Hong Kong's Territorial Tax System Fundamentals Understanding the core principles of Hong Kong's tax system......

Understanding Hong Kong’s Salaries Tax and Personal Allowances Navigating any tax system begins with understanding......

Growing Cross-Border Transfer Pricing Complexity The deepening economic integration between Hong Kong and Mainland China......

Understanding Hong Kong's Probate System Basics for Foreign Executors Navigating the administration of an estate......

Hong Kong's Appeal for Expat Asset Management Hong Kong stands as a premier international financial......

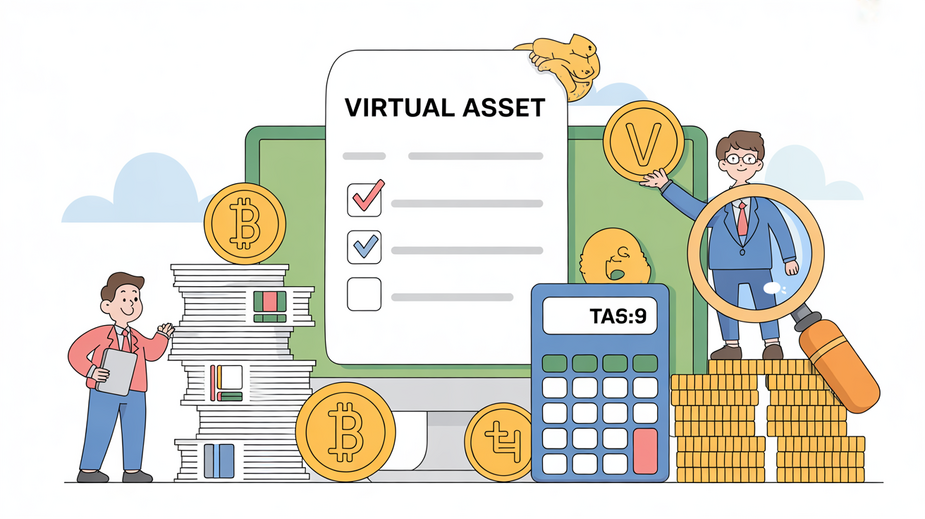

Defining Taxable Activities for VASPs For Virtual Asset Service Providers (VASPs) operating in Hong Kong,......

Understanding Hong Kong-China Cross-Border Taxation Operating a business across the distinct tax jurisdictions of Hong......

Identifying Corporate Tax Audit Triggers in Hong Kong For businesses operating in Hong Kong, understanding......

Understanding Hong Kong’s Framework for Charitable Trusts Establishing a charitable trust in Hong Kong provides......

Hong Kong’s Territorial Tax System for Family Offices Understanding Hong Kong's territorial tax system is......

Hong Kong's Core Tax Advantages for Holding Companies Setting up a holding company in Hong......

The Strategic Value of Intellectual Property for Tech Startups In the intensely competitive landscape of......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308