Understanding Hong Kong Freelancer Tax Fundamentals Navigating the tax obligations as a freelancer or independent......

Evolving Regulatory Landscape in Greater Bay Area Operating across the Hong Kong and Mainland China......

Decoding Hong Kong's Partnership Business Framework Hong Kong provides a diverse array of business structures,......

Understanding Hybrid Mismatch Arrangements Hybrid mismatch arrangements constitute a significant area of complexity within international......

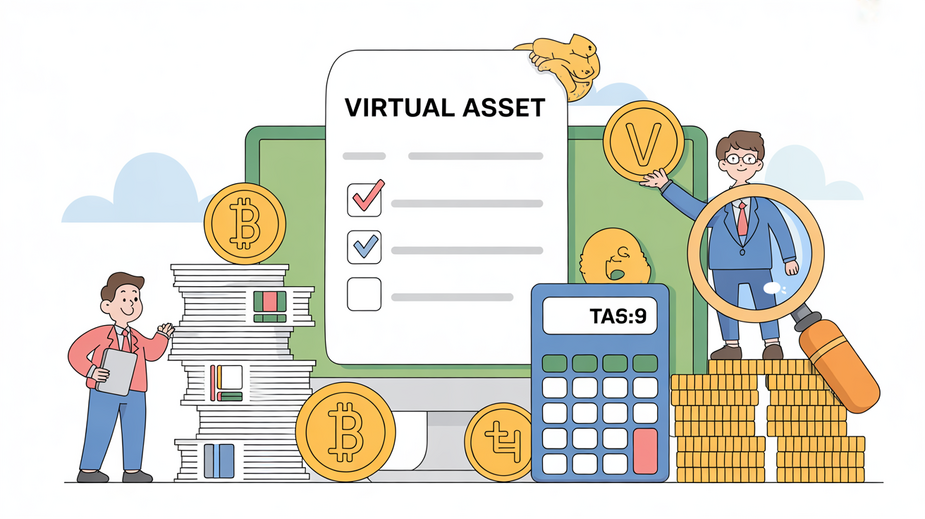

Defining Taxable Activities for VASPs For Virtual Asset Service Providers (VASPs) operating in Hong Kong,......

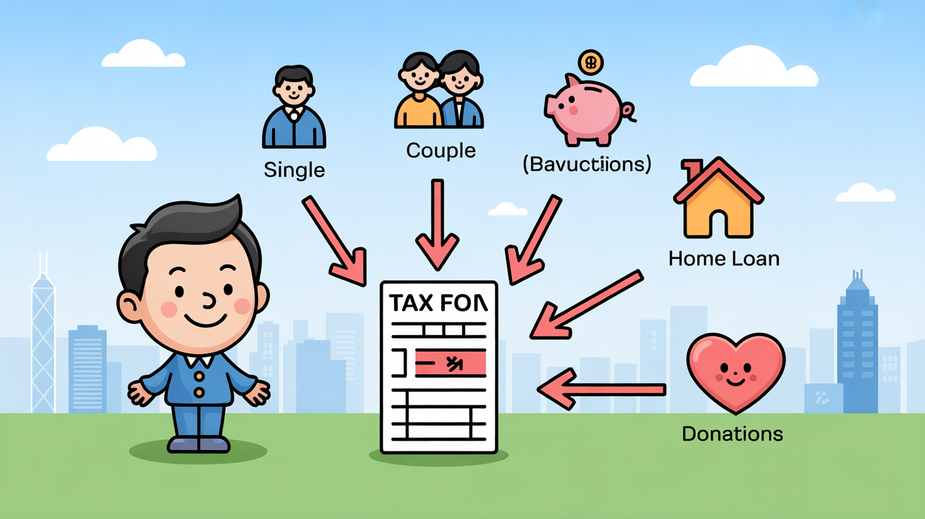

Understanding Personal Allowances in Hong Kong Navigating personal income tax requires a clear understanding of......

Decoding Hong Kong's Transfer Pricing Framework Hong Kong's transfer pricing (TP) framework is deeply rooted......

Understanding Hong Kong's Source-Based Taxation and Non-Domicile Status Hong Kong operates a territorial tax system,......

Why Tax Compliance is Non-Negotiable for Hong Kong Freelancers Operating as a freelancer in Hong......

Hong Kong’s Tax Regime: A Unique Advantage for Investors Hong Kong's tax regime is renowned......

Hong Kong's Integrated Approach to ESG and Tax Policy Hong Kong is strategically developing its......

Understanding Hong Kong's Stamp Duty on Overseas Equities Investing in foreign-listed stocks from Hong Kong......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308