Trust Fundamentals for Wealth Preservation

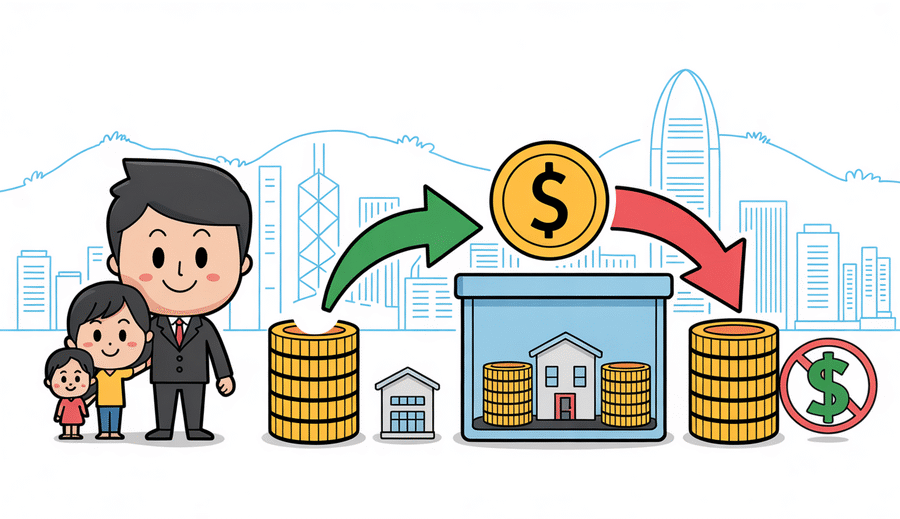

For entrepreneurs in Hong Kong focused on securing their legacy, understanding the fundamentals of trusts is crucial. Trusts are more than just legal instruments for transferring assets; they represent sophisticated structures specifically designed to preserve wealth across generations. They offer layers of protection and strategic advantages that direct transfers or wills alone often cannot provide, forming a cornerstone of effective estate planning that enables controlled and efficient asset distribution.

A primary benefit trusts offer is the ability to bypass probate. Probate is the often time-consuming and public legal process required to validate a deceased person’s will and execute the distribution of their assets. By placing assets into a trust during one’s lifetime, these assets are typically held by the trustee for the benefit of the designated beneficiaries and thus do not need to pass through the probate court upon the settlor’s death. This significantly reduces delays, minimizes legal costs, and facilitates a far quicker, more certain transition of wealth to the intended recipients.

Furthermore, trusts are exceptionally effective tools for consolidating and managing cross-border assets. Entrepreneurs frequently hold diverse investments, businesses, and properties in multiple jurisdictions. Navigating the intricate legal complexities, varying tax implications, and distinct inheritance laws of several countries simultaneously can be incredibly challenging. A single trust structure can effectively hold these geographically dispersed assets, bringing them under one unified administration. This simplifies management, streamlines distribution, and helps avoid the need for multiple wills and complex probate proceedings across different nations.

Another significant advantage inherent in trust structures is the preservation of family confidentiality. Unlike the probate process, which becomes a matter of public record detailing a deceased person’s assets and beneficiaries, the administration and distribution of assets within a trust remain private. This discretion is highly valued by families who prefer to keep their financial affairs out of the public eye, helping to prevent potential disputes and maintaining the privacy of both the beneficiaries and the extent of the wealth being transferred.

These foundational principles highlight why trusts are indispensable tools for Hong Kong entrepreneurs focused on effective and secure wealth preservation and transfer. The key advantages can be summarized as follows:

| Wealth Preservation Benefit | Description |

|---|---|

| Probate Avoidance | Sidesteps slow, costly, and public court processes for a faster, private asset distribution to beneficiaries. |

| Global Asset Consolidation | Unifies management of assets across different countries under a single, simplified structure, easing administration. |

| Enhanced Confidentiality | Maintains privacy regarding the settlor’s assets and beneficiaries, unlike public probate. |

Hong Kong’s Tax Advantages for Trust Settlors

Establishing a trust with a connection to Hong Kong offers significant potential tax advantages for settlors, positioning it as an attractive jurisdiction for wealth transfer and preservation. These benefits largely arise from Hong Kong’s favourable tax regime, particularly concerning capital gains, estate duty, and the treatment of foreign-sourced income.

