Understanding Hong Kong’s Land Tenure System

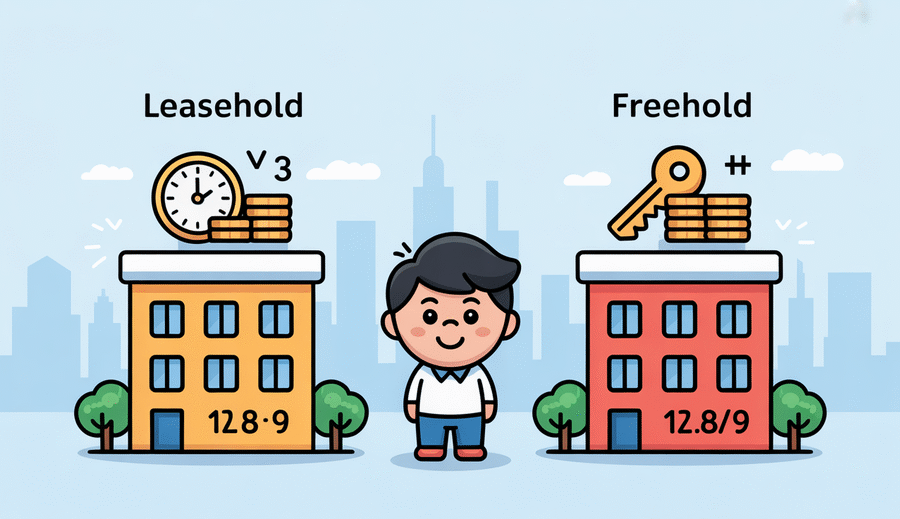

Navigating the property landscape in Hong Kong necessitates a fundamental grasp of its unique land tenure system, which diverges significantly from the predominantly freehold models prevalent elsewhere. At its core lies the distinction between leasehold and freehold ownership. Freehold denotes perpetual ownership of both the land and any structures upon it, granting rights without a time limit. Conversely, leasehold confers ownership or the right to occupy and use land and property for a finite, defined period, as stipulated in a lease agreement with the ultimate landowner, which in Hong Kong is the government.

The historical context is paramount to understanding Hong Kong’s reliance on the leasehold system. During the colonial era, the British administration granted land under leases from the Crown (and subsequently, the government) rather than selling it as perpetual freehold. This strategy enabled controlled development, generated revenue through land premiums, and allowed the Crown to retain ultimate control. The treaties governing the transfer of sovereignty in 1997 included provisions ensuring the continuation of these leaseholds, solidifying this system as the standard for the vast majority of properties in the territory today.

Consequently, almost all land and property in modern Hong Kong are held under leasehold tenure. These leases are typically granted for terms such as 50 or 75 years, though some are longer. While most residential leases granted before 1997 were initially set to expire around 2047, a standing policy provides for automatic extension for a further 50 years without a premium, contingent upon payment of an annual government rent. This widespread adoption of leasehold tenure underscores the critical importance of understanding the terms, duration, and renewal processes associated with these leases for anyone involved in the Hong Kong property market, as these factors fundamentally define the nature and extent of property rights.

Key Differences in Ownership Rights and Implications

The distinction between leasehold and freehold ownership structures forms the bedrock of property rights in Hong Kong and is crucial when evaluating real estate. The most fundamental difference resides in the duration of the rights granted over the land. Leasehold tenure means rights are granted for a specific, finite period, such as 50, 75, or 99 years, after which the rights theoretically revert to the original lessor – overwhelmingly the government in Hong Kong’s context. This stands in stark contrast to true freehold ownership, which implies perpetual or indefinite rights to the land, meaning ownership does not expire after a set number of years.

For properties held under leasehold, the impending expiry date of the lease is a significant consideration, particularly as the term shortens. Historically, this could involve negotiating lease renewals with the government, potentially requiring a premium payment. However, a pivotal aspect of the Hong Kong system for most residential government leases expiring after 1997 is a statutory provision for automatic extension for 50 years without an additional premium, although the liability for annual government rent continues. This automatic renewal mechanism provides a substantial degree of security for leasehold owners, mitigating some of the uncertainties traditionally associated with fixed-term leases as their expiry date approaches.

In a pure freehold system, which is exceedingly rare in Hong Kong, the concept of lease expiry or the need for renewal is absent. The owner holds indefinite rights, and there is no “landlord” to whom the property reverts or from whom an extension must be sought. This lack of a finite term simplifies long-term planning and eliminates concerns about future renewal processes or associated costs beyond standard property taxes and government charges applicable regardless of tenure. While both freehold and leasehold ownership are subject to land laws, zoning regulations, and the government’s power of resumption for public purposes (a separate legal process), the core difference in Hong Kong revolves squarely around the finite nature of the lease term for leaseholds and the distinct legal process for continuing those rights via extension.

