Understanding Personal Allowances in Hong Kong

Navigating personal income tax requires a clear understanding of the tools available to reduce your tax liability. In Hong Kong, personal allowances serve as a fundamental mechanism for achieving this. Simply put, these are statutory deductions granted by the Inland Revenue Department (IRD) to eligible taxpayers, representing specific amounts of income considered non-taxable. They acknowledge various personal and family responsibilities, providing essential tax relief.

The core function of personal allowances is to directly lower your assessable income. Your tax liability is calculated by starting with your gross income, subtracting eligible expenses and deductions to arrive at assessable income, and then applying your personal allowances against this figure. The remaining amount is your taxable income. For instance, if your assessable income is HK$300,000 and you qualify for a HK$132,000 basic personal allowance, your taxable income is reduced to HK$168,000. The progressive tax rates are applied to this lower figure, resulting in a reduced tax bill compared to taxing the full assessable amount. Therefore, accurately claiming all eligible allowances is a key strategy in effective tax planning.

Hong Kong’s tax system offers a range of common personal allowances tailored to different taxpayer circumstances. The foundational Basic Allowance is available to all individual taxpayers, irrespective of marital status. Married individuals electing for joint assessment can claim the significantly higher Married Person’s Allowance, reflecting their combined financial situation. Furthermore, the system provides various allowances for supporting dependents, including Dependent Parent/Grandparent, Dependent Child, and Dependent Brother/Sister Allowances. Each of these comes with specific eligibility criteria concerning age, residency, and the level of financial support provided. Identifying which of these allowances apply to your personal situation is the first step towards accurate tax calculation and ensuring you benefit from all entitled reductions.

Avoiding Common Mistakes in Allowance Claims

Successfully claiming personal allowances is crucial for reducing your tax burden in Hong Kong, but certain common errors can lead to invalid claims or complications with the Inland Revenue Department (IRD). Awareness of these potential pitfalls is essential to ensure your tax return accurately reflects your entitlements and avoids future issues.

A frequent mistake is failing to promptly update personal circumstances, particularly changes in marital status or dependent situations. Life events like marriage, divorce, or a dependent child reaching a specific age threshold directly impact eligibility for allowances such as the Married Person’s Allowance or various Dependent Allowances. Submitting outdated information on your tax return can result in incorrect claims that the IRD may disallow, potentially leading to tax reassessments and associated penalties.

Missing documentation deadlines is another significant issue. The IRD enforces strict deadlines for submitting tax returns and any required supporting documentation. Failure to meet these dates can result in the forfeiture of your ability to claim allowances for that tax year or cause significant delays in processing. While late submissions might occasionally be accepted, they often trigger closer scrutiny. Maintaining organized records and ensuring timely submission is critical for a smooth and successful claim process.

Moreover, overlooking or misunderstanding the specific eligibility criteria for different allowances is common. Simply listing a dependent is insufficient; the legal requirements for claiming that dependent must be fully met. For example, claiming for a dependent parent involves specific conditions related to their age, residency status, and whether you provide financial support. Misinterpreting or being unaware of these detailed rules can easily result in claims being rejected, underscoring the importance of carefully reviewing official IRD guidelines.

Avoiding these errors requires diligence, timely updates to your information, and meticulous attention to both documentation and eligibility details. By managing your tax affairs proactively, you significantly increase the likelihood that your valid personal allowance claims will be accepted, effectively contributing to lowering your tax burden in Hong Kong.

Key Personal Allowance Categories Detailed

Understanding the primary personal allowances available in Hong Kong is fundamental to accurately calculating your tax liability and identifying potential tax reductions. These key allowances represent substantial deductions applied against your assessable income, directly decreasing the portion of income subject to tax rates.

The most universally applicable allowance is the Basic Allowance. For the 2023/24 tax year, this allowance is set at HK$132,000 for most individual taxpayers who file their returns separately. It provides a standard level of tax relief for single individuals and serves as a baseline for tax calculation.

