Understanding Hong Kong's Stamp Duty Fundamentals Stamp duty in Hong Kong is a foundational tax......

Real-Life Case Study: Offshore Income Misreporting Risks A significant real-life case illustrating the potential consequences......

Navigating Hong Kong Offshore Tax Claims: Avoiding Common Pitfalls Businesses operating internationally often seek to......

Understanding the OECD’s CRS Framework The Common Reporting Standard (CRS), an initiative spearheaded by the......

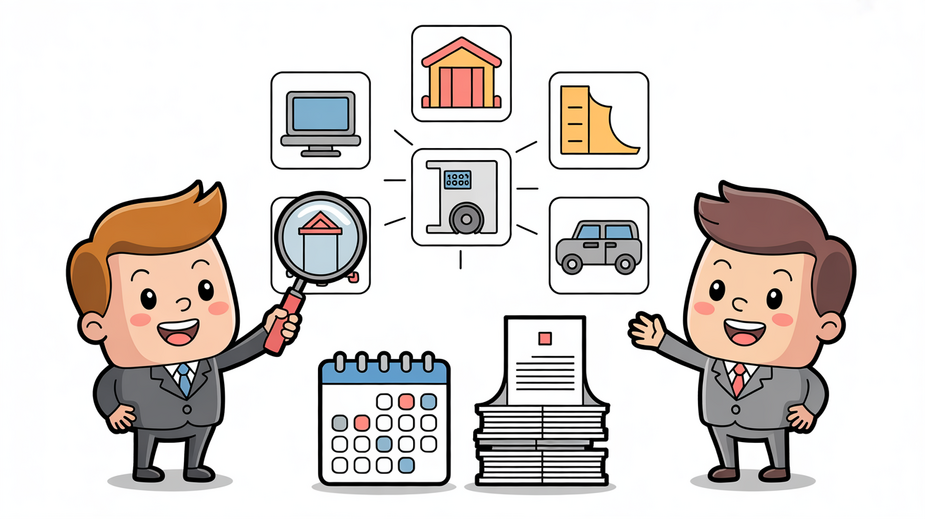

Decoding BEPS Action Plan 13 Requirements Transfer pricing documentation is fundamental to enabling tax administrations......

Defining Mixed-Use Property in Hong Kong's Context Hong Kong's exceptionally dense urban environment frequently necessitates......

Hong Kong's Distinct Tax Framework for Wealth Preservation Hong Kong distinguishes itself globally with a......

Escalating Financial Risks in Mainland China The economic and regulatory landscape within Mainland China has......

Hong Kong's Tax System: Key Features for Expats Hong Kong offers a remarkably straightforward and......

Capital Allowances 101: Core Concepts Demystified Understanding capital allowances is a fundamental aspect of tax......

Understanding Hong Kong's Two-Tier Tax Structure Hong Kong's profits tax system features a distinctive two-tiered......

Hong Kong's Territorial Tax System Explained Hong Kong operates a territorial basis of taxation, a......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308