How Hong Kong’s Trust Law Compares to Singapore for High-Net-Worth Estates

📋 Key Facts at a Glance

- Trust Duration: Hong Kong: 80-year perpetuity period vs. Singapore: Perpetual trusts allowed

- Tax Advantage: Hong Kong offers 0% tax on qualifying income for Family Investment Holding Vehicles (FIHV) with HK$240M+ AUM

- Strategic Positioning: Hong Kong: Gateway to Mainland China wealth vs. Singapore: Neutral hub for Southeast Asia & global capital

Where should Asia’s ultra-high-net-worth families establish their trust structures? With over US$2 trillion in private wealth flowing through Asia-Pacific financial centers, the choice between Hong Kong and Singapore represents one of the most critical decisions for multi-generational wealth preservation. Both jurisdictions have transformed their trust laws to attract global families, but they offer fundamentally different approaches to trust duration, settlor control, and strategic positioning that can dramatically impact your estate planning outcomes.

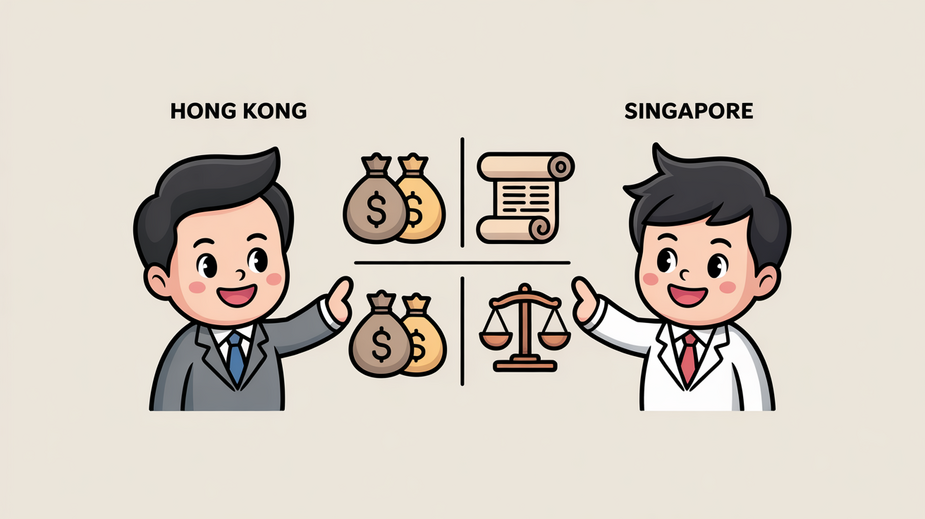

Strategic Positioning: Gateway to China vs. Global Neutral Hub

Hong Kong and Singapore have evolved distinct strategic identities that directly influence their appeal to different segments of the high-net-worth market. Understanding these positioning differences is essential for families whose wealth originates from or is invested in specific geographic regions.

Hong Kong: The Mainland China Gateway

Hong Kong’s unparalleled advantage lies in its deep economic integration with Mainland China. As the primary conduit for Chinese wealth seeking international diversification, Hong Kong naturally attracts families with substantial ties to the world’s second-largest economy. This positioning provides:

- Direct access to the rapidly expanding pool of Chinese wealth seeking professional management

- Cultural and linguistic alignment with Mainland Chinese families

- Proximity to business operations and investments in Greater China

- Established legal and financial infrastructure tailored to China-linked transactions

Singapore: The Neutral Global Hub

Singapore has meticulously cultivated its reputation as a politically neutral, stable, and globally connected financial center. This positioning appeals to a broader international client base, including:

- Families from across ASEAN nations seeking regional diversification

- Indian and Middle Eastern wealth looking for Asian exposure

- International families navigating complex geopolitical landscapes

- Those prioritizing perceived neutrality over geographic specialization

| Strategic Feature | Hong Kong | Singapore |

|---|---|---|

| Primary Geographic Focus | Gateway to Mainland China | Southeast Asia & Broader International |

| Strategic Alignment | Deep Integration with China | Neutral, Globally Connected Hub |

| Market Positioning | China-linked wealth management | Diverse international capital |

| Trust Market Standing | Leading Asian Trust Hub | Leading Asian Trust Hub |

Trust Structure Flexibility: Duration, Control & Legal Frameworks

Beyond strategic positioning, the technical differences in trust law between Hong Kong and Singapore create distinct planning opportunities and limitations. Both jurisdictions have modernized their frameworks, but they approach key trust features differently.

Trust Duration: 80 Years vs. Perpetuity

One of the most significant differences lies in the maximum permissible duration of private trusts:

- Hong Kong: Maintains an 80-year perpetuity period under the Perpetuities and Accumulations Ordinance (Cap. 257)

- Singapore: Allows trusts to exist in perpetuity, providing indefinite multi-generational planning

While 80 years represents substantial planning flexibility for most families, those seeking ultra-long-term structures spanning centuries may prefer Singapore’s perpetual option. However, Hong Kong’s 80-year period can often be extended through careful drafting and periodic restructuring.

