Understanding Hong Kong's Two-Tiered Profits Tax System Hong Kong's profits tax framework has undergone a......

Core Principles of Territorial vs. Worldwide Tax Systems Understanding the fundamental differences between territorial and......

Understanding Hong Kong’s Framework for Charitable Trusts Establishing a charitable trust in Hong Kong provides......

Unforeseen Financial Pitfalls in Global Trade Operations Navigating the complexities of international trade involves a......

Hong Kong's Renewable Energy Tax Incentives Overview Hong Kong has strategically advanced its commitment to......

Recent Amendments to Tax Residency Requirements in Hong Kong Hong Kong's Inland Revenue Department (IRD)......

Hong Kong's Evolving Tax Framework: Key Changes Impacting Family Offices Hong Kong has recently implemented......

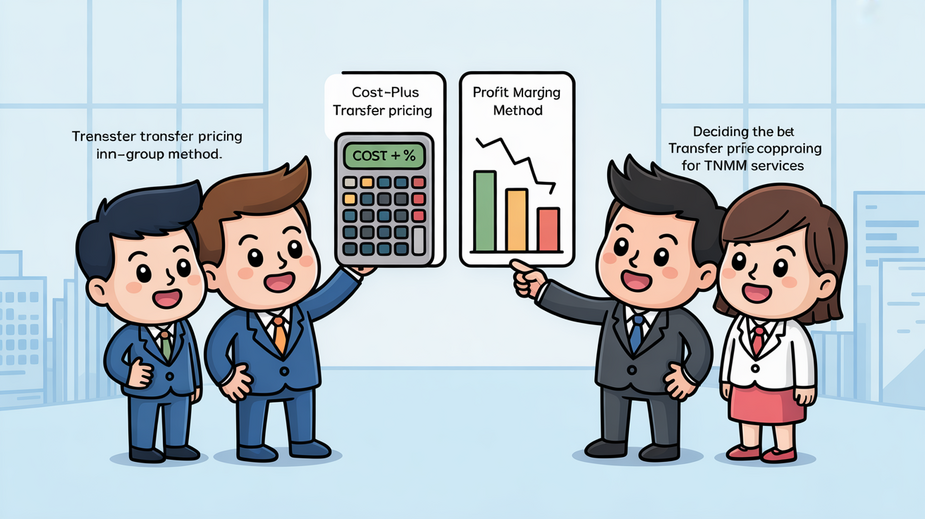

Hong Kong's Transfer Pricing Framework for Services The foundation of Hong Kong's transfer pricing regulations......

Understanding Offshore Trusts in Hong Kong An offshore trust is a sophisticated legal arrangement where......

Navigating Mainland China's Inheritance Landscape: Understanding the Risks For individuals and families accumulating substantial wealth,......

Current Stamp Duty Policy Landscape in Hong Kong Hong Kong's stamp duty system is a......

The Strategic Role of Trusts in Intellectual Property Management In the contemporary business landscape, intellectual......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308