Property Rates and Government Charges

Understanding the recurring costs associated with property ownership is essential, and in Hong Kong, this involves both property rates and, specifically for leasehold properties, government rent. Property rates constitute a significant tax levied on the occupation of property throughout the territory. This charge is primarily based on the property’s rateable value, an estimate of its annual rental value determined by the Rating and Valuation Department. Crucially, property rates apply broadly to the vast majority of properties in Hong Kong, regardless of whether they are held under a leasehold arrangement or one of the rare freehold titles. This means that both leasehold and freehold owners (or their tenants, depending on the lease agreement) are subject to this recurring tax obligation.

The application and implications of property rates can vary based on the property’s usage, differentiating between residential and commercial classifications. While the standard rate is typically set at 5% of the rateable value, nuances exist. For instance, owner-occupied residential properties have historically benefited from government concessions, effectively reducing the payable amount, though the availability and extent of such concessions are subject to annual government policy decisions. Commercial properties, by contrast, are generally subject to the standard rate without such concessions. Understanding these distinctions is vital for accurately estimating annual holding costs.

In addition to property rates, leasehold properties in Hong Kong are also liable for an annual Government Rent. This charge directly stems from the nature of the government land lease itself, representing a payment to the government as the ultimate landowner for the right to occupy and use the land during the lease term. Freehold properties, having historically held perpetual ownership directly from the Crown, are not subject to Government Rent. The calculation of Government Rent for leasehold properties is typically based on a percentage of the property’s rateable value. For leases granted before 1997 that were automatically extended, the rent is calculated at 3% of the rateable value assessed in 1999, subject to periodic revisions based on changes to *that specific value*. For leases granted after 1997, the rent is calculated at 3% of the *current* rateable value, reviewed every three years. This makes Government Rent a unique and specific recurring cost solely for leasehold owners.

| Charge Type | Applies To | Basis of Calculation |

|---|---|---|

| Property Rates | Leasehold & Freehold | Percentage of Current Rateable Value |

| Government Rent | Leasehold Only | Percentage of Rateable Value (Specific basis varies by lease type) |

Financial Implications Over Ownership Periods

Examining the financial aspects of property ownership in Hong Kong requires a long-term perspective, particularly when contrasting the predominant leasehold tenure with the rare freehold status. While the initial purchase price is a primary consideration, the ongoing and potential future costs, as well as potential returns, associated with each tenure type can differ significantly over decades. Understanding these divergences is crucial for assessing the true cost of ownership and potential profitability over the lifespan of an investment or residence.

Over the long term, leasehold properties typically incur ongoing government rent payments, particularly after the initial term, in addition to standard property rates applicable to both tenure types. While rates are based on rateable value and represent a consistent cost based on market rental value, the cumulative effect of annual government rent adds a specific financial burden over time for leasehold owners. Freehold properties, being exempt from government rent, offer a potential saving over many years; however, their scarcity means this financial benefit is not widely accessible to most property owners in Hong Kong.

The impact of tenure length on property appreciation potential is another significant financial consideration. Properties with long remaining lease terms often appreciate in line with overall market demand, much like rare freehold properties would. However, as the lease term shortens, particularly when nearing its expiry date, the future financial obligation (if renewal is required) and the perceived uncertainty can negatively influence market value. This can potentially slow appreciation or even lead to depreciation compared to properties with lengthy remaining leases or perpetual tenure, as buyers and investors factor in the diminishing asset life and the potential costs associated with extending rights.

A critical financial implication specific to leasehold properties, especially those nearing expiry without automatic extension provisions, is the potential lease extension premium. If a new lease term needs to be negotiated and paid for, a substantial premium is typically payable. This premium is often calculated based on the property’s market value at the time of renewal, assessed as if the lease had already been extended. This valuation considers factors like the property’s size, location, and prevailing market conditions. This potentially large, one-off payment represents a significant future cost that owners of certain leaseholds must anticipate and plan for, fundamentally altering the long-term financial landscape compared to perpetual freehold ownership.

Legal Considerations and Risks

Navigating the property landscape in Hong Kong requires a keen understanding of the specific legal intricacies that define ownership, particularly under the predominant leasehold system. Unlike jurisdictions with widespread freehold tenure offering perpetual rights, Hong Kong’s properties are held under government leases for specified, finite terms. This fundamental difference introduces unique legal considerations and potential risks that prospective owners must carefully evaluate before acquisition.

One significant legal aspect centres on the process of lease renewal or extension. While many leases granted before the 1997 handover with terms expiring around 2047 are generally extended for a further 50 years without a premium (save for the continued annual government rent), the specifics and legal certainty can vary depending on the original lease terms and government policy. For leases granted post-1997 or those with different initial durations, the process upon expiry may involve negotiation and adherence to governmental policies prevailing at that time. Understanding the legal framework governing these extensions and any potential conditions or complexities that might be imposed upon renewal is paramount to avoiding future legal disputes or unexpected financial liabilities.

