Hong Kong's Strategic Position for Global Wealth Management Hong Kong has long solidified its standing......

Hong Kong's Strategic Tax Position for Wealth Management Hong Kong maintains a prominent position as......

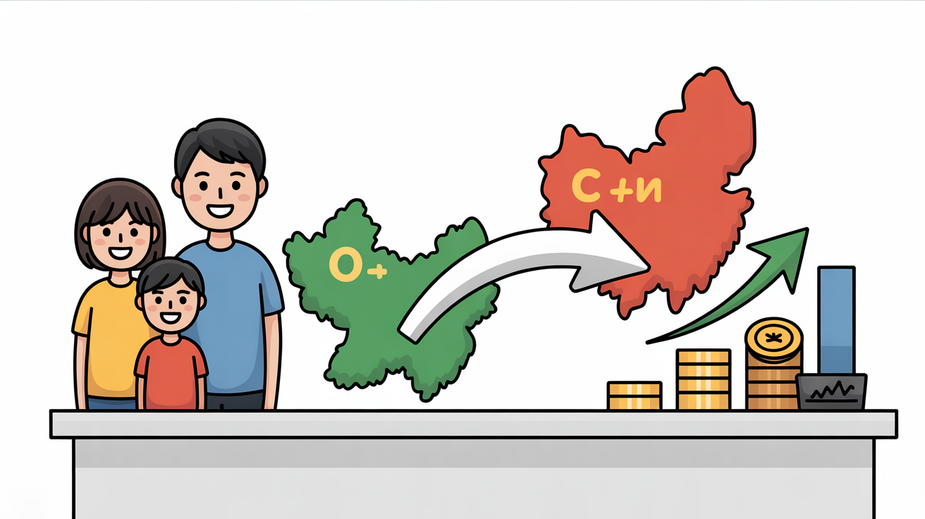

Key Differences: Territorial vs. Worldwide Taxation in Hong Kong and Mainland China When a company......

Understanding the Tax Investigation Process in Hong Kong Facing scrutiny from the Inland Revenue Department......

Understanding Rental Losses in Hong Kong Property Tax In Hong Kong's property tax system, a......

Understanding MPF Fundamentals for Hong Kong Employers For any business owner in Hong Kong, navigating......

Regulatory Foundations of Transfer Pricing Understanding the foundational regulatory approaches is essential when comparing transfer......

Understanding Dependent Eligibility Criteria for Hong Kong Tax Purposes Claiming dependents on your Hong Kong......

Immediate Financial Consequences of Tax Dispute Losses Losing a tax dispute in Hong Kong triggers......

Hong Kong's Customs Landscape: Navigating Current Challenges As a pivotal hub in global supply chains,......

Why Stamp Duty Knowledge Impacts Business Strategy For businesses operating or planning cross-border expansion, particularly......

Navigating the Dual Tax Landscape: Hong Kong vs. Mainland China for Family Offices Establishing a......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308