Understanding Hong Kong’s Territorial Tax System

Hong Kong operates under a distinctive and generally favorable tax system founded on the principle of territoriality. This fundamental concept dictates that taxation is imposed only on income considered to have its source in or derived from Hong Kong. Crucially, this applies regardless of whether the individual or company earning the income is resident in Hong Kong or not. For non-resident business owners, this means their global income is not automatically subject to Hong Kong tax; the focus remains strictly on income streams with a taxable nexus within the territory itself. Precisely determining the source of income, especially for business profits generated from activities spanning multiple jurisdictions, is a critical exercise under this system.

The Hong Kong tax framework primarily distinguishes between two key structures relevant to business owners: Profits Tax and Salaries Tax. Profits Tax is levied on assessable profits arising in or derived from Hong Kong from a trade, profession, or business carried on in Hong Kong. Salaries Tax, conversely, applies to income from employment, offices, or pensions sourced in Hong Kong. While both fall under the Inland Revenue Ordinance, they operate under distinct rules regarding assessability, deductions, and tax rates, presenting different considerations for extracting value from a Hong Kong-based business.

The status of being a non-resident introduces specific implications within this territorial framework. A non-resident individual earning employment income with a Hong Kong source will typically be subject to Salaries Tax on that specific income. Similarly, a non-resident company carrying on business in Hong Kong and deriving profits with a Hong Kong source will be liable for Profits Tax. Non-resident status does not grant automatic exemption; instead, it emphasizes the necessity of carefully assessing the source of all income streams to determine their taxability in Hong Kong. Understanding these foundational principles is vital for non-resident business owners navigating their tax obligations and payment strategies.

Comparing Salary and Dividend Tax Implications

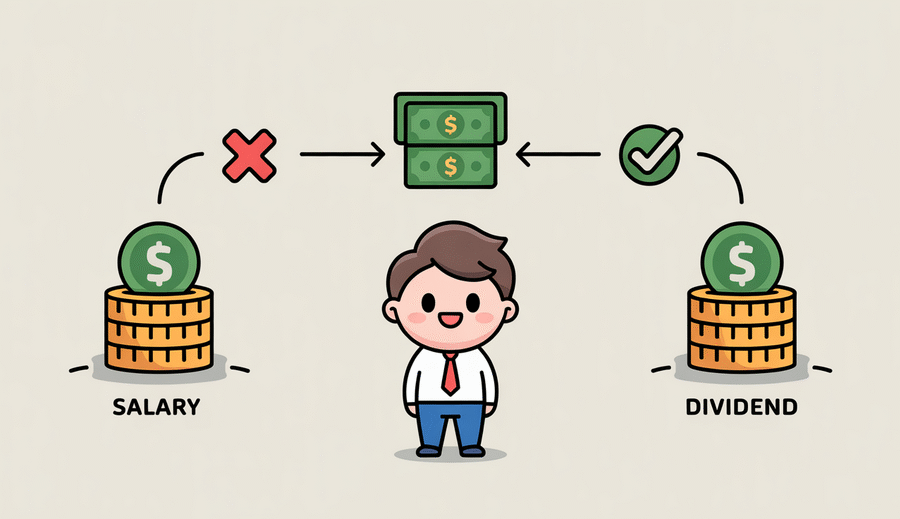

For non-resident owners of Hong Kong companies, a clear understanding of the distinct tax treatments for drawing income as a salary versus receiving it as a dividend is fundamental to tax optimization. These two primary methods of extracting value are subject to different tax regimes within Hong Kong, leading to potentially significant variations in the final tax burden. Analyzing the applicable rates and how they apply is the first step in strategic financial planning for wealth extraction.

Income received as a salary from a Hong Kong company is subject to Salaries Tax for the individual recipient. This operates under a progressive tax system, meaning the tax rate increases with higher income levels. While various tax allowances and deductions can reduce the assessable income, the top marginal tax rate can reach 17%. Salaries Tax is imposed directly on the individual receiving the payment, treated as earned income.

