Maximizing Tax Savings: A Guide to Hong Kong Tax Deductions and Allowances

Understanding the intricacies of Hong Kong’s tax system and leveraging available deductions is fundamental to effective financial management. The Inland Revenue Department (IRD) offers various opportunities for taxpayers to reduce their assessable income, thereby lowering their tax liability. This guide delves into key tax deductions and allowances, from mandatory contributions to commonly overlooked expenses and specific non-deductible items, providing a comprehensive overview for residents aiming to optimize their tax position.

Mandatory Contributions That Reduce Taxable Income

A significant avenue for tax reduction in Hong Kong is through mandatory contributions to recognized schemes. These payments, required by law, are acknowledged by the IRD as necessary allocations of income and are therefore eligible for deduction.

Principal among these is the Mandatory Provident Fund (MPF). Both employees and self-employed individuals contributing to their MPF schemes can typically deduct these mandatory contributions from their assessable income. The government establishes an annual maximum limit for this deduction, which is currently HKD 18,000 per tax year. This limit applies to the total mandatory contributions made within that year. It is important to note that any contributions exceeding this mandatory cap, or those made voluntarily, do not qualify for a tax deduction.

Beyond the standard MPF, contributions made to certain other recognized retirement schemes may also be tax-deductible. Eligibility for these deductions depends on the scheme’s formal recognition under relevant legislation. Like MPF, specific rules and limits may apply to deductions for these alternative schemes, contingent on their structure and regulatory approval status.

To effectively utilize these deductions, taxpayers must be aware of the specific limits and maintain accurate records. The HKD 18,000 annual limit for MPF is a crucial figure to track. Retaining statements from your MPF provider or employer detailing your contributions is essential for substantiating your claim when filing your annual tax return. Claiming deductions for mandatory contributions like MPF is a foundational step in personal tax planning in Hong Kong, directly impacting your taxable income and reducing your overall tax burden.

| Contribution Type | Annual Deduction Limit (HKD) |

|---|---|

| Mandatory MPF Contributions | 18,000 |

| Recognized Occupational Retirement Schemes | (Subject to scheme rules & approval) |

Common Deductible Expenses Hong Kong Residents May Overlook

While mandatory contributions are widely known, several other common expenses incurred by Hong Kong residents offer valuable tax deduction opportunities that are frequently missed. Identifying and claiming these can significantly reduce your annual tax liability. Success in claiming these deductions requires careful adherence to specific criteria and diligent record-keeping.

One of the most substantial deductions available for many residents is the allowance for home loan interest. If you own property in Hong Kong that serves as your primary residence and have a mortgage, the interest paid on that mortgage throughout the year may be deductible. This deduction acknowledges the significant cost of home ownership. It is subject to an annual maximum cap, currently set at HKD 100,000 per year of assessment. Maintaining detailed statements from your lender that clearly show the interest portion of your payments is crucial for accurate substantiation.

Another potential area for tax savings lies in self-education expenses. Costs incurred for courses, workshops, or qualifying examinations directly relevant to your current employment or profession may be tax-deductible. The key criterion is that the education must be undertaken to maintain or improve the knowledge or skills specifically required for your existing job. Expenses for general interest or training for a completely new career path typically do not qualify, making the direct link to your current role a vital consideration for eligibility.

Furthermore, contributions made to approved charitable organizations can provide tax relief. Donations must be directed towards institutions or trusts of a public character recognized as tax-exempt under Section 88 of the Inland Revenue Ordinance. This deduction encourages charitable giving within the community. While minimum and maximum limits apply based on your assessable income, verifying the organization’s approved status and obtaining an official receipt for your contribution are essential steps for claiming this deduction successfully.

Allowable Business-Related Expense Claims

For individuals operating a business or earning income from a profession in Hong Kong, understanding and claiming business-related expenses is critical for minimizing tax liability. The fundamental principle governing these claims is that the expenditure must have been incurred “wholly and exclusively” for the purpose of producing assessable profits. This strict test is applied by the IRD when reviewing claims. Expenses that serve a dual purpose – partly business and partly personal – are generally not allowed, unless the business portion can be clearly and separately identified and justified, a process subject to careful scrutiny by the IRD.

The “wholly and exclusively” rule means that the expense should be solely for generating income or operating your business, with no personal benefit or non-business motivation involved. This standard ensures that only legitimate costs of doing business are used to reduce taxable income. Examples of costs that may qualify under this rule include necessary office supplies, rent for premises used exclusively for business, utility bills directly related to operations, and salaries paid to employees. Each claimed expense must demonstrate a clear and direct connection to the income-producing activity.

