Understanding Double Taxation Relief Fundamentals Operating across international borders, whether as an individual earning income......

The Critical Role of Accurate Customs Valuation in International Trade In the intricate landscape of......

Core Principles of Hong Kong’s Tax System Hong Kong's tax system is widely recognized for......

Purpose and Scope of the HK-UK Tax Treaty The Double Taxation Relief Agreement (DTRA) between......

Avoiding Common Pitfalls in Hong Kong Individual Tax Filing Navigating the annual process of filing......

Trust Fundamentals for Hong Kong Asset Holders Understanding the fundamental components of a trust is......

Understanding Hong Kong Property Tax Fundamentals Hong Kong's property tax is a cornerstone of property......

Understanding Hong Kong's Tax Year Framework Navigating the intricacies of Hong Kong's tax system fundamentally......

Time Drain: The Hidden Hours Lost to Manual Tax Filing Manual tax filing often feels......

Recent Shifts in China's Cross-Border Tax Legislation Mainland China is proactively reforming its tax framework......

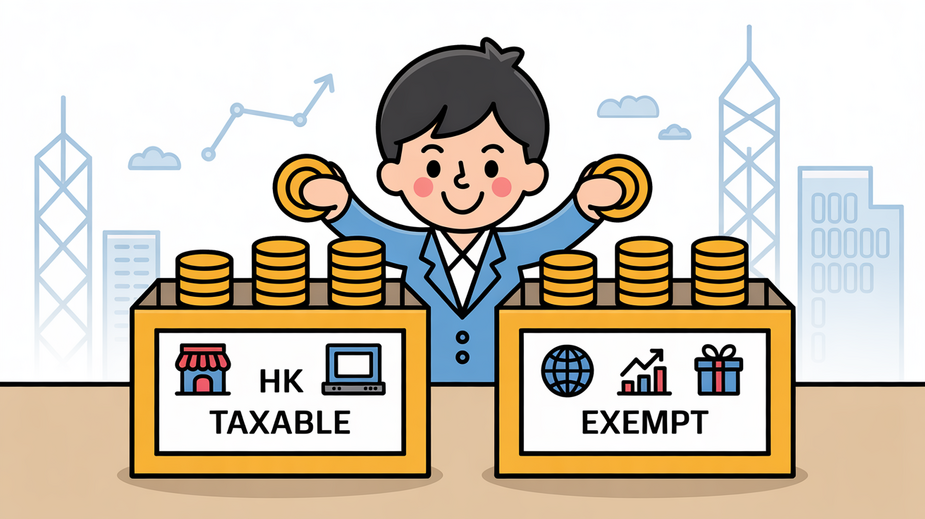

Defining Assessable Profits Under Hong Kong Law Navigating Hong Kong's corporate tax landscape begins with......

The Legal Position of Unmarried Couples in Hong Kong Succession Law Navigating the complexities of......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308