Basics of Hong Kong Provisional Tax Provisional tax in Hong Kong functions as an advance......

Understanding Hong Kong's Education Tax Relief Framework Hong Kong's tax system provides specific provisions offering......

Understanding Hong Kong’s Industrial Property Rate System Property rates are a fundamental component of real......

Understanding Hong Kong's Double Taxation Treaty Network A cornerstone of effective international tax planning and......

Understanding Tax Deductions for Retirement Insurance in Hong Kong Hong Kong's tax framework actively encourages......

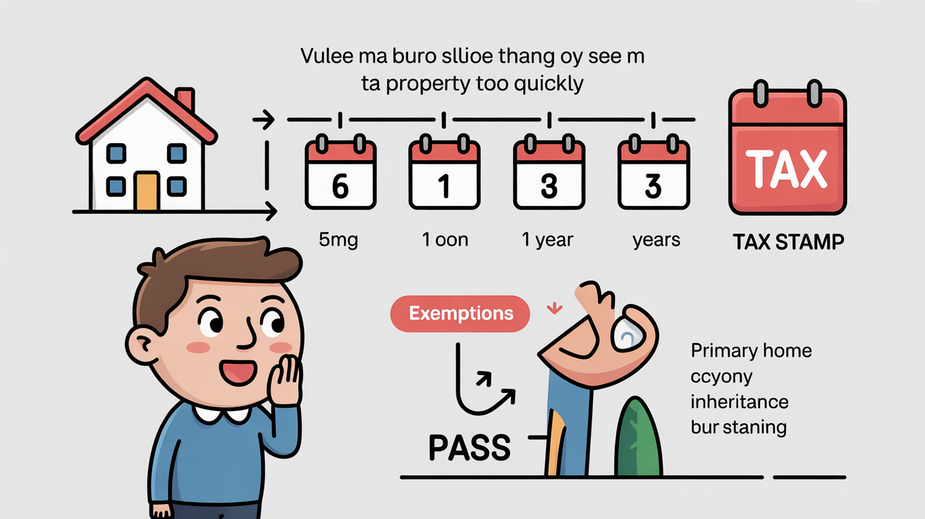

Understanding Hong Kong's Special Stamp Duty (SSD) Framework Hong Kong's property market is renowned for......

Navigating Hong Kong's Pre-Reform Startup Tax Landscape Before the implementation of the two-tiered profits tax......

Immediate Financial Consequences of Tax Dispute Losses Losing a tax dispute in Hong Kong triggers......

Understanding the Tax Treaty Framework Navigating the tax landscape for businesses operating between Mainland China......

Case Study Breakdown: $2.3M Compliance Failure Real-world examples provide invaluable insights into navigating complex regulatory......

Understanding the Disability Tax Allowance in Hong Kong Navigating personal finances while managing the challenges......

Understanding Trust Distributions and Tax Liability in Hong Kong For individuals receiving distributions from a......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308