Hong Kong's Property Tax Framework Explained Hong Kong's tax system operates on the principle of......

Defining Forensic Accounting in the Tax Context Forensic accounting is a specialized discipline that merges......

Understanding Customs Duty Fundamentals Customs duties represent a significant, often underestimated, element of the total......

The Nuances of Hong Kong's Territorial Taxation Principle Hong Kong is often celebrated for its......

Understanding Hong Kong’s Two-Tiered Tax Structure Hong Kong distinguishes itself with a competitive two-tiered profits......

Decoding Hong Kong's Safe Harbor Framework for Transfer Pricing In the complex landscape of international......

Leveraging Hong Kong's Territorial Tax System A foundational element for structuring tax efficiency when operating......

Understanding Hong Kong Tax Residency Thresholds Determining your tax residency status is the critical first......

Navigating Hong Kong's Stamp Duty Framework for Securities Hong Kong maintains a well-established stamp duty......

Hong Kong's Tax Landscape for Digital Commerce Hong Kong operates under a fundamental and distinct......

Understanding Hong Kong's Property Rate System Expanding your business operations to Hong Kong involves navigating......

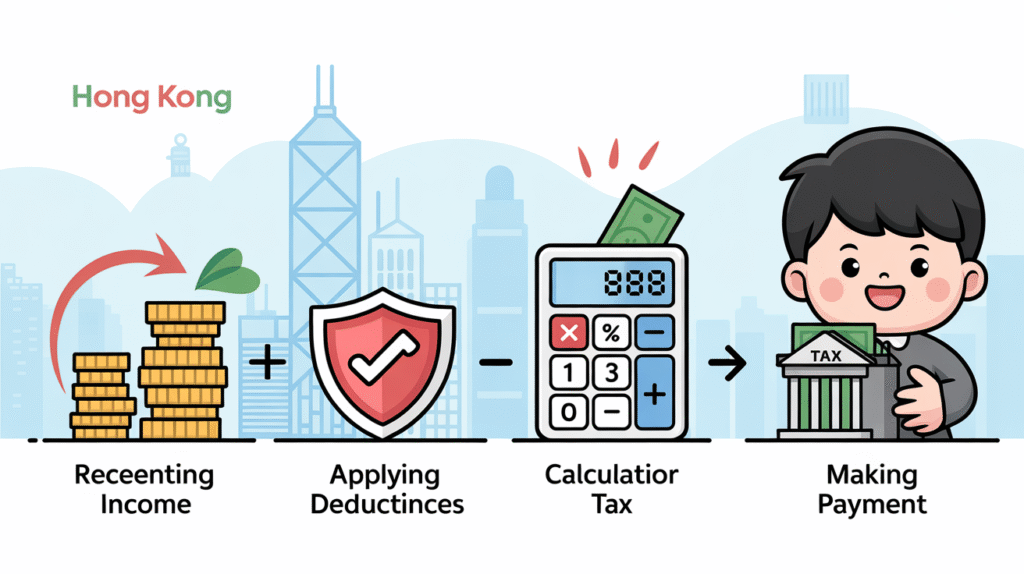

Understanding Hong Kong Salaries Tax Fundamentals