Understanding Hong Kong Tax Audit Triggers: Common Red Flags for the IRD Tax audits in......

Understanding Your Property Tax Assessment Notice Receiving your annual Property Tax Assessment Notice from the......

The Strategic Role of Business Structure in Tax Efficiency Choosing the appropriate business structure is......

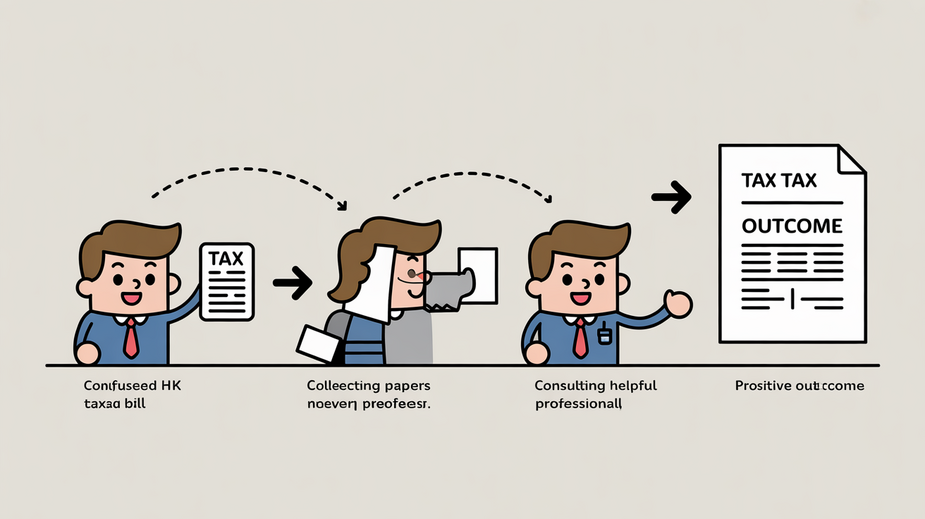

Understanding Hong Kong Profits Tax Assessments Receiving a profits tax assessment from the Inland Revenue......

Navigating the Complexities of Estate Planning for Hong Kong's HNW Families High-net-worth (HNW) families in......

Understanding Hong Kong Property Tax Fundamentals Navigating property ownership in Hong Kong necessitates a clear......

Navigating Permanent Establishment Thresholds in Hong Kong and Mainland China Understanding when a company establishes......

Hong Kong Tax Calendar Essentials Navigating the tax landscape in Hong Kong begins with a......

Understanding Offshore Trusts in Hong Kong An offshore trust is a sophisticated legal arrangement where......

Real-Life Case Study: Offshore Income Misreporting Risks A significant real-life case illustrating the potential consequences......

E-Commerce Growth and Hong Kong's Digital Landscape Hong Kong's economy is undergoing a significant transformation,......

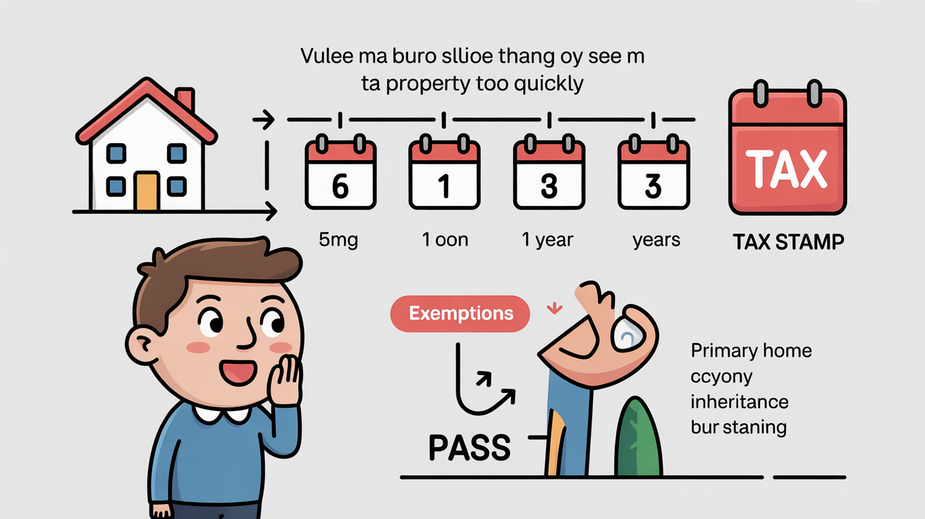

Understanding Hong Kong's Special Stamp Duty (SSD) Framework Hong Kong's property market is renowned for......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308