Understanding Double Taxation Challenges in Hong Kong Businesses in Hong Kong operating internationally often encounter......

Understanding Hong Kong's Two-Tiered Profits Tax Structure Hong Kong's implementation of a two-tiered profits tax......

Understanding the Double Taxation Arrangement Framework The Double Taxation Arrangement (DTA) between Hong Kong and......

Understanding Joint Tenancy vs. Tenancy in Common in Hong Kong When acquiring property with another......

Hong Kong’s Top Tax-Efficient Investment Vehicles for Foreign Entrepreneurs Hong Kong stands as a premier......

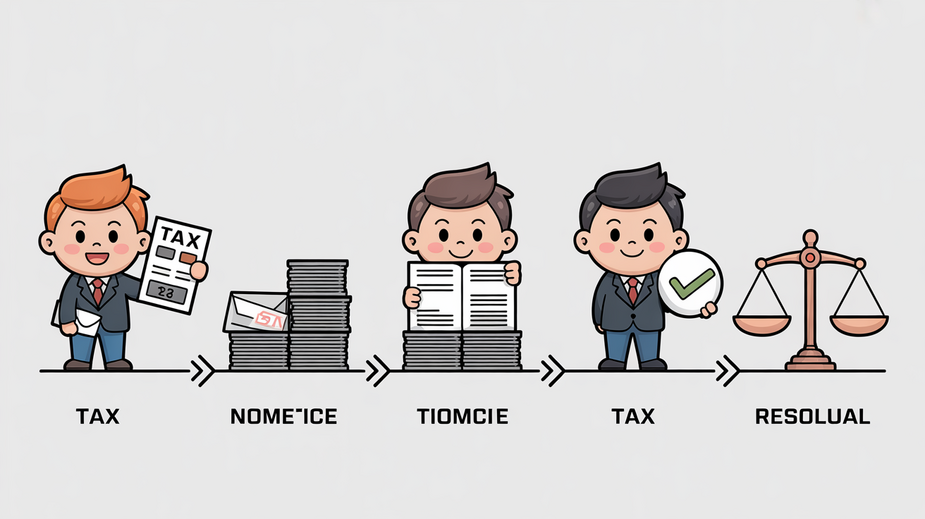

Receiving the Initial Investigation Notice The arrival of a tax investigation notice can understandably cause......

Understanding Hong Kong's Territorial Tax System Hong Kong operates under a distinctive and generally favorable......

Understanding Salaries Tax Obligations in Hong Kong Navigating your tax responsibilities in Hong Kong begins......

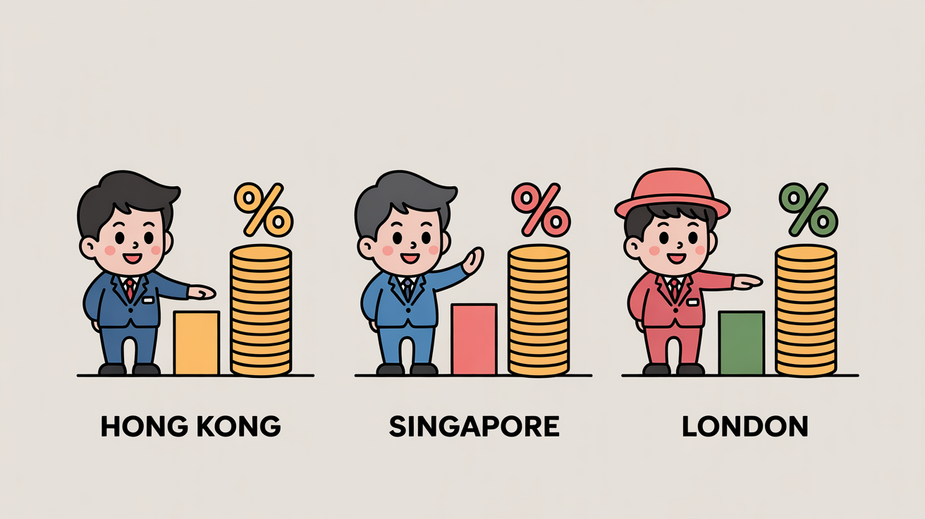

Understanding Stamp Duty Fundamentals in Key Financial Hubs Stamp duty is a fundamental fiscal instrument......

Understanding Eligibility for Dependent Parent and Grandparent Allowances in Hong Kong Claiming dependent parent and......

Hong Kong's Crypto Tax Framework Explained Hong Kong's tax system is based on the territorial......

Decoding the Initial Audit Notification Receiving a tax audit notification from the Inland Revenue Department......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308