Financial Consequences Beyond Direct Fines

Navigating tax obligations in a new country presents inherent complexities. For expatriates in Hong Kong, failing to meet these requirements carries significant financial consequences that extend well beyond the immediate penalties often discussed. While fines represent a direct cost of non-compliance, it is crucial to understand the broader array of financial burdens that can accumulate, substantially increasing the total expense of unresolved tax matters and potentially impacting long-term financial stability. These less obvious penalties can escalate rapidly, transforming an initial oversight into a considerable financial strain.

A significant, though frequently overlooked, financial consequence is the accumulation of late payment interest charges. When tax payments are missed or delayed, the Inland Revenue Department (IRD) levies interest on the outstanding balance. This interest accrues continuously, either daily or monthly, contingent on the specific circumstances and duration of the default. What might initially appear as a minor tax debt can expand substantially over time due to compounding interest, making the eventual settlement considerably more costly than the original tax amount due. Ignoring official reminders further allows this debt and its associated interest to spiral.

In more serious instances where tax debts persist despite repeated demands, the IRD possesses powers to pursue more forceful recovery actions, including asset seizure. Authorities may take steps to freeze or seize assets held by the non-compliant individual within Hong Kong, such as bank account balances. In scenarios involving persistent or high-value debts, these actions could potentially extend to other forms of property to satisfy the outstanding tax liability. This intrusive measure can significantly disrupt an individual’s financial operations and security, underscoring the serious nature with which tax debts are pursued by the authorities.

Furthermore, if the IRD is compelled to initiate legal proceedings to enforce payment and recover outstanding tax debt, the non-compliant expat may become liable for the legal fees incurred during this recovery process. These costs are added to the existing outstanding tax debt and accumulated penalties, further exacerbating the financial burden. The initiation of legal processes typically occurs after other resolution methods have failed, often following a prolonged period of non-compliance which inevitably results in higher overall costs due to accrued interest, penalties, and now legal expenses. Understanding these cascading financial penalties is essential for any expat living and earning in Hong Kong.

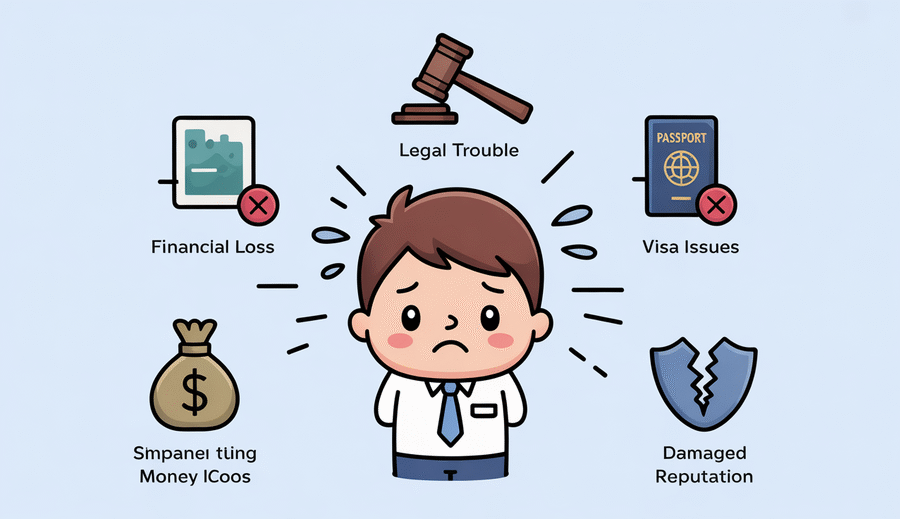

Legal Repercussions and Prosecution Risks

Non-compliance with Hong Kong’s tax regulations extends far beyond purely monetary penalties. For expats, the potential legal repercussions can be profoundly disruptive, impacting future financial status and personal freedom in significant ways. One immediate consequence of being flagged for non-compliance or becoming involved in tax disputes is the potential imposition of mandatory audits on all future tax filings. This isn’t merely a one-off event; it signifies a loss of trust with the Inland Revenue Department (IRD) and subjects every subsequent tax declaration to intense scrutiny. Navigating these mandatory audits is time-consuming, stressful, and frequently necessitates engaging professional assistance, adding further unplanned costs and considerable administrative burden for years to come.

Significantly more severe are the risks associated with deliberate tax evasion. Should the IRD conduct an investigation and uncover compelling evidence of intentional misrepresentation, concealment of income, or fraudulent tax filings undertaken with the explicit aim of avoiding tax liability, the matter can rapidly escalate to criminal prosecution. Hong Kong tax law imposes substantial penalties for such offenses, including hefty fines that far exceed the original tax amount due and, in serious cases, potentially even imprisonment. A criminal record, particularly one linked to financial misconduct, can irrevocably damage an expat’s professional reputation, jeopardize current or future employment prospects, and complicate residency status globally. This clearly highlights the critical distinction authorities make between making an honest error and actively attempting to defraud the tax system.

