Double Tax Treaties and Royalty Income: Hong Kong’s Favorable Terms

📋 Key Facts at a Glance

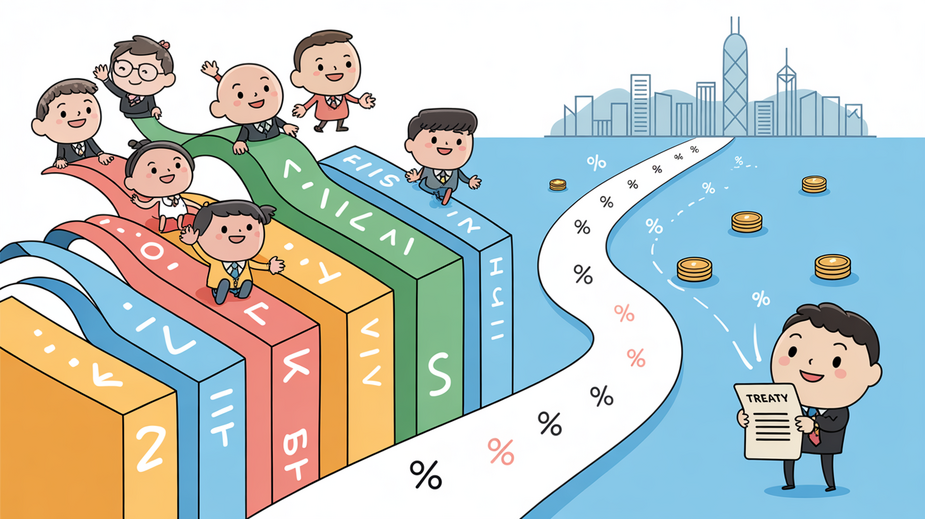

- Hong Kong’s Treaty Network: Comprehensive agreements with 45+ jurisdictions including Mainland China, Singapore, UK, Japan, and major trading partners

- Royalty Withholding Tax Rates: Typically 0-5% under treaties vs. 10-30% without treaties in many countries

- FSIE Regime: Foreign-sourced royalty income exempt from Hong Kong profits tax if economic substance requirements are met

- Profits Tax Advantage: Two-tier system with 8.25% on first HK$2 million for corporations, territorial basis for taxation

Did you know that Hong Kong’s double tax treaties can reduce royalty withholding taxes from as high as 30% down to 0%? In today’s digital economy where intellectual property drives unprecedented value, understanding how to navigate cross-border royalty taxation is no longer optional—it’s essential for business survival and growth. Hong Kong’s strategic position as a global financial hub is amplified by its extensive treaty network and favorable tax policies, making it an ideal jurisdiction for managing international royalty income streams.

The Digital Revolution: Royalty Income in Modern Business

Intellectual property has transformed from a supplementary asset to the core engine of modern business value creation. From software-as-a-service (SaaS) subscriptions and digital content distribution to patented technologies and trademark licensing, royalty streams now represent critical revenue pillars for companies worldwide. This digital transformation enables businesses to generate recurring income from intangible assets across borders, but it also introduces complex tax challenges that require strategic navigation.

The Strategic Value of Royalty Management

Effective royalty management delivers multiple strategic advantages:

- Cash Flow Stability: Recurring royalty payments provide predictable revenue streams

- Global Expansion: Licensing enables market entry without heavy capital investment

- Tax Efficiency: Proper structuring can optimize global tax outcomes

- IP Monetization: Unlocks value from research and development investments

The Double Taxation Dilemma Without Treaties

When intellectual property crosses borders without treaty protection, the same royalty income can be taxed twice—once in the source country where the IP is used, and again in the residence country where the IP owner is based. This double taxation can erode 30-50% of royalty income, making international IP licensing financially unsustainable without proper planning.

| Jurisdiction (Without Treaty) | Typical Withholding Tax Rate | Net Royalty per HK$100 |

|---|---|---|

| United States (Non-Treaty) | 30% | HK$70 |

| Japan (Non-Treaty) | 20% | HK$80 |

| Various European Countries | 15-25% | HK$75-85 |

Administrative Nightmares

Beyond financial impact, operating without treaties creates compliance chaos:

- Different filing requirements and deadlines in each country

- Varying documentation standards and language requirements

- Complex foreign tax credit calculations with potential limitations

- Increased audit exposure across multiple jurisdictions

Hong Kong’s Treaty Network: Your Royalty Tax Shield

Hong Kong’s comprehensive double tax agreement (CDTA) network with over 45 jurisdictions provides a powerful solution to cross-border royalty taxation challenges. These treaties establish clear rules for determining taxing rights and typically reduce or eliminate withholding taxes on royalty payments.

