Immediate Steps Following an IRD Query Receiving official correspondence from the Inland Revenue Department (IRD)......

Understanding Tax Disputes: A Real-World Scenario Examining concrete situations offers valuable insight into the complexities......

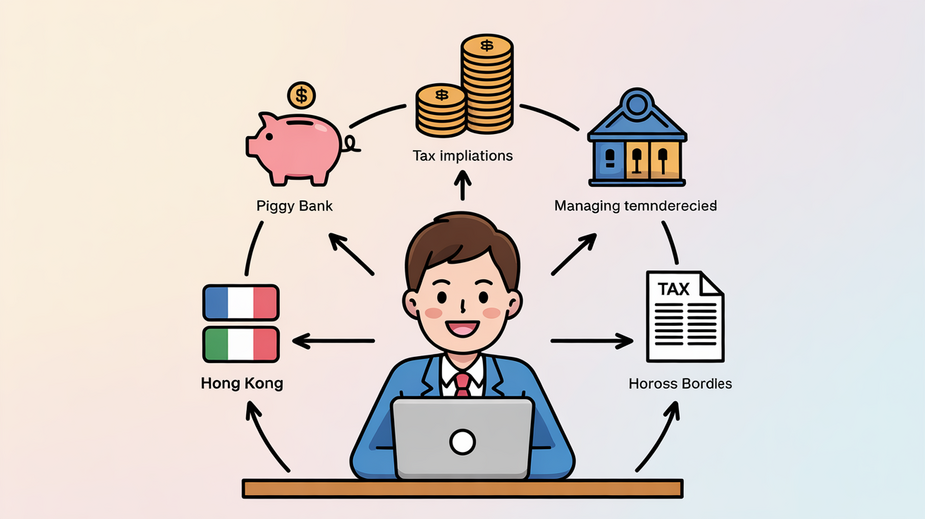

Why Dual Tax Optimization Demands Strategic Trust Planning Managing wealth and assets that span both......

Understanding Property Tax on Rental Income in Hong Kong Property owners generating rental income from......

Understanding Your Tax Filing Obligations in Hong Kong Embarking on your tax journey as a......

Hong Kong's Taxable Compensation Categories In Hong Kong, understanding how various forms of remuneration, particularly......

Hong Kong's Strategic Position for Global Wealth Management Hong Kong has long solidified its standing......

Hong Kong's Tax Framework for Rental Income Effectively managing rental properties in Hong Kong requires......

Hong Kong’s Territorial Tax System Explained Hong Kong operates a distinct territorial basis of taxation,......

Navigating Hong Kong's Tax Documentation Essentials Understanding and adhering to Hong Kong's tax documentation standards......

Understanding Cross-Border Management Fee Fundamentals Structuring operations between a Hong Kong entity and its counterpart......

Hong Kong’s Distinct Tax Framework for Regional Operations Hong Kong stands as a leading international......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308