Furthermore, property owners must be aware of the government’s inherent power of land resumption. Under ordinances such as the Lands Resumption Ordinance, the government retains the right to take back land for public purposes, even if it is currently under a valid government lease. While compensation is legally mandated based on market value, the process and outcome can differ from voluntary sale transactions. This possibility, although relatively infrequent for individual residential plots outside of large-scale public development or infrastructure projects, represents a distinct legal risk inherent in the leasehold system compared to the rights associated with perpetual freehold ownership.

Finally, thorough legal due diligence on the title deed and associated documents is critical. These documents, often originating from the government’s original Conditions of Sale or Grant, contain specific restrictions, covenants, and conditions binding the property owner. These can include limitations on land use (e.g., residential only), building height, plot ratio, external alterations, or specific maintenance obligations within a development. Failing to understand and adhere to these restrictions can lead to legal non-compliance, potential fines, or difficulties in future redevelopment or sale. Diligent review of the title documentation provides a comprehensive legal picture of the rights and obligations tied to the specific leasehold property.

Market Trends and Buyer Preferences

Hong Kong’s unique land tenure system significantly shapes its property market dynamics, influencing demand shifts and buyer preferences between properties with differing leasehold terms. While true freehold is exceptionally rare and typically commands a premium, the length and specific terms of government leases are critical factors impacting how both investors and those seeking a home view potential acquisitions. Understanding these trends requires examining the motivations driving different buyer groups and the overarching influence of government land supply policies.

The decision-making process for acquiring property often diverges sharply between investors and end-users. Investors typically prioritize factors like potential for capital appreciation, rental yields, market liquidity for future exit strategies, and the long-term implications of the lease expiry date on valuation and resale value. Properties with shorter remaining lease terms may be perceived as higher risk or requiring more complex future planning. An end-user, on the other hand, is often more focused on the property’s suitability for their lifestyle needs, location, immediate affordability, and long-term security for their family, with the lease expiry being a less pressing concern if it is many decades away, especially given the automatic extension policy for many residential leases.

Here’s a comparison of key factors influencing each group:

| Factor | Investor Perspective | End-User Perspective |

|---|---|---|

| Primary Goal | Maximise return on investment (ROI) | Secure a home, stability |

| Lease Expiry Risk | Major concern, impacts valuation & exit timing | Less critical if lease is long & covered by automatic extension policy; focus on immediate needs |

| Market Liquidity | Essential for flexible resale | Secondary to property suitability & long-term occupancy |

| Price Sensitivity | High, focus on value metrics relative to yield/appreciation potential | Balanced with lifestyle factors, location, and personal affordability |

Furthermore, government land supply policies play a pivotal role in shaping these trends. As the primary supplier of land through auctions and tenders, the government’s decisions on the volume, type, and location of land parcels offered directly impact future supply levels. This, in turn, influences overall pricing and can affect the perceived value and desirability of existing properties, particularly those with shorter remaining lease terms. Market participants constantly assess how prevailing government policies might impact potential lease extension terms and premiums, adding another layer of complexity to valuation and influencing buyer preferences. These intertwined factors create a complex market landscape where tenure type and its associated terms remain significant considerations.

Strategic Approaches for Property Investors

Investing in the dynamic Hong Kong property market, which is significantly shaped by its unique land tenure system, requires a calculated and strategic approach. Successful investors understand that factors related to the leasehold system, alongside other market dynamics, profoundly impact long-term returns and risk exposure. Developing a robust investment strategy tailored to this specific environment is crucial for navigating its complexities and capitalising on opportunities while mitigating potential pitfalls.

A key component of a sound investment strategy in Hong Kong is informed decision-making regarding leasehold terms. Investors must not only assess a property’s current market value and rental yield but also conduct a thorough analysis of the remaining lease duration. Properties with shorter remaining terms may present acquisition opportunities at lower initial prices but come with increased risk related to future marketability, potential financing challenges for future buyers, and the eventual process of lease extension or expiry. Strategists evaluate the potential for appreciation versus these risks, considering the impact of time on the lease’s value.

Effective exit strategy planning is particularly vital when dealing with leasehold properties. Unlike freehold assets, which typically involve indefinite ownership, leaseholds have a defined lifespan. Investors must anticipate how the remaining lease term will affect the property’s marketability and value over time, especially years down the line when they might plan to sell. Planning the optimal time to exit, perhaps well before the lease end date becomes a significant factor for potential buyers or lenders, is essential to maximising return on investment and avoiding potential complications related to lease renewal premiums or perceived uncertainty by future purchasers.

Furthermore, rigorous due diligence is non-negotiable for any property acquisition in Hong Kong. For investors, this involves a thorough investigation beyond superficial market analysis. Key aspects include scrutinising the title deeds to understand the specific terms of the government lease, including the exact lease duration, permitted uses, and any restrictive covenants that could impact redevelopment potential or future value. Understanding the property’s history, current market rates and government rents liabilities, building condition, and potential future liabilities forms a critical checklist that informs the investment decision and helps identify potential risks before committing capital. A disciplined approach to due diligence helps uncover unforeseen issues that could impact profitability or complicate exit plans within the leasehold framework.