Key Updates in Hong Kong's 2024 Tax Framework Hong Kong's tax landscape is undergoing significant......

Understanding Hong Kong’s Property Rate System Hong Kong’s property rate system constitutes a fundamental element......

Understanding the Double Taxation Arrangement Framework The Double Taxation Arrangement (DTA) between Hong Kong and......

Understanding Cross-Border Transaction Fundamentals for Hong Kong Businesses For businesses operating in Hong Kong, engaging......

Why Self-Education Tax Relief Matters in Hong Kong In today's dynamic professional landscape, continuous learning......

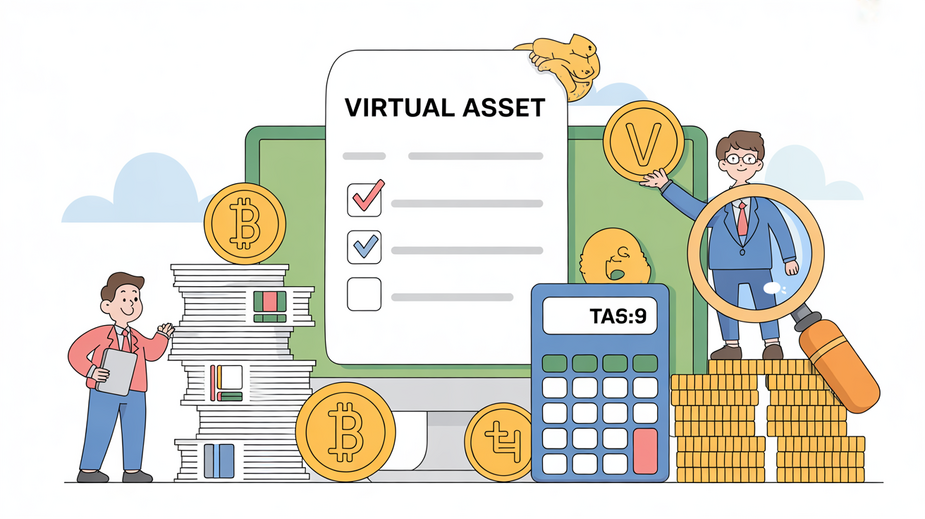

Defining Taxable Activities for VASPs For Virtual Asset Service Providers (VASPs) operating in Hong Kong,......

Current Landscape of Hong Kong Property Values The current state of Hong Kong's property market......

Understanding Hong Kong's Tax Treaty Landscape Hong Kong has strategically positioned itself as a leading......

Leveraging Hong Kong’s Trust Advantages for Wealth Preservation Hong Kong presents a compelling jurisdiction for......

Understanding Double Taxation Agreements (DTAs) Double Taxation Agreements (DTAs) are foundational international treaties designed to......

Navigating the Evolving Landscape of Global Tax Regulations The international tax environment is undergoing continuous......

Navigating Property Tax and Lease Stamp Duty in Hong Kong Understanding the tax obligations associated......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308