Conversely, profits earned by the company itself are first subject to Hong Kong Profits Tax. For corporations, this tax is levied at a flat rate of 16.5% on assessable profits. This tax is paid by the company out of its earnings before any distribution can be made to shareholders.

Crucially, dividends distributed by a Hong Kong company out of profits that have already been subjected to Profits Tax are treated as tax-exempt for the recipient shareholder in Hong Kong. This means there is typically no further tax liability imposed on the individual within Hong Kong when they receive these dividend payments, provided the underlying profits were properly taxed at the corporate level. This characteristic of the Hong Kong tax system is a key factor when comparing payment structures.

A simplified comparison of the core tax implications highlights the difference:

| Income Type | Subject To Hong Kong Tax? | Who Pays Hong Kong Tax? | Hong Kong Tax Rate/Treatment |

|---|---|---|---|

| Salary (from HK source) | Yes (Salaries Tax) | Individual Recipient | Progressive (up to 17%) |

| Company Profits (from HK source) | Yes (Profits Tax) | The Company | Flat 16.5% |

| Dividends (from HK taxed profits) | No (Exempt) | N/A (Profits already taxed) | Tax Exempt for Recipient in HK |

This distinction underscores a fundamental difference: salary is taxed directly to the individual at potentially higher progressive rates, while dividends originate from profits taxed at the flat corporate rate and are typically received free of further Hong Kong tax in the recipient’s hands. This difference forms the basis for optimizing how profits are extracted.

Legal and Compliance Requirements for Payments

Structuring how a non-resident business owner extracts value from their Hong Kong company through salary or dividends isn’t solely about tax optimization; it also involves navigating specific legal and regulatory compliance requirements. Failure to adhere to these rules can lead to significant penalties, disputes with the tax authorities, and even challenges to the legality of the payments themselves. Understanding the foundational legal mandates is paramount to ensuring your payment strategy is robust and defensible under scrutiny from the Inland Revenue Department (IRD) or other relevant bodies.

When a non-resident owner also serves as a director or employee of the Hong Kong entity, any salary paid must rigorously adhere to the arm’s length principle. This principle dictates that the compensation should be comparable to what an unrelated party would pay for similar services under similar conditions in the open market. The IRD expects such salary payments to be commercially justifiable and to reflect the value of services rendered, not merely an arbitrary distribution of profits. Establishing arm’s length benchmarks, often through market comparisons or by evaluating the director’s specific responsibilities and time commitment, is crucial for substantiating the legitimacy of the salary expense as a deductible business cost.

The allocation of profits and subsequent distribution of dividends to shareholders are governed by company law in Hong Kong and have specific procedural requirements. While dividends paid by a Hong Kong company are generally not subject to tax in Hong Kong for the recipient, the process by which profits are determined and declared as dividends must be legally sound. This includes ensuring distributions are made from lawfully available distributable reserves and adhering to the procedures outlined in the company’s articles of association. Proper board resolutions and shareholder approvals are essential for documenting the legal basis for dividend payments and demonstrating compliance with corporate governance standards.

Given that payments to non-resident owners often involve cross-border transactions, meticulous and comprehensive documentation is non-negotiable. This includes having clear service agreements or employment contracts in place to justify salary payments, retaining official board minutes authorizing dividend declarations, and maintaining clear records of all payment transfers. Such detailed documentation is vital not only for demonstrating compliance with Hong Kong regulations but also for potentially satisfying reporting or tax obligations in the owner’s country of residence and, critically, for defending the legitimacy of these transactions during any compliance review or tax audit by relevant authorities.

Optimizing Profit Extraction Strategies

For non-resident owners operating a business in Hong Kong, determining the most tax-efficient and strategically beneficial way to take profits out of the company is a critical decision. This involves a careful balancing act between accessing funds for personal use and retaining earnings within the business to fuel future growth, manage cash flow, or meet investment needs. The choice directly impacts the overall tax liability at both the corporate and individual levels, depending on the owner’s residence jurisdiction and how the funds are classified. Retaining earnings can strengthen the company’s balance sheet and provide capital for expansion, while distributing profits offers immediate personal liquidity.