Another critical legal risk, often not considered until it materializes, is the potential for travel restrictions. For expats with significant or unresolved tax debts or ongoing legal disputes concerning their tax affairs, the IRD possesses the authority to request immigration authorities implement travel bans. This severe measure can prevent an individual from leaving Hong Kong or re-entering the territory until the tax matter is fully resolved. Such a ban can have devastating effects on personal relationships, international business commitments, and overall quality of life, effectively trapping an individual within the territory.

These legal and prosecution risks clearly demonstrate that ignoring tax obligations in Hong Kong carries consequences far more serious than financial penalties alone. The potential for mandatory future audits, criminal charges, and travel restrictions constitutes a formidable set of challenges that can significantly derail an expat’s life and career in the territory.

Visa and Residency Status Complications

For expatriates residing and working in Hong Kong, maintaining meticulous tax compliance is not merely about avoiding financial penalties; it is critically linked to their immigration status and their fundamental right to remain in the territory. The government’s immigration department works in conjunction with tax authorities, meaning that issues with an individual’s tax record can directly impact their visa and residency standing.

One significant risk is encountering visa renewal denials. When expats apply to extend their stay or modify their visa status, immigration officers may review for any outstanding legal or financial issues, including tax arrears or unresolved tax disputes. A history of non-compliance or a current tax problem can be flagged during this assessment, potentially resulting in the refusal of a visa extension. This outcome can be sudden and profoundly disruptive, potentially compelling the individual to leave Hong Kong and jeopardizing their established career and life in the city.

Furthermore, tax non-compliance presents substantial obstacles for expats aspiring to obtain permanent residency in Hong Kong. Achieving permanent resident status typically requires demonstrating a history of contributing to and respecting the laws of the territory, and a clean tax record is a fundamental component of this evaluation. Significant tax issues, whether arising from negligence or deliberate evasion, can substantially delay or even entirely derail an application for permanent residency, undermining years of effort dedicated to establishing a long-term future in Hong Kong.

In the most severe circumstances, particularly those involving deliberate and serious tax evasion or fraud, non-compliance can even carry the risk of deportation. While not a common outcome for minor administrative errors, willful and significant violations of tax law demonstrate a clear disregard for Hong Kong’s legal framework. Such actions can lead to complex legal entanglements that may ultimately impact an individual’s eligibility to reside in the territory, potentially culminating in proceedings that could result in their removal from Hong Kong. Therefore, safeguarding your tax compliance is paramount to securing your continued right to live and work abroad.

Reputational Damage in Professional Circles

Beyond the tangible financial and legal consequences, tax non-compliance in Hong Kong carries a significant hidden cost: severe damage to an expat’s professional reputation. In a competitive international financial hub like Hong Kong, a professional’s standing and credibility are paramount. Tax issues can erode trust and confidence among peers and employers, impacting career progression and business opportunities in ways that are often challenging to mend.

A major repercussion is the erosion of employer trust, particularly if a tax investigation becomes publicly known or involves the employer in any capacity. Employers rely on their staff to be reliable, discreet, and fully compliant with local laws. An employee facing tax problems can be perceived as a potential liability, raising concerns about their judgment, integrity, and reliability. This perception can lead to being bypassed for promotions, excluded from sensitive projects, or even jeopardize one’s position, as companies are typically cautious of any association that could reflect negatively on them or cause internal disruption.

For expats who operate their own businesses or work in highly regulated sectors such as finance, the stakes are considerably higher. Tax non-compliance can directly threaten the ability to conduct business legally. There is a real possibility of business license revocation by relevant authorities, effectively halting an expat’s livelihood. Furthermore, within close-knit professional networks, particularly in finance, tax issues are heavily scrutinized. Being flagged for non-compliance can lead to professional ostracism, making it difficult to secure future roles, attract clients, or maintain crucial professional relationships within the industry.

Ultimately, the reputational damage stemming from tax non-compliance casts a long shadow that can follow an expat throughout their career in Hong Kong and potentially internationally. Rebuilding trust with employers, colleagues, clients, and industry peers is a slow and arduous process. The loss of professional credibility represents a deeply impactful cost, potentially limiting opportunities and long-term career prospects in this dynamic city.

Long-Term Financial Planning Disruptions

While the immediate consequences of tax non-compliance for expats in Hong Kong are severe, the ripple effects can extend far into your future financial stability. Failure to fulfill tax obligations doesn’t solely result in immediate fines and penalties; it can fundamentally disrupt your capacity to build and manage long-term wealth and security. These disruptions frequently manifest in critical areas that form the bedrock of financial planning, making it considerably harder to achieve significant life goals.