For married couples who choose joint assessment, the Married Person’s Allowance is available. This allowance amounts to HK$264,000 for the 2023/24 tax year, effectively double the basic rate. Opting for joint assessment and claiming this allowance is often financially beneficial, as it combines the couple’s incomes and allowances, potentially resulting in a lower total tax payable compared to individual assessments, depending on their respective income levels.

Hong Kong’s tax system also provides allowances for supporting dependent parents and grandparents. The specific amount of this allowance and eligibility criteria are influenced by several factors, including the dependent’s age, whether they ordinarily reside in Hong Kong, and whether they live with the taxpayer claiming the allowance. The system often includes higher allowance amounts for older dependents or those living with the taxpayer, acknowledging the potentially greater support required.

Correctly claiming these primary allowances ensures you benefit from the most significant statutory deductions available. Each category plays a vital role in reducing your taxable income base before the progressive tax rates are applied.

Here is a summary of these key personal allowances for the 2023/24 tax year:

| Allowance Type | Description | Amount (2023/24) |

|---|---|---|

| Basic Allowance | Available to most single resident taxpayers. | HK$132,000 |

| Married Person’s Allowance | For married couples electing for joint assessment. | HK$264,000 |

| Dependent Parent/Grandparent Allowance | For supporting qualifying parents or grandparents. | Varies by age and living situation |

Familiarizing yourself with these fundamental personal allowances is a crucial step in effectively managing and optimizing your tax position in Hong Kong.

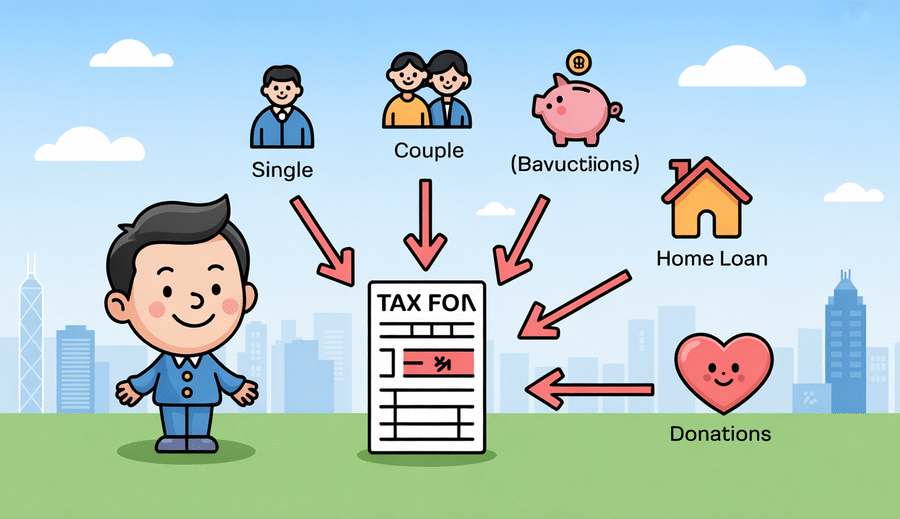

Exploring Special Deductions

Beyond the standard personal allowances, the Hong Kong tax system offers several valuable special deductions that can further reduce your taxable income. These deductions recognize specific types of expenses and contributions, allowing individuals to significantly lower their assessable income and, consequently, their final tax bill. Understanding and claiming these special deductions alongside your applicable personal allowances is essential for comprehensive tax optimization.

A significant special deduction relates to contributions made to the Mandatory Provident Fund (MPF). Both mandatory contributions required by law and eligible voluntary contributions made by the employee are deductible from your assessable income. This deduction encourages retirement saving and is subject to an annual cap. For the 2023/24 tax year, the maximum deduction for MPF contributions is HK$18,000.

Another important deduction is available for interest paid on a home loan. If you have taken out a mortgage to finance the purchase of your primary residence in Hong Kong, the interest portion of your loan repayments can be deducted. This deduction provides tax relief for homeowners and is subject to an annual limit, currently HK$100,000.