Beyond the simple choice between immediate distribution and retention, the timing of how profits are extracted, particularly through dividends, offers flexibility that salaries typically do not. While salaries are usually paid on a regular schedule based on service provision, dividends can often be declared based on accumulated profits at opportune moments. Strategically timing dividend declarations can align with personal financial planning or changes in tax landscapes, potentially maximizing the efficiency of fund transfers from the company to the owner or related entities. This requires careful consideration of the company’s profitability, cash position, and future capital requirements, ensuring distributions do not hinder operational needs.

Furthermore, the structure through which the Hong Kong operating company is owned can significantly enhance profit extraction strategies. Utilizing a holding company structure, potentially based in a jurisdiction with favorable tax treaties or regulations regarding dividend flows, can add layers of efficiency. Such structures can facilitate the consolidation of international profits, provide flexibility in how and when funds are distributed to the ultimate beneficial owner, and potentially mitigate tax liabilities on subsequent transfers or upon a future sale of the operating company. These structural considerations are integral to a sophisticated approach to optimizing how value is realized from the Hong Kong business in alignment with broader international tax planning.

Managing Cross-Border Compliance Risks

Operating a business internationally from a Hong Kong base requires careful navigation of compliance obligations that extend beyond the territory’s borders. While Hong Kong offers a favorable tax regime rooted in territoriality, non-resident owners must be acutely aware of how their activities and income streams could interact with tax laws in other jurisdictions, particularly their country of residence or where significant business operations occur. Managing these risks effectively is crucial for long-term sustainability and avoiding potentially costly penalties or double taxation.

A primary concern is avoiding the inadvertent creation of a “permanent establishment” (PE) in a foreign country. A PE typically arises if a company has a fixed place of business or conducts business activities through an agent in another jurisdiction, potentially triggering corporate tax obligations there. Non-resident owners receiving salaries or dividends must understand how their personal presence or activities in their home country, or other locations where business is conducted, could be perceived and potentially create a PE for their Hong Kong company. Careful structuring of roles, responsibilities, and physical presence is essential to mitigate this risk.

Another critical area is transfer pricing compliance. This relates to the pricing of transactions between related entities in different tax jurisdictions, such as services provided by the Hong Kong company to an affiliate abroad, or management fees paid. Tax authorities in other countries require these intercompany transactions to be conducted at “arm’s length”—meaning the price should be what unrelated parties would agree upon under similar circumstances. Failure to comply can lead to profit adjustments, double taxation, and penalties. Robust documentation, often in the form of a transfer pricing study, is typically required to support the arm’s length nature of these intercompany transactions.

Finally, non-resident owners have personal foreign income reporting obligations in their country of residence. Regardless of how income is extracted from the Hong Kong company (salary or dividend), the owner is typically required to report this income and pay tax on it according to their home country’s tax laws. This often involves understanding applicable double taxation agreements (DTAs) between their country of residence and Hong Kong to claim credits or exemptions where applicable and ensure accurate reporting to both sets of tax authorities. Effective cross-border planning requires coordinating tax strategies in both jurisdictions.

Long-Term Business Growth Considerations

While optimizing immediate tax liabilities is often a primary concern for non-resident business owners in Hong Kong, the choice between salary and dividend payments also carries significant implications for the company’s long-term trajectory and value. These decisions can profoundly influence how the business is perceived by external parties, funded for expansion, and eventually transitioned or sold. Thinking beyond the current tax year allows for strategies that support sustainable growth and future planning.