One of the primary long-term impacts arises from damage to your creditworthiness. Unpaid tax debts, accumulated penalties, or legal judgments related to tax issues can significantly impair your credit score and financial standing. This compromised credit profile makes obtaining crucial financing, such as mortgages, incredibly challenging, if not impossible. Whether your plans involve purchasing property in Hong Kong or internationally, a history of tax non-compliance can close doors to favorable loan terms or result in outright rejections, significantly derailing home ownership aspirations.

Furthermore, tax investigations and audits can have a chilling effect on your investment activities. During prolonged audits or as part of debt recovery procedures, authorities may impose holds or freezes on your investment accounts. This action prevents you from trading, accessing funds, or benefiting from market movements, potentially leading to significant losses or missed opportunities for portfolio growth. Such disruptions can cripple your long-term investment strategy and undermine years of diligent financial planning.

Perhaps most critically, unresolved tax liabilities can necessitate the forced liquidation of hard-earned assets to satisfy outstanding debts. This involuntary selling of investments, property, or other holdings directly impacts your retirement planning. Assets specifically earmarked for future security may need to be sacrificed, resulting in substantial delays or even a complete derailment of your retirement timeline. The ability to retire comfortably is fundamentally jeopardized when the very assets intended for that purpose are used to settle past tax burdens accumulated through non-compliance.

The long-term financial consequences underscore the pervasive nature of tax non-compliance, extending beyond immediate financial strain to fundamentally undermine future security and aspirations built over years.

| Type of Disruption | Potential Long-Term Consequence |

|---|---|

| Impaired Creditworthiness | Difficulty or inability to secure significant loans (e.g., mortgages). |

| Investment Account Freezes | Interruption of investment strategies and potential loss of growth opportunities. |

| Forced Asset Liquidation | Depletion of assets intended for retirement or other long-term goals. |

Addressing tax obligations properly is thus not merely about avoiding penalties today, but about safeguarding your financial future against these profound and lasting disruptions.

Hidden Costs of Compliance Investigations

Beyond the readily apparent fines and penalties, tax non-compliance often triggers comprehensive investigations by tax authorities. These inquiries introduce a layer of less obvious, yet potentially significant, financial burdens that can severely impact an expat’s overall financial and personal well-being. These hidden costs extend beyond direct tax liabilities and penalties, manifesting in various disruptive ways throughout the investigation process itself.

One substantial, often underestimated, cost is the toll on personal health. The intense stress, anxiety, and uncertainty associated with a prolonged tax investigation can take a severe toll on an individual’s physical and mental health. Navigating demands for documentation, attending meetings with authorities or legal counsel, and confronting the prospect of significant penalties can lead to stress-related health issues. This can result in unexpected medical expenses, including doctor visits, medication, or even psychological support, adding a financial strain not directly related to the tax liability itself.

Another considerable hidden cost is the accumulation of professional fees. While initial consultations with legal or accounting professionals might seem manageable, investigations can often extend for months or even years. This protracted process requires ongoing support from tax specialists, lawyers, or accountants, leading to substantial hourly fees that can escalate quickly. The longer the investigation persists, the greater the financial drain from these prolonged professional representation costs, diverting funds that could otherwise be used for savings, investments, or personal expenditures.

Furthermore, an investigation can directly impact an individual’s earning capacity. The significant time and mental energy required to address the complexities of the case can serve as a major distraction from work responsibilities, potentially leading to decreased productivity or missed professional opportunities. In some instances, individuals may need to take time off work for meetings, document preparation, or potential court appearances, resulting in direct loss of income. For business owners, the distraction and potential reputational damage can negatively affect business operations, client relationships, and revenue generation throughout the period leading to resolution.

To further highlight these less visible expenses, consider the following aspects of an investigation’s broader financial footprint:

| Type of Hidden Cost | Impact |

|---|---|

| Stress-Induced Health Expenses | Unexpected medical bills and healthcare costs arising from the physical and mental strain of the investigation process. |

| Prolonged Professional Service Fees | Significant and accumulating costs for ongoing legal, accounting, or tax specialist support required throughout the potentially lengthy investigation. |

| Opportunity Cost / Income Loss | Reduction in earnings or loss of business opportunities due to time spent addressing the investigation, distraction from work, or negative professional impact during the resolution period. |

These hidden costs underscore that the financial burden of non-compliance is far broader than merely the back taxes and penalties ultimately assessed. They represent a significant, often unforeseen, financial and personal weight that can persist long after the initial tax issue is identified, making proactive compliance a far less costly and disruptive alternative in the long run.

Real-World Case Studies from HK Expats

While theoretical consequences of tax non-compliance provide valuable context, examining real-world cases faced by expats in Hong Kong offers a stark and tangible understanding of the risks involved. These are not hypothetical scenarios but actual outcomes experienced by individuals and businesses, serving as critical warnings for anyone living and working in the city. Understanding how non-compliance has impacted others can strongly underscore the importance of diligent adherence to tax regulations and obligations.

