Hong Kong's Tax Landscape for Business Sales For any business owner in Hong Kong contemplating......

DTA Networks: Scope and Global Reach Double Tax Avoidance (DTA) treaties are essential tools for......

Understanding Hong Kong Property Tax Fundamentals Hong Kong's property tax is a cornerstone of property......

Understanding Double Taxation Risks in Global Business Navigating the international business landscape offers significant opportunities......

Understanding Hong Kong's Territorial Tax System Hong Kong distinguishes itself with a territorial tax system,......

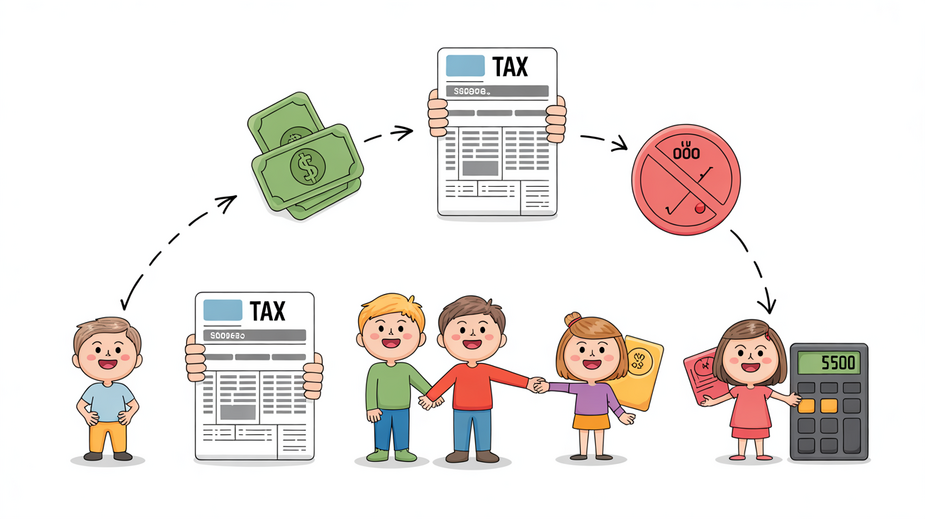

The Tax Workflow Bottleneck in Modern Businesses Modern businesses, irrespective of size, frequently face significant......

Understanding the Scope of Hong Kong Property Tax Navigating the tax landscape for property in......

Tax Filing Implications of Marriage in Hong Kong Getting married in Hong Kong is a......

Understanding Hong Kong's Capital Gains Tax Exemption Hong Kong distinguishes itself as a major global......

Hong Kong's Strategic Position for Global Wealth Management Hong Kong has long solidified its standing......

Hong Kong has established a comprehensive transfer pricing framework, meticulously designed to align with international......

Understanding Hong Kong's Capital Gains Tax Framework Hong Kong is renowned globally as an attractive......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308