One critical area affected is company valuation metrics. The way profits are extracted directly impacts the financial health and appearance of the profit and loss statement and balance sheet. High salaries reduce declared net profit, which can make the company appear less profitable and potentially depress valuation multiples based on earnings (e.g., Price-to-Earnings ratio). Conversely, retaining profits within the business through dividend distributions (which are paid from after-tax profits and do not impact the profit & loss statement above the net profit line) or lower salary draws allows for stronger retained earnings and a more robust balance sheet. This presents a stronger financial picture, often viewed favorably by potential investors, lenders, or future buyers when assessing the company’s worth.

Furthermore, the decision between taking high salaries versus distributing dividends or retaining earnings has a direct bearing on the capital available for funding international expansion plans. Growing a business often requires significant investment in new markets, infrastructure, talent acquisition, or technology. Capital extracted as salary is permanently removed from the business’s resources. In contrast, profits distributed as dividends are typically taken from post-tax earnings, and profits retained remain as internal funding for reinvestment. A strategy that prioritizes capital retention through managed salary levels and strategic dividend policies can provide the necessary liquidity to seize expansion opportunities without relying solely on external financing, preserving equity and control.

Finally, the chosen payment structure can play a vital role in succession planning. Business owners eventually look towards retirement or transitioning ownership. The accumulation of personal wealth outside the business through salary can be one approach, but strategic dividend distributions can also be used to fund retirement plans, facilitate wealth transfer to family members, or structure buy-sell agreements for transferring ownership to partners or key employees. Integrating profit extraction strategies with long-term succession goals ensures a smoother transition, helps preserve the value built over the years, and aligns the owner’s personal financial planning with the company’s future. Considering these long-term factors alongside immediate tax advantages is key to building a resilient and valuable enterprise.

Navigating Emerging Global Tax Reforms

The global tax landscape is undergoing significant transformation, driven by initiatives aimed at increasing transparency and ensuring multinational enterprises pay a minimum level of tax globally. For non-resident business owners operating in Hong Kong, understanding these emerging reforms is critical, as they can indirectly influence the overall tax efficiency of salary versus dividend payment structures, even within Hong Kong’s territorial tax system. Staying ahead of these changes requires careful consideration of international developments and their potential ripple effects on cross-border business structures and income flows.

A primary area of focus globally is the work from the Organisation for Economic Co-operation and Development (OECD), particularly the BEPS (Base Erosion and Profit Shifting) 2.0 project. Pillar Two of this project introduces a global minimum corporate tax rate, typically set at 15%. While Hong Kong’s standard profits tax rate of 16.5% for corporations (and 8.25% for the first HKD 2 million of assessable profits) is often above this threshold, the rules are complex and can affect corporate groups based on their consolidated global revenue and presence in various jurisdictions. Non-resident owners with business operations or group entities in other countries subject to these rules must understand how the minimum tax calculations could impact the group’s overall effective tax rate, potentially affecting decisions on where profits are held or how they are distributed.

Adapting to these potential minimum tax rules involves evaluating the overall corporate structure and profit flows beyond Hong Kong. Even if the Hong Kong entity is compliant locally under its territorial system, income received by a non-resident owner in another jurisdiction or profits earned by related entities elsewhere could trigger top-up tax obligations under Pillar Two or similar domestic rules in other countries implementing these reforms. This necessitates a broader perspective when planning salary levels versus dividend distributions, considering not just the Hong Kong tax outcome but also the potential tax treatment and minimum tax implications in all relevant jurisdictions involved in the ownership and operational structure.

Leveraging Double Taxation Agreements (DTAs) becomes even more important in this complex environment. Hong Kong has an extensive network of DTAs that clarify taxing rights between jurisdictions and often provide mechanisms for reducing withholding taxes on cross-border payments like dividends or interest. While DTAs primarily prevent double taxation, they also incorporate principles from BEPS actions, including measures against treaty abuse and provisions for mutual agreement procedures. Understanding the specific DTA between Hong Kong and the non-resident owner’s country of residence, and how it interacts with emerging minimum tax rules and domestic legislation, is crucial for optimizing the tax efficiency of salary and dividend payments and ensuring compliance across borders. These agreements provide a framework for managing cross-border tax outcomes amidst evolving international norms.