Immediate Steps Following an IRD Query Receiving official correspondence from the Inland Revenue Department (IRD)......

Hong Kong's Financial Services Tax Advantages Hong Kong is renowned as a premier international financial......

The Strategic Value of Intellectual Property for Tech Startups In the intensely competitive landscape of......

Historical Context and Foundations of Hong Kong's Property Rates Hong Kong's system of property rates......

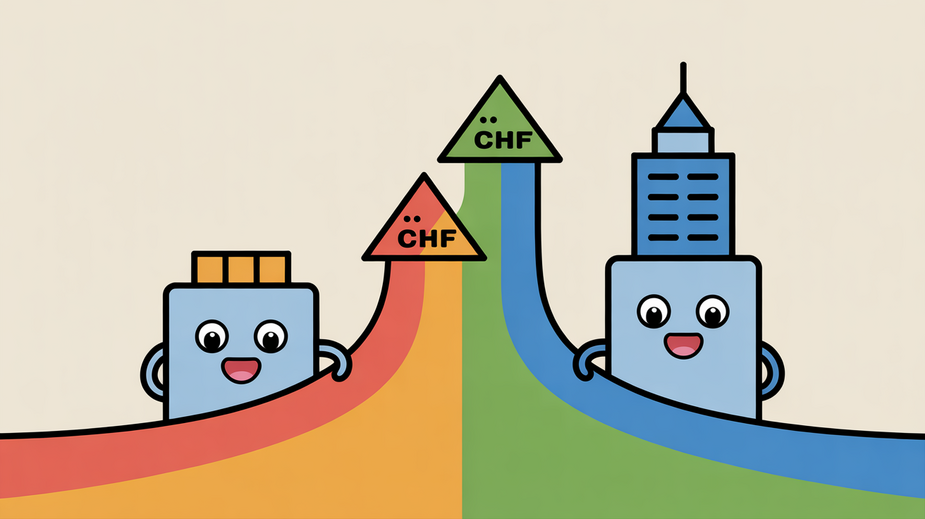

Understanding Hong Kong's Two-Tiered Profits Tax Structure Hong Kong's profits tax system features a distinct......

Why Tax Compliance Matters from Day One for Hong Kong Startups Launching a startup in......

Understanding Hong Kong's Progressive Two-Tier Profits Tax Hong Kong distinguishes itself with a progressive two-tiered......

Overlooked Pitfalls in Estate Distribution Practices Navigating the complex transfer of multi-generational wealth, particularly in......

Understanding Hong Kong’s Industrial Property Rate System Property rates are a fundamental component of real......

Understanding Hong Kong’s Framework for Charitable Trusts Establishing a charitable trust in Hong Kong provides......

Hong Kong's Taxable Compensation Categories In Hong Kong, understanding how various forms of remuneration, particularly......

Purpose and Scope of the HK-UK Tax Treaty The Double Taxation Relief Agreement (DTRA) between......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308