One compelling case involved a financial professional who faced severe repercussions for significant tax discrepancies over several years. Due to unreported income and apparent deliberate underestimation of liabilities, the Inland Revenue Department (IRD) initiated rigorous action. The ultimate penalty imposed was substantial, reportedly amounting to 300% of the original tax liability. This punitive fine clearly demonstrates that penalties can escalate dramatically beyond the initial tax debt, causing devastating financial damage and severely impacting one’s professional standing in a finance-centric city like Hong Kong.

Another impactful case highlights the risks specifically for business owners. A consultancy firm operated by an expat encountered serious issues with tax compliance that came to light during a routine audit. Despite opportunities provided to rectify the situation, persistent non-compliance or unresolved disputes ultimately led to the revocation of the firm’s business registration by the relevant authorities. Without a valid business license, the consultancy was legally unable to continue operations, resulting in the closure of the business and significant financial loss for the owner and any employees.

Perhaps one of the most personally disruptive cases involved a family whose residency status was jeopardized. The tax non-compliance of one spouse, reportedly stemming from a misunderstanding of filing obligations or simple neglect, created significant complications with their visa status. The issue became so severe that it ultimately contributed to the cancellation of the entire family’s dependent visas. This case powerfully illustrates that the failure to comply with tax laws can have far-reaching consequences that extend beyond the individual taxpayer, potentially jeopardizing the ability of innocent family members to remain in Hong Kong and requiring a complete upheaval of their lives.

These specific examples drawn from the expat community in Hong Kong powerfully illustrate the severe and varied consequences of tax non-compliance. They transition the discussion from abstract risks to concrete, lived outcomes, showing how neglecting tax duties can lead to crippling financial penalties, the termination of businesses, and even the forced relocation of families. Such cases serve as undeniable evidence of the critical necessity for all residents to fully understand and diligently fulfill their tax obligations in Hong Kong.

Proactive Compliance Strategies Moving Forward

To effectively navigate the complexities of taxation in Hong Kong and successfully avoid the significant pitfalls of non-compliance, expats should prioritize proactive strategies. Rather than merely reacting to tax issues as they arise, implementing forward-thinking measures ensures accuracy, timeliness, and ultimately provides peace of mind regarding tax obligations. These strategies focus on leveraging expert knowledge, utilizing technology for streamlined record-keeping, and staying continuously informed about evolving regulations.

Adopting a proactive approach involves integrating specific actions into one’s financial management routine throughout the year. Here are key steps expats can take to ensure they remain compliant and mitigate risks:

| Proactive Strategy | Key Benefit for Expats |

|---|---|

| Engage a Cross-Border Tax Specialist Early | Receive expert guidance tailored to international financial situations and residency status, ensuring accurate reporting from the outset and correctly applying tax treaties. |

| Implement Robust Digital Record-Keeping Systems | Maintain organized, accessible, and comprehensive financial records throughout the year, significantly simplifying the annual filing process and providing a robust audit trail. |

| Stay Informed on Tax Law Changes and Procedures | Ensure awareness of the latest tax regulations, filing requirements, deadlines, and procedural updates directly from official sources or reliable professional channels. |

Engaging a tax specialist with specific experience in cross-border matters and Hong Kong taxation is often the most crucial initial step. These professionals can provide tailored advice specific to an expat’s country of origin and individual financial profile, helping to correctly apply relevant tax treaties, navigate reporting requirements for foreign income, and structure affairs compliantly from the outset. Early consultation prevents potential misunderstandings and ensures tax obligations are addressed accurately and timely.

Implementing a robust digital system for tracking all income and expenses throughout the year streamlines the compliance process significantly. Whether utilizing dedicated accounting software, expense tracking applications, or meticulously organized digital spreadsheets, maintaining real-time records eliminates the common last-minute scramble for documentation. This organized approach reduces the risk of errors or omissions during filing and provides a readily available, comprehensive audit trail should the IRD require clarification or conduct a review.

Finally, making a consistent effort to stay informed about the latest tax regulations and procedural changes is essential for ongoing compliance. Hong Kong’s tax laws can undergo amendments, and filing requirements or deadlines may occasionally shift. Actively seeking updates through official IRD channels, subscribing to tax news alerts from reputable firms, or attending (or reviewing materials from) annual IRD briefings ensures expats are always aware of their current obligations. This continuous education and vigilance are vital for preventing accidental non-compliance due to outdated information.

By consistently applying these three proactive measures—seeking expert professional advice early, maintaining detailed digital records diligently, and staying abreast of regulatory changes—expats can build a strong foundation for tax compliance in Hong Kong, significantly mitigating risks and effectively avoiding the multifaceted costs associated with non-compliance.