| Treaty Partner | Royalty Withholding Tax Rate | Net Royalty per HK$100 |

|---|---|---|

| Mainland China | 7% | HK$93 |

| United Kingdom | 3% | HK$97 |

| Singapore | 5% | HK$95 |

| Japan | 5% | HK$95 |

| Netherlands | 0% | HK$100 |

The FSIE Advantage: Foreign-Sourced Royalty Exemption

Hong Kong’s Foreign-Sourced Income Exemption (FSIE) regime, expanded in January 2024, provides additional benefits for royalty income:

- Phase 2 Implementation: Expanded coverage to include dividends, interest, disposal gains, and IP income

- Economic Substance Requirement: Must demonstrate adequate personnel, premises, and expenditure in Hong Kong

- Nexus Approach: For IP income, exemption linked to R&D activities and qualifying expenditures

- Compliance Framework: Requires proper documentation and annual reporting

Hong Kong vs. Competing Jurisdictions

When choosing a jurisdiction for royalty management, Hong Kong offers distinct advantages over other financial hubs:

| Feature | Hong Kong | Singapore | Ireland |

|---|---|---|---|

| Typical Royalty WHT Rate | 0-5% | 5-10% | 0-10% |

| Corporate Tax Rate | 8.25% (first HK$2M) 16.5% (remainder) |

17% | 12.5% |

| Sales Tax/VAT on Royalties | None | GST applies | VAT applies |

| Treaty Network Size | 45+ jurisdictions | 90+ jurisdictions | 75+ jurisdictions |

| China Access | Direct treaty (7% rate) | No direct treaty | No direct treaty |

Compliance Essentials: Claiming Treaty Benefits

Accessing Hong Kong’s favorable treaty rates requires careful compliance with both treaty provisions and domestic requirements:

- Establish Beneficial Ownership: Prove the Hong Kong entity genuinely owns and controls the IP, not just acting as a conduit

- Demonstrate Economic Substance: Maintain adequate personnel, premises, and decision-making in Hong Kong

- Prepare Treaty Relief Applications: Submit proper documentation to source country tax authorities

- Maintain Comprehensive Records: Keep license agreements, payment trails, and corporate documents for 7+ years

- Navigate Anti-Abuse Rules: Comply with Limitation of Benefits (LOB) and Principal Purpose Test (PPT) provisions

Documentation Requirements

Essential documents to support treaty claims include:

- Certificate of Tax Residency from Hong Kong IRD

- Executed license agreements with clear terms

- Detailed payment records and bank statements

- IP registration certificates and ownership documentation

- Evidence of substance (office leases, employee records, meeting minutes)

- Annual financial statements and tax returns

Strategic Planning for Future Developments

The international tax landscape continues to evolve, and forward-looking planning is essential:

Global Minimum Tax (Pillar Two)

Hong Kong enacted the Global Minimum Tax framework on June 6, 2025, effective from January 1, 2025. This 15% minimum effective tax rate applies to multinational enterprise groups with revenue ≥ EUR 750 million. While primarily affecting large corporations, it signals Hong Kong’s commitment to international tax standards.

Treaty Network Expansion

Hong Kong continues to expand its treaty network, with ongoing negotiations focusing on:

- ASEAN economic community members

- Belt and Road Initiative partner countries

- Key European and North American trading partners

- Emerging markets with growing IP commercialization

Digital Economy Considerations

As digital services evolve, treaty provisions may be updated to address:

- Cloud computing and SaaS revenue classification

- Data licensing and digital content distribution

- Automated digital services taxation

- Cross-border e-commerce and platform royalties

✅ Key Takeaways

- Hong Kong’s treaty network reduces royalty withholding taxes to 0-5% vs. 10-30% without treaties

- The FSIE regime exempts foreign-sourced royalty income if economic substance requirements are met

- Proper documentation and substance are critical for claiming treaty benefits and avoiding challenges

- Hong Kong offers competitive advantages over other hubs, particularly for China-focused businesses

- Stay informed about evolving international standards including BEPS and Global Minimum Tax

Hong Kong’s combination of extensive treaty networks, favorable domestic tax policies, and strategic geographic position creates a powerful platform for managing global royalty income. Whether you’re licensing software across Asia, distributing digital content worldwide, or commercializing patented technologies, Hong Kong provides the tax efficiency and compliance framework needed to maximize returns on intellectual property investments. As international tax standards continue to evolve, Hong Kong’s commitment to alignment with global best practices ensures its position as a leading jurisdiction for royalty management well into the future.

📚 Sources & References

This article has been fact-checked against official Hong Kong government sources and authoritative references:

- Inland Revenue Department (IRD) – Official tax rates, allowances, and regulations

- Rating and Valuation Department (RVD) – Property rates and valuations

- GovHK – Official Hong Kong Government portal

- Legislative Council – Tax legislation and amendments

- IRD Comprehensive Double Taxation Agreements – Official treaty network information

- IRD Foreign-sourced Income Exemption (FSIE) Regime – Official FSIE guidance

- IRD Tax Rates for Dividends, Interest, Royalties – Official withholding tax rates

Last verified: December 2024 | Information is for general guidance only. Consult a qualified tax professional for specific advice.