Furthermore, the tax system provides a deduction for approved charitable donations. Contributions made to charities recognized by the Hong Kong government are deductible, fostering philanthropy. The amount you can claim under this deduction is limited to a percentage of your adjusted assessable income, with a maximum set at 35% for the relevant tax year. This deduction supports the non-profit sector by incentivizing individual contributions.

Effectively utilizing these special deductions in conjunction with your personal allowances can lead to substantial tax savings. Each deduction has specific eligibility criteria and annual limits, which are summarized below for the 2023/24 tax year:

| Deduction Type | Key Limit (Tax Year 2023/24) |

|---|---|

| MPF Contributions | Up to HK$18,000 per year |

| Home Loan Interest | Up to HK$100,000 per year |

| Approved Charitable Donations | Up to 35% of adjusted assessable income |

Claiming these deductions correctly, alongside your personal allowances, is a key strategy for minimizing your tax liability.

Calculating Your Tax Liability: A Step-by-Step Guide

Translating your eligible personal allowances and deductions into concrete tax savings involves following a specific calculation process laid out by the Hong Kong tax system. This systematic approach clarifies how these provisions impact your final tax bill, demonstrating their financial benefit.

The initial step is to accurately determine your assessable income. This figure represents the total of all your income sources subject to Salaries Tax in Hong Kong for the tax year. It includes your basic salary, bonuses, commissions, allowances, and any other taxable emoluments. This is your gross income before any tax-reducing elements are applied.

Next, you apply your eligible personal allowances and approved deductions against your assessable income. This is where the significant impact of these provisions becomes evident. You subtract the total value of your applicable basic allowance, married person’s allowance, dependent allowances, and eligible deductions such as MPF contributions, home loan interest, and charitable donations. The resulting figure is your net chargeable income, used for calculation under progressive rates, or your net assessable income (after MPF and charitable donations only), used for the standard rate calculation. This reduced amount forms the base for your tax calculation.

Finally, you calculate your tax payable by applying the relevant tax rates. Hong Kong’s system calculates tax using two methods, and you are required to pay the lower of the two amounts. One method applies the progressive tax rates to your net chargeable income, with rates increasing across different income tiers. The other method applies a standard rate (currently 15%) to your net assessable income. By performing both calculations and paying the lesser amount, you finalize your tax obligation. The difference between taxing your initial assessable income (hypothetically) and taxing your significantly reduced net income clearly illustrates the substantial savings achieved through effectively claiming your eligible allowances and deductions.

Proactive Strategies for Maximizing Allowances

Merely being aware of Hong Kong’s personal allowances is not sufficient; a proactive and strategic approach is necessary to fully optimize your tax position. Maximizing these benefits requires foresight and careful planning, especially as your life circumstances change or as you manage family finances. By taking a strategic stance, you can ensure you are leveraging every available allowance and deduction to its maximum potential, directly contributing to a lower overall tax liability year after year.

One effective strategy involves coordinating claims for dependent allowances within a family unit. For example, if multiple family members are eligible to claim the same dependent parent or grandparent, discussing and agreeing on which person makes the claim can maximize the overall tax savings for the household. This is particularly beneficial when family members fall into different tax brackets, as the value of an allowance provides a greater tax reduction for individuals subject to higher marginal tax rates. Carefully considering each individual’s income and potential tax liability is key to making the most advantageous claiming decision.

Timing is another critical element, particularly concerning deductions like charitable contributions. While these donations are deductible up to 35% of your adjusted assessable income, understanding when you make contributions can influence their impact on a specific tax year. Making larger donations towards the end of the financial year or strategically spreading contributions across two tax years can help ensure you fully utilize the deduction limit in the most effective period, provided the contributions are made to approved charities.

Furthermore, staying informed about and leveraging transitional provisions related to significant life changes is crucial. Events such as getting married, welcoming a child, or becoming responsible for supporting an aging dependent directly alter your eligibility for specific allowances. Promptly notifying the Inland Revenue Department (IRD) and understanding how these changes affect your claims for both the current and future tax years ensures you do not miss opportunities to adjust your taxable income accordingly. Staying informed about the regulations surrounding these life events allows for timely and accurate claims, maximizing your tax benefit during these periods of transition.