One of the primary appeals is Hong Kong’s absence of a general capital gains tax. Unlike many other jurisdictions where profits derived from the sale of assets such as stocks, real estate, or businesses are subject to taxation, Hong Kong generally imposes no tax on capital gains. When assets are settled into a trust and subsequently appreciate in value or are sold by the trustee, the lack of capital gains tax within Hong Kong provides a distinct advantage, allowing wealth to grow and be managed more efficiently without this particular tax liability impacting the trust’s portfolio performance.

Furthermore, Hong Kong repealed its estate duty in 2006. This significant change means that assets situated in Hong Kong are not subject to estate tax upon the death of the owner. While this benefit applies broadly, structuring wealth through a trust complements this environment by providing a clear, pre-determined framework for asset distribution to beneficiaries. This can often avoid potential complexities and delays associated with probate processes that might still be relevant for foreign-situated assets, even in a death-tax-free environment like Hong Kong. It ensures a smoother, more certain transfer aligned with the settlor’s wishes.

Additionally, Hong Kong operates under a territorial basis of taxation. This principle dictates that only income sourced within Hong Kong is subject to profit tax or salaries tax. Income sourced outside of Hong Kong generally falls outside the scope of Hong Kong taxation. For trusts holding foreign assets or generating income from foreign sources, this principle is highly beneficial. Properly structured trusts can effectively shelter foreign-sourced income, ensuring that earnings from international investments or businesses held within the trust are not taxed in Hong Kong, provided the income source is genuinely outside the territory.

These combined factors create a compelling tax landscape when considering settling trusts with a connection to Hong Kong, particularly for entrepreneurs and high-net-worth individuals with cross-border assets. Leveraging these tax advantages through a carefully planned trust structure can significantly enhance the efficiency of wealth transfer and asset management.

| Tax Type | Hong Kong Approach | Benefit for Trusts |

|---|---|---|

| Capital Gains Tax | None | Assets within the trust can grow tax-free on capital appreciation. |

| Estate Duty | Repealed in 2006 | Wealth passes to beneficiaries without death taxes on HK-situated assets. |

| Foreign Income Tax | Territorial basis (generally not taxed if source is outside HK) | Foreign-sourced trust income can be sheltered from HK tax. |

Structuring Trusts for Multigenerational Transfer

Beyond the initial act of settling a trust, building a structure capable of effectively transferring wealth across multiple generations requires careful, forward-thinking design. This involves making critical decisions about the trust’s foundational elements to ensure its longevity, security, and alignment with the settlor’s long-term vision for their family’s prosperity.

A pivotal decision in establishing an enduring trust structure is selecting the optimal jurisdiction. While Hong Kong offers compelling tax advantages, the trust itself may be governed by the laws of another jurisdiction renowned for its robust trust legislation, strong asset protection laws, and political stability. Choosing a reputable offshore or onshore financial centre can provide enhanced legal certainty, safeguard assets from potential future claims or instability, and offer a framework conducive to complex wealth planning—all crucial considerations for entrepreneurs with diverse, global asset portfolios.

Another essential component for effective long-term governance is appointing a professional protector. The protector serves as an independent oversight figure, acting as a check on the trustee’s powers and ensuring the trust is administered strictly according to the settlor’s intentions as outlined in the trust deed. Unlike family members who might face conflicts of interest, professional protectors bring impartiality, expertise, and continuity. They typically possess powers such as the ability to remove and appoint trustees or veto significant decisions, thereby adding a crucial layer of security and governance to the trust structure over its potentially very long lifespan.

Finally, defining staggered distribution triggers is fundamental to managing wealth transfer responsibly across generations. Instead of distributing significant assets outright to beneficiaries at a single point in time, the trust deed can specify conditions or age milestones that must be met before distributions occur. This mechanism helps protect younger beneficiaries from receiving substantial wealth before they are ready to manage it effectively. It aligns the transfer of assets with their maturity, educational achievements, or other life events, ensuring the wealth supports their development rather than potentially becoming a burden or risk.

These three elements—jurisdiction, protector appointment, and distribution staging—are cornerstones in designing a trust built for enduring, multigenerational wealth transfer. They collectively create a resilient framework capable of adapting to future circumstances while upholding the settlor’s legacy.

| Structural Element | Purpose | Key Consideration |

|---|---|---|

| Trust Jurisdiction | Legal stability, asset protection, privacy | Governing trust laws, tax regime, political environment |

| Professional Protector | Independent trustee oversight | Expertise, impartiality, long-term availability |

| Staggered Distributions | Manage beneficiary readiness & responsibility | Age triggers, life milestones, specific conditions |

Navigating Hong Kong’s Trust Legal Framework

Establishing a trust in Hong Kong requires a thorough understanding of the jurisdiction’s robust legal framework. While trusts are rooted in English common law principles, Hong Kong has developed its own specific statutes and judicial interpretations that govern their operation. A key aspect for any settlor or trustee is comprehending the duties and responsibilities incumbent upon the trustee under this system. Trustees in Hong Kong owe a fiduciary duty of utmost loyalty and care to the beneficiaries, acting impartially and prudently in managing trust assets strictly according to the terms of the trust deed and established common law principles, augmented by legislation like the Trustee Ordinance.

