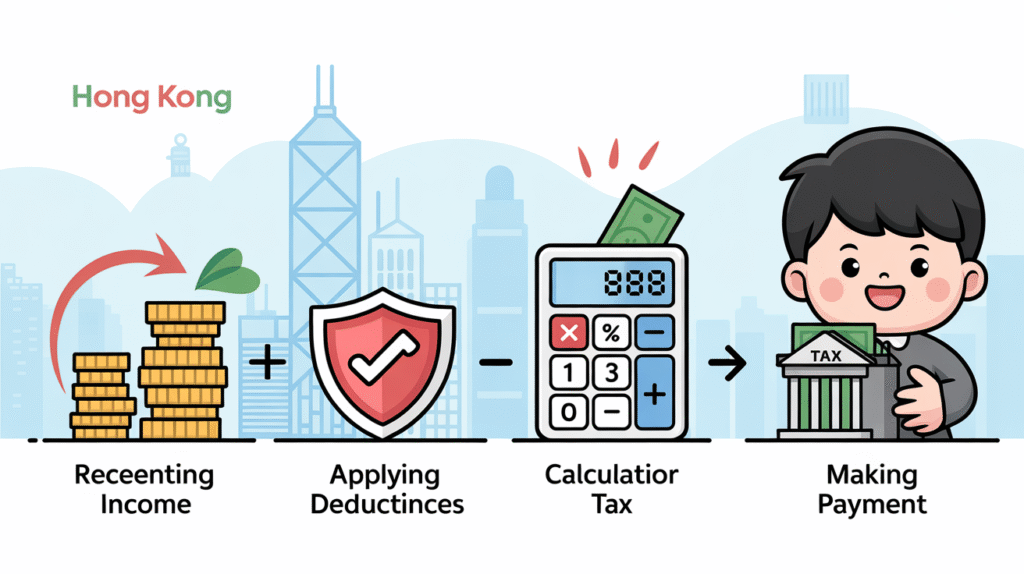

Understanding Hong Kong Salaries Tax Fundamentals Navigating the Hong Kong tax system begins with grasping......

Hong Kong's Profits Tax Framework and Exemption Principles Navigating Hong Kong's profits tax system effectively......

Decoding Hong Kong's Trust Legal Framework Establishing a trust in Hong Kong offers a robust......

Understanding Property Co-Ownership Structures in Hong Kong Navigating property ownership is a critical aspect of......

Hong Kong's Procurement Appeal Versus Tax Reality Hong Kong has long been a favored location......

Understanding Hong Kong's Double Tax Treaty Network Hong Kong boasts a wide and expanding network......

Core Principles of Hong Kong's Profits Tax System Navigating the landscape of business taxation in......

Understanding Hong Kong’s Salaries Tax and Personal Allowances Navigating any tax system begins with understanding......

Understanding the IRD's Decision-Making Framework Successfully navigating discussions with the Hong Kong Inland Revenue Department......

Navigating Hong Kong's Pre-Reform Startup Tax Landscape Before the implementation of the two-tiered profits tax......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308