Understanding Property Management Fees for Hong Kong Rentals Property management fees in Hong Kong represent......

Greater Bay Area's Strategic Role in China's Economy The Greater Bay Area (GBA) initiative stands......

Defining Heritage Buildings in Hong Kong Understanding what constitutes a heritage building in Hong Kong......

Hong Kong's Territorial Tax System Explained Hong Kong operates under a territorial basis of taxation,......

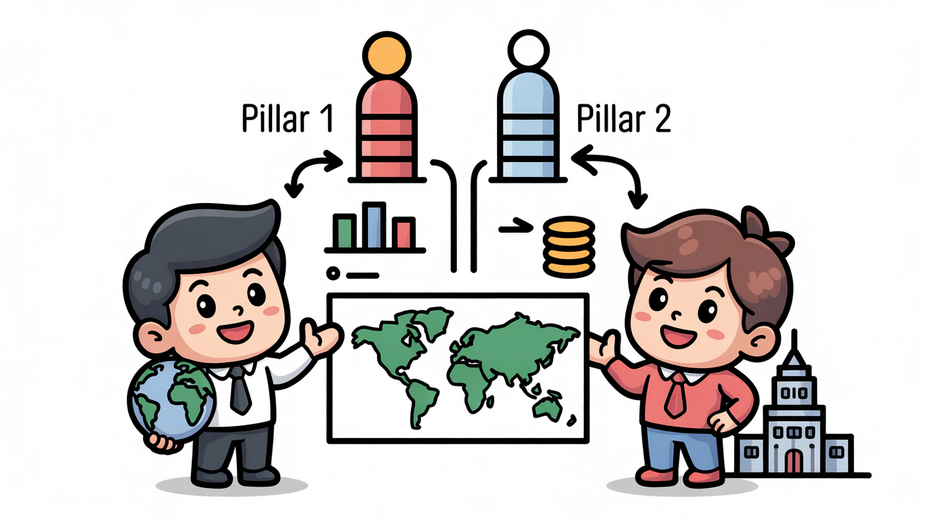

BEPS 2.0 and the Two-Pillar Framework Explained The international tax landscape is undergoing a significant......

Understanding Hong Kong's Tax Regime for VC Investments Navigating the tax landscape is a critical......

Immediate Financial Penalties for Late Tax Returns Failing to submit your Hong Kong tax return......

Defining Forensic Accounting in the Tax Context Forensic accounting is a specialized discipline that merges......

Understanding Mainland China's Tax Jurisdiction Navigating the tax landscape in Mainland China presents unique challenges......

Understanding Hong Kong's Capital Gains Tax Exemption for Real Estate Investors Hong Kong operates under......

Unique Advantages of Private Trust Companies for Sophisticated Wealth Management While traditional trusts remain valuable......

Understanding Hong Kong's Tax System Structure Navigating the tax landscape is fundamental for residents and......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308