Historical Context of Hong Kong's Stock Stamp Duty Hong Kong's system for levying stamp duty......

Understanding Hong Kong's Tax Year Structure For small and medium-sized enterprises (SMEs) in Hong Kong,......

Navigating Permanent Establishment Thresholds in Hong Kong and Mainland China Understanding when a company establishes......

Understanding Offshore Trusts in Hong Kong An offshore trust is a sophisticated legal arrangement where......

Understanding Hong Kong's Free Port Status Hong Kong's designation as a free port is fundamental......

Hong Kong's Territorial Tax System Explained Hong Kong operates under a territorial basis of taxation,......

Understanding Hong Kong's Tax Year Framework Navigating the intricacies of Hong Kong's tax system fundamentally......

Offshore Income Classification Basics Understanding the fundamental distinction between offshore and onshore income is crucial......

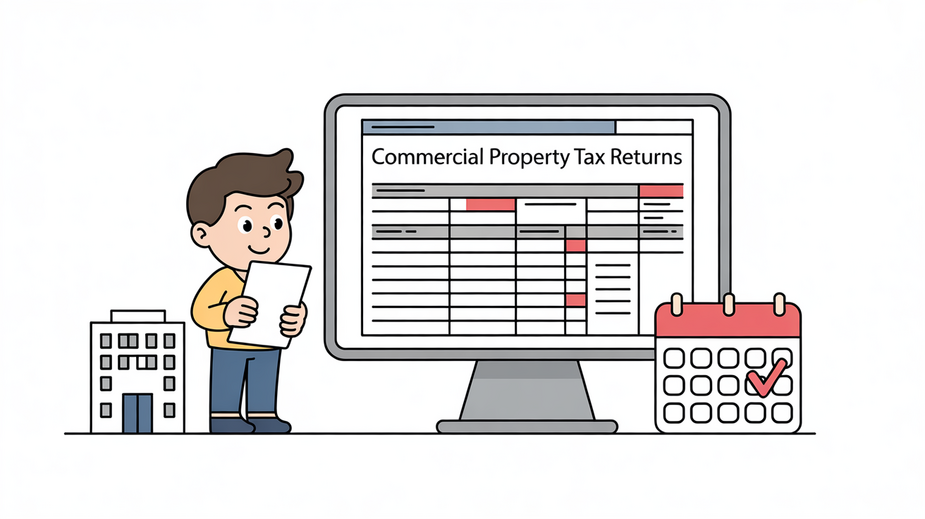

Understanding Hong Kong's Commercial Property Tax Navigating the specifics of Hong Kong's property tax system......

Hong Kong's Appeal for Expat Asset Management Hong Kong stands as a premier international financial......

Hong Kong Tax Calendar Essentials Navigating the tax landscape in Hong Kong begins with a......

Understanding Trust Distributions and Tax Liability in Hong Kong For individuals receiving distributions from a......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308