Navigating the Cross-Border Tax Environment in the Greater Bay Area Operating within the Greater Bay......

📋 Key Facts at a Glance Fact 1: Property management fees are NOT separately deductible......

Understanding MPF Fundamentals for Hong Kong Employers For any business owner in Hong Kong, navigating......

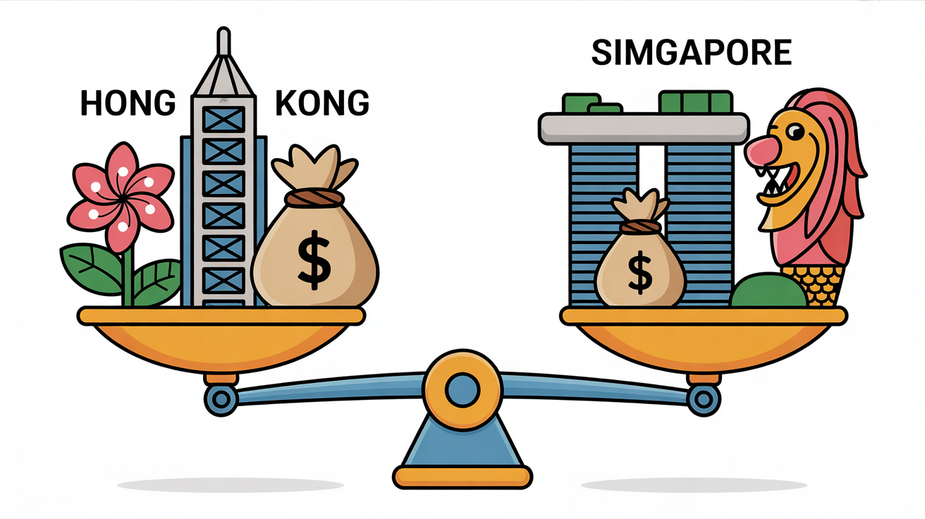

Understanding Hong Kong's Territorial Tax System A defining characteristic and significant appeal of Hong Kong's......

Understanding MPF's Role in Tax Reduction The Mandatory Provident Fund (MPF) System is a cornerstone......

Hong Kong's Capital Gains Tax Stance Explained Hong Kong operates under a territorial principle of......

Navigating the Post-Pandemic Economic Landscape: Challenges and Opportunities for Hong Kong SMEs The economic environment......

📋 Key Facts at a Glance Extensive Network: Hong Kong has comprehensive Double Taxation Agreements......

📋 Key Facts at a Glance Tax Rate: 0% profits tax on qualifying transactions (vs.......

📋 Key Facts at a Glance Free Port Status: Hong Kong levies no customs tariffs......

📋 Key Facts at a Glance Hong Kong Profits Tax: Two-tier system: 8.25% on first......

📋 Key Facts at a Glance Hong Kong enacted BEPS 2.0 Pillar Two legislation: The......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308