Specific types of business expenses are also assessed under this principle. For example, travel expenses incurred on business assignments abroad can often be deducted, provided the trip was solely for business purposes linked to generating assessable profits. This would typically include costs such as flights, accommodation, and local transportation at the destination. Similarly, professional subscriptions paid to industry bodies or associations relevant to your trade are usually allowable, as they are often deemed necessary for maintaining professional standards or knowledge. Maintaining meticulous records, including invoices, receipts, and notes detailing the business purpose of each expense, is vital to support claims during a tax assessment. Strict adherence to the “wholly and exclusively” criterion is the cornerstone of valid business expense deductions.

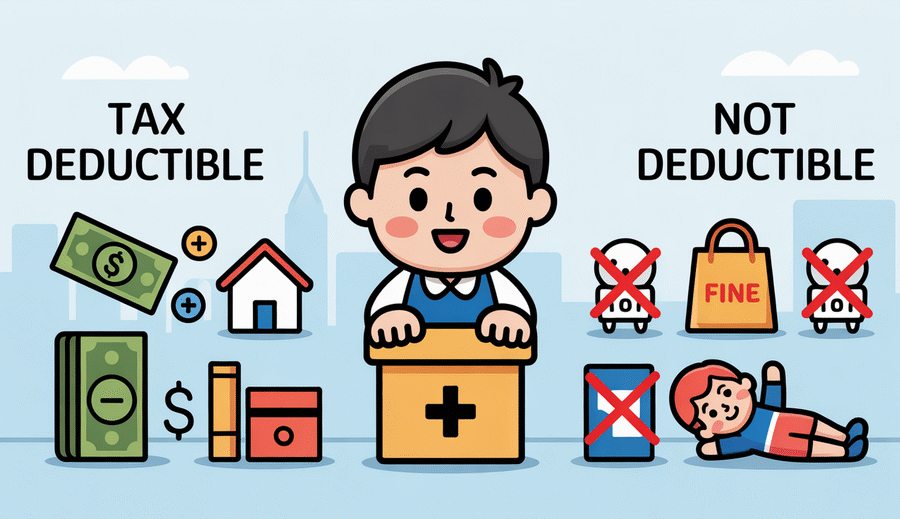

Specific Non-Deductible Personal Expenditures

Navigating tax deductions involves recognizing not only what can be claimed but also understanding expenses the IRD classifies as purely personal, and therefore non-deductible. The tax system is structured to allow deductions for costs necessarily incurred in earning income, or specific allowances granted by law, but it generally excludes expenditures related to personal living or consumption.

A common area of non-deductible expense includes the costs associated with employing domestic helpers or general household maintenance. While essential for many families, the salaries paid to domestic staff, along with other household costs such as utilities, general repairs, or cleaning supplies, are considered personal living expenses. These expenditures are not viewed as being incurred in the production of assessable income and consequently do not qualify for any tax deduction.

Similarly, expenses related to elderly residential care fees typically do not qualify for deduction. While Hong Kong tax law provides allowances for maintaining dependent parents or grandparents, the actual fees paid for their accommodation and care in residential homes or nursing facilities are generally treated as personal or family expenses. These outlays are not considered expenses incurred in earning income for the taxpayer and thus fall outside the scope of deductible items under current legislation. Despite the significant financial commitment involved in supporting elderly family members, the direct cost of residential care homes is not a deductible expense for the individual taxpayer.

Furthermore, while premiums for certain qualifying deferred annuity policies are deductible up to a statutory limit, this is a specific provision. Premiums paid for other types of annuity products, or payments into schemes that do not meet the strict criteria for a “qualifying deferred annuity policy” as defined by the IRD, are generally not deductible. These non-qualifying payments are typically considered personal savings or investment contributions rather than deductible expenses for tax purposes, highlighting the need to understand the precise requirements for any potential deduction related to retirement or savings products. Understanding these specific non-deductible items is crucial for accurate tax planning and filing.

Categories of Prohibited Deductions Under HK Tax Law

Equally important to understanding deductible expenses is recognizing which categories of expenditure are explicitly prohibited from being claimed against assessable income under Hong Kong tax law. These typically involve costs not related to income production, those that are inherently personal, or those arising from penalties for non-compliance.

A broad category of non-deductible costs encompasses general personal and family expenses. This includes everyday living costs such as ordinary meals not related to business activities, clothing not specifically required for employment duties (like uniforms), personal entertainment, and routine household expenditures. These outlays are considered part of private life and maintaining one’s household, distinct from activities generating assessable income, and thus do not qualify for tax relief.

Furthermore, the tax law expressly prohibits deductions for fines and penalties resulting from breaches of the law or regulations. This includes traffic fines, penalties for late tax filing, or financial penalties imposed by regulatory bodies. Allowing such costs as tax deductions would undermine their punitive nature, which is contrary to public policy. Consequently, any form of fine or penalty incurred is strictly non-deductible.

