Navigating the Post-Pandemic Economic Landscape: Challenges and Opportunities for Hong Kong SMEs The economic environment......

Understanding Hong Kong's Tax System Framework Navigating the tax landscape is a crucial first step......

Foundations of Legal Systems Compared Understanding the fundamental legal systems governing Hong Kong and mainland......

Landmark Cases Reshaping Expense Interpretation in Hong Kong Recent judgments from the Hong Kong Tax......

Understanding Tax Deductions for Retirement Insurance in Hong Kong Hong Kong's tax framework actively encourages......

Why Tax-Free Retirement Matters for Hong Kong Entrepreneurs Achieving tax-efficient retirement withdrawals is a primary......

East-West Communication Styles in Tax Negotiations Navigating a tax dispute in a cross-cultural environment like......

Eligibility Criteria for Dependent Parent Allowances Securing dependent parent allowances in Hong Kong requires meeting......

Navigating Property Tax and Lease Stamp Duty in Hong Kong Understanding the tax obligations associated......

Understanding Hong Kong's Property Tax Framework Hong Kong's property tax system is a fundamental aspect......

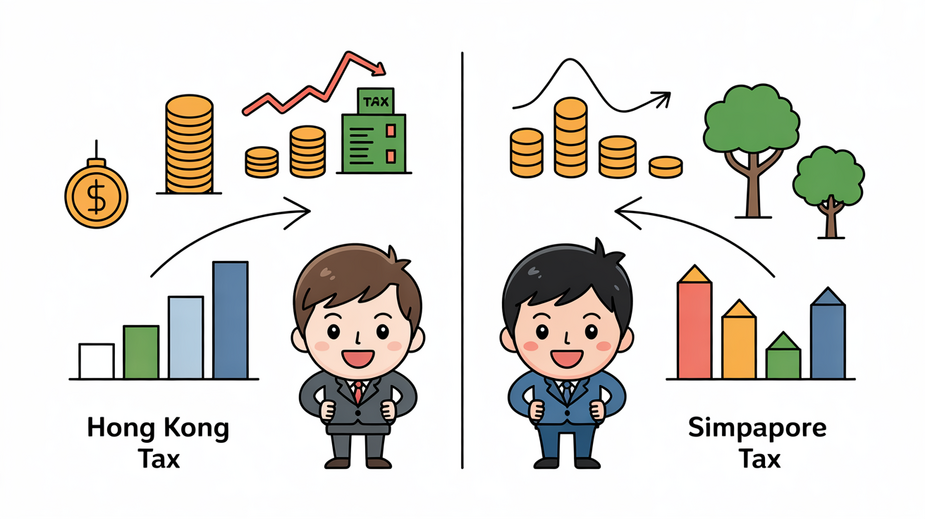

Strategic Position as Global Business Hubs Hong Kong and Singapore have firmly established themselves as......

Decoding Hong Kong's CFC Rule Fundamentals Hong Kong's introduction of Controlled Foreign Company (CFC) rules......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308