Settlor Control: Reserved Powers Framework

The extent to which settlors can retain control differs significantly:

| Control Feature | Hong Kong | Singapore |

|---|---|---|

| Maximum Trust Duration | 80 years | Perpetual |

| Settlor’s Retained Control | Enhanced flexibility (post-2013 reforms), certain powers can be reserved | Explicit Statutory Reserved Powers regime allows clear reservation of powers |

| Legislative Framework | Trust Law (Amendment) Ordinance 2013 | Trusts Act 2004 (amended) |

| Foreign Asset Protection (‘Firewall’) | Strong statutory and common law provisions | Robust statutory protection measures against foreign judgments/rules |

Hong Kong’s 2013 trust law reforms significantly enhanced settlor flexibility, allowing reservation of certain administrative and dispositive powers. However, Singapore’s dedicated statutory framework for reserved powers provides greater clarity and certainty for settlors wishing to maintain specific controls.

Asset Protection: Firewall Provisions

Both jurisdictions offer robust “firewall” protections against foreign legal challenges, but their approaches differ:

- Hong Kong: Combines statutory provisions with common law principles to protect against forced heirship claims and certain creditor actions

- Singapore: Provides explicit statutory protection against foreign judgments and legal rules that conflict with Singapore trust law

Tax Considerations: Hong Kong’s Competitive Advantages

While trust law differences are crucial, tax considerations often drive final jurisdiction decisions. Hong Kong offers several compelling tax advantages for high-net-worth families:

Family Investment Holding Vehicle (FIHV) Regime

Hong Kong’s FIHV regime provides a powerful incentive for family offices:

- Tax Rate: 0% on qualifying income (compared to Singapore’s variable rates)

- Minimum AUM: HK$240 million (approximately US$30.7 million)

- Requirements: Substantial activities must be conducted in Hong Kong

- Scope: Covers dividends, interest, disposal gains from qualifying transactions

Hong Kong’s General Tax Advantages

Beyond the FIHV regime, Hong Kong maintains its traditional tax advantages:

- Territorial Tax System: Only Hong Kong-sourced profits are taxable

- No Capital Gains Tax: Trusts can realize investment gains tax-free

- No Dividend Withholding Tax: Distributions to beneficiaries are tax-efficient

- No Estate/Inheritance Tax: Wealth transfer occurs without death duties

Practical Decision Framework: Choosing Your Jurisdiction

Selecting between Hong Kong and Singapore requires a structured approach. Consider these key questions:

- Geographic Focus: Where is your wealth primarily sourced and invested? China-focused families typically prefer Hong Kong, while internationally diversified wealth may favor Singapore.

- Planning Horizon: Do you require perpetual trust duration, or is 80 years sufficient? Ultra-long-term planning may necessitate Singapore.

- Settlor Control: How much ongoing control do you wish to retain? Singapore’s explicit reserved powers regime offers greater certainty.

- Tax Optimization: Can you meet Hong Kong’s FIHV requirements? The 0% tax rate represents a significant advantage for qualifying families.

- Cross-Border Complexity: Which jurisdiction’s firewall provisions best match your international exposure?

✅ Key Takeaways

- Hong Kong offers superior China access and a 0% FIHV tax rate for qualifying family offices with HK$240M+ AUM

- Singapore provides perpetual trust duration and clearer statutory reserved powers for settlors

- Both jurisdictions offer robust asset protection, but their strategic positioning appeals to different wealth origins

- The choice ultimately depends on your geographic focus, planning horizon, and desired level of settlor control

Hong Kong and Singapore represent two sophisticated but distinct approaches to trust structuring for high-net-worth estates. Hong Kong’s deep China integration and competitive FIHV tax regime make it compelling for families with Mainland connections, while Singapore’s perpetual trusts and neutral positioning appeal to internationally diversified wealth. The optimal choice isn’t about which jurisdiction is “better” universally, but which aligns with your specific family circumstances, geographic focus, and multi-generational objectives. As both jurisdictions continue evolving their wealth management frameworks, staying informed about legal developments and tax incentives remains crucial for effective estate planning.

📚 Sources & References

This article has been fact-checked against official Hong Kong government sources and authoritative references:

- Inland Revenue Department (IRD) – Official tax rates, allowances, and regulations

- Rating and Valuation Department (RVD) – Property rates and valuations

- GovHK – Official Hong Kong Government portal

- Legislative Council – Tax legislation and amendments

- IRD FIHV Regime – Family Investment Holding Vehicle tax concessions

- Perpetuities and Accumulations Ordinance – Hong Kong trust duration regulations

- Family Office HK – Official family office resources and incentives

Last verified: December 2024 | Information is for general guidance only. Consult a qualified tax professional for specific advice.