Compliance obligations also form a critical component of the Hong Kong trust landscape, particularly concerning anti-money laundering and counter-terrorist financing regulations. The Anti-Money Laundering and Counter-Terrorist Financing Ordinance (AMLO) imposes significant requirements on trust service providers operating in or from Hong Kong. This includes performing rigorous Customer Due Diligence (CDD) on settlors, trustees, and beneficiaries, maintaining detailed records of transactions, and implementing robust internal controls to detect and report suspicious activities to the relevant authorities. Adherence to AMLO is not merely a formality but a legal imperative designed to safeguard the integrity of Hong Kong’s financial system and, by extension, the reputation of the trust structure itself.

Despite careful planning, disagreements can occasionally arise within a trust structure, perhaps between trustees, beneficiaries, or a combination thereof. The Hong Kong legal framework provides established mechanisms for resolving such conflicts. Increasingly, modern trust deeds incorporate specific clauses mandating or encouraging alternative dispute resolution (ADR) methods, such as mediation or arbitration. Mediation, for instance, offers a confidential and potentially less adversarial path to resolving disputes compared to traditional litigation, allowing parties to work towards mutually acceptable solutions. Understanding these resolution mechanisms and considering their proactive inclusion in the trust documentation is vital for the long-term harmony and effective administration of the trust.

Trusts vs Direct Gifts in Business Families

For Hong Kong entrepreneurs planning wealth transfer within their family, the choice between establishing a trust and making direct gifts is significant, especially when involving business assets. While direct gifts offer a perceived simplicity, they often fall short of addressing the complex needs of preserving family wealth across generations and safeguarding the integrity of a family business. Trusts, conversely, provide sophisticated mechanisms specifically tailored for these unique challenges, offering layers of protection and control that direct transfers simply cannot match.

One critical distinction lies in mitigating the risks associated with beneficiary immaturity or financial inexperience. A direct gift places assets immediately under the recipient’s full legal control, regardless of their age, maturity, or financial acumen. This can regrettably lead to mismanagement, premature depletion of wealth, or exposure to financial pressures. A trust, however, allows the settlor to define staggered distributions based on age, educational milestones, or other specific conditions, with a professional trustee overseeing the assets and managing funds responsibly until the beneficiary is deemed ready, thereby safeguarding the inheritance over time.

Furthermore, trusts offer robust protection against potential asset loss due to beneficiaries’ marital disputes or other creditor claims. Assets held within a properly structured and administered discretionary trust are typically not considered the personal property of the beneficiary and are therefore less vulnerable to claims made during divorce proceedings or other forms of litigation against the beneficiary. In stark contrast, assets received as a direct gift become fully integrated into the beneficiary’s personal estate, potentially exposing them to division in such circumstances.

Maintaining control over business assets during generational transitions is another area where trusts excel. Direct gifts of business shares or assets transfer immediate and potentially absolute control to the recipient. This can destabilize operations if the successor is not fully prepared or if multiple beneficiaries inherit unequal interests and management philosophies. Trusts, however, can be structured to separate beneficial ownership from control. This allows existing leadership or appointed professional trustees to retain oversight, manage voting rights, and guide the business through a smooth transition, ensuring continuity and stability while the wealth ultimately benefits the family according to the settlor’s plan.

Comparing these fundamental aspects highlights why trusts are often the preferred method for wealth transfer in business families seeking long-term preservation, strategic control, and protection against unforeseen future events.

| Feature/Concern | Using a Trust | Using Direct Gifts |

|---|---|---|

| Beneficiary Readiness Risk | Structured distributions based on conditions (age, milestones) and trustee oversight help manage funds responsibly. | Immediate, unrestricted access by recipient can lead to mismanagement or premature depletion. |

| Asset Protection (Marital/Creditor) | Assets held in trust are often protected from a beneficiary’s personal marital or creditor claims. | Assets become the beneficiary’s personal property, potentially vulnerable to division or claims. |

| Maintaining Business Control | Control mechanisms (e.g., trustee/protector powers) can be retained or structured during the transition period. | Full legal control transfers immediately with asset ownership, potentially disrupting business continuity. |

Understanding these critical differences is vital for entrepreneurs aiming to ensure their legacy is preserved and their family business continues to thrive under careful stewardship for generations to come.