Other specific examples of disallowed deductions include political donations and losses arising from speculative activities. While contributing to political causes is a personal choice, such contributions are not recognized as expenses incurred in earning income under Hong Kong tax principles. Similarly, losses from ventures deemed speculative, such as gambling or certain investments outside the scope of a recognized trade or business, are generally viewed as capital or personal losses and cannot be offset against assessable income from sources like employment or property. Familiarity with these prohibited areas is vital to avoid incorrect claims and potential issues during tax assessment.

Documentation Requirements for Successful Tax Claims

The effectiveness of claiming tax deductions and allowances in Hong Kong depends significantly on maintaining accurate and comprehensive documentation. While the IRD does not require taxpayers to submit supporting documents with their annual tax returns, it reserves the right to request proof for any claim made during a review or audit. Failure to provide satisfactory evidence can lead to the disallowance of claims, potentially resulting in additional tax liabilities and penalties. Therefore, treating documentation as an integral part of the tax filing process is essential.

A fundamental rule requires taxpayers to retain all relevant records for a minimum period of six years. This period typically commences from the end of the relevant year of assessment. This extended retention timeframe allows the IRD sufficient opportunity to conduct audits or inquiries into past tax affairs if deemed necessary. Maintaining organized files for income statements, expense receipts, donation receipts, and other pertinent financial paperwork for this duration is not only recommended but a statutory obligation to protect your tax position.

Specific types of deductions necessitate particular forms of documentation. For instance, claims for approved charitable donations require original receipts issued by institutions recognized under Section 88 of the Inland Revenue Ordinance. These receipts serve as definitive proof of the contribution amount and confirm the recipient’s eligibility status. Without these original documents, the IRD will likely disallow the charitable donation deduction.

Similarly, Mandatory Provident Fund (MPF) contributions, a common deductible item, require proper verification. The standard documentation for MPF claims includes the annual contribution statements provided by your MPF trustee. These statements clearly detail the contributions made throughout the year. For employees, pay slips or employer records might also serve as supporting evidence if the trustee statement is unavailable, but the annual statement is generally the most direct proof required.

Beyond these examples, taxpayers should be prepared to substantiate any deduction or allowance claimed, whether it’s self-education expenses, home loan interest, or contributions to recognized retirement schemes. Each type of claim has specific documentation requirements. Implementing a comprehensive and organized system for storing all financial documents related to income and expenses is the most reliable way to ensure you can readily provide the necessary proof if requested by the IRD, thereby supporting the validity of your claims.

| Type of Record/Claim | Documentation Requirement |

|---|---|

| General Tax Records | Retain all relevant documents for a minimum of 6 years from the end of the year of assessment. |

| Approved Charitable Donations | Original receipts from institutions approved under Section 88 of the Inland Revenue Ordinance. |

| Mandatory Provident Fund (MPF) Contributions | Annual contribution statements from the MPF trustee or employer records showing contributions. |

| Home Loan Interest | Annual interest statements from the lender. |

| Self-Education Expenses | Receipts for course fees, examination fees, etc., confirming the link to current employment. |

Recent Changes and Updates Affecting Tax Deductions

Staying current with updates from the Hong Kong Inland Revenue Department is vital, as tax rules and deduction limits are subject to periodic review and amendment. Being aware of the latest changes ensures you can maximize your eligible claims and remain compliant with current regulations.

Recent years have seen notable adjustments aimed at providing tax relief or refining existing provisions. For instance, the deduction for domestic rental payments, introduced in 2022/23, allows eligible taxpayers who rent their primary residence in Hong Kong to claim a deduction. While specific details might be updated, the availability of this deduction represents a significant potential saving for many residents.

Furthermore, there have been expansions in allowances for qualifying medical insurance premiums. Premiums paid for government-certified Voluntary Health Insurance Scheme (VHIS) plans are tax-deductible. Recent changes have often involved increases in the maximum deductible amount per insured person, or broader coverage for premiums paid for dependents, encouraging participation in these health insurance schemes. Taxpayers utilizing this deduction should verify the current annual limit and confirm their policy’s VHIS qualification.

In addition to changes in deduction amounts and eligibility criteria, there has been a growing emphasis on digital processes for tax filing and claim submission. The IRD increasingly encourages, and in some cases requires, the use of online platforms for filing tax returns and submitting supporting information. While this is not a deduction in itself, understanding and adapting to these digital requirements is essential for successfully making any claims in the current tax landscape. This shift aims to enhance efficiency, streamline the process, and reduce errors in submissions.