The Real Cost of Customs Duty Miscalculations Navigating international trade requires a precise understanding and......

Real-Life Case Study: Offshore Income Misreporting Risks A significant real-life case illustrating the potential consequences......

From Manual Reviews to AI-Driven Audit Systems The Inland Revenue Department (IRD) in Hong Kong......

Unique Advantages of Private Trust Companies for Sophisticated Wealth Management While traditional trusts remain valuable......

Hong Kong's Distinct Tax Framework for Wealth Preservation Hong Kong distinguishes itself globally with a......

Understanding Hong Kong's Double Tax Treaty Network Hong Kong boasts a wide and expanding network......

Understanding Hong Kong’s Territorial Tax System Hong Kong's tax framework is fundamentally defined by its......

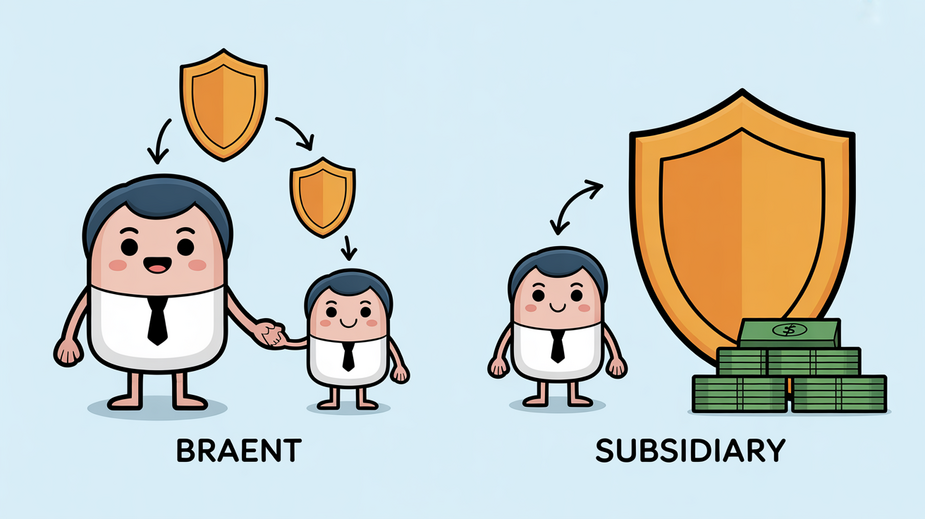

The Strategic Role of Business Structure in Tax Efficiency Choosing the appropriate business structure is......

Understanding Hong Kong's Stamp Duty Framework Navigating the Hong Kong property market involves various costs,......

Understanding Hong Kong’s Tax-Efficient Dividend Framework Hong Kong presents a highly attractive tax environment, particularly......

Hong Kong's Green Economy Shift and Opportunities for SMEs Hong Kong is actively transitioning towards......

The Precarious Path of Family Business Succession Family-owned enterprises are vital engines of global economies,......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308