Common Pitfalls in Trust Implementation

Establishing a trust is a significant step in wealth transfer and preservation, offering numerous advantages for Hong Kong entrepreneurs. However, the journey from conceptualizing a trust to achieving successful, long-term implementation is fraught with potential missteps. Awareness of these common pitfalls is crucial to ensure the trust effectively serves its intended purpose without creating unforeseen complications or failing to adapt to changing circumstances over time.

A primary issue frequently encountered is the inadequate funding of the trust assets. A trust is a legal entity designed to hold and manage assets for beneficiaries; it requires actual, sufficient assets to operate and fulfill its objectives. If the initial funding is insufficient, or if promised assets are never formally transferred into the trust, the structure may lack the substance needed to achieve its goals, such as providing adequately for beneficiaries or managing specific investments efficiently. Furthermore, administrative costs and professional fees might outweigh the value of the assets it holds, rendering the structure inefficient or impractical.

Another critical oversight, particularly for families with international ties or assets located abroad, is neglecting to consider forced heirship rules. These are legal principles in some jurisdictions that restrict an individual’s freedom to dispose of their property by will or gift, mandating that a certain portion must pass to specific relatives (typically children). If beneficiaries or significant assets are located in jurisdictions with such rules, a trust structure designed without considering these mandatory provisions could face legal challenges, potentially disrupting the settlor’s intended distributions and causing costly litigation.

Finally, a surprisingly common error is the failure to conduct regular trust reviews. The legal, tax, and financial landscapes evolve constantly, as do family circumstances, beneficiary needs, and the nature of the trust assets themselves. A trust agreement drafted years ago, while initially sound, may no longer be optimal or fully compliant with current regulations, or it may simply no longer reflect the settlor’s current wishes or the beneficiaries’ present circumstances. Periodic reviews, ideally conducted with professional advisors, are essential to ensure the trust remains relevant, effective, compliant, and aligned with the settlor’s intentions, preventing it from becoming an outdated impediment to effective wealth management.

Innovations in Digital Asset Trust Solutions

As the landscape of wealth continues to evolve, traditional trust structures are adapting to incorporate modern asset classes, particularly digital assets. This marks a significant innovation in wealth transfer, addressing the unique challenges and opportunities presented by cryptocurrencies, non-fungible tokens (NFTs), and other forms of virtual property. Entrepreneurs in Hong Kong holding substantial digital portfolios increasingly require trust solutions that can effectively integrate these novel holdings into their comprehensive estate planning and wealth transfer strategies.

Integrating cryptocurrency and other virtual assets into a trust requires careful consideration of custody, valuation, security, and accessibility. Unlike physical assets or traditional securities, digital assets exist on decentralized ledgers and are accessed via cryptographic private keys. Trust structures designed to hold digital assets must account for secure storage methods, such as cold storage or specialized institutional custodians, and establish clear, secure protocols for managing private keys, executing transactions, and eventually distributing or liquidating assets within the trust framework. This ensures these potentially valuable assets are protected and can be managed according to the settlor’s wishes, even after their death.

Furthermore, the advent of blockchain technology introduces possibilities for automating certain trust functions. Smart contracts, which are self-executing contracts with the terms of the agreement directly written into code and deployed on a blockchain, can potentially be incorporated into trust arrangements to automate specific trust distributions or actions upon predefined triggers. While this remains an emerging area requiring careful legal and technical structuring, the potential for increased efficiency, transparency, and precision in managing trust payouts based on specific events or dates, without requiring manual intervention, represents a promising development for the future of trust administration involving digital assets.

A critical aspect of handling digital assets within a trust is navigating the rapidly evolving global regulatory environment. Jurisdictions worldwide are still developing and refining legal frameworks for virtual assets, addressing complex issues like ownership proof, taxation, and compliance. Trust structures designed to hold digital assets must be flexible enough to adapt to these ongoing changes and ensure full compliance with anti-money laundering (AML), counter-terrorist financing (CTF), and other relevant regulations as they evolve. Working with trustees and legal advisors knowledgeable in both traditional trust law and the unique regulatory landscape surrounding virtual assets is absolutely essential for the long-term viability and effectiveness of such innovative trusts.