Understanding Cross-Border Dividend Tax Between Hong Kong and Mainland China Navigating the tax implications when......

Historical Context of Hong Kong's Stock Stamp Duty Hong Kong's system for levying stamp duty......

The Influence of Stamp Duty on Property Valuation and Transactions In Hong Kong, stamp duty......

Hong Kong's Tax Landscape for Retirement Savings Navigating retirement planning as an expatriate involves a......

Understanding Estate Donations in Hong Kong Estate donations, often referred to as charitable bequests, represent......

Evolving Tax Policies in a Digital Economy The accelerating shift towards a digital economy is......

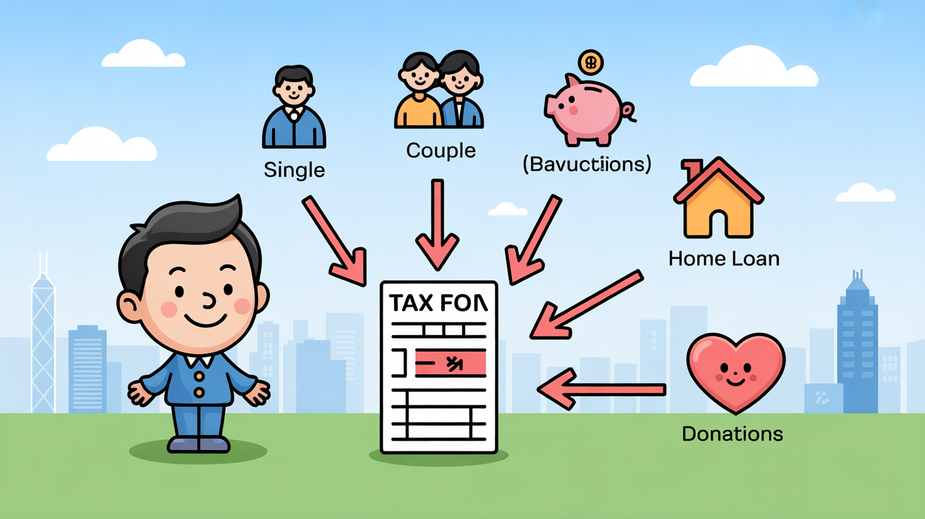

Understanding Personal Allowances in Hong Kong Navigating personal income tax requires a clear understanding of......

Hong Kong's Evolving Tax Landscape for Tech SMEs Hong Kong has solidified its position as......

Navigating Cross-Border Tax for Hong Kong Companies in Mainland China Operating a Hong Kong company......

Why Domicile Status Matters in Hong Kong Understanding your domicile status is fundamental for effective......

Understanding Hong Kong-China Cross-Border Taxation Operating a business across the distinct tax jurisdictions of Hong......

Core Differences in Structure and Location Establishing a family office necessitates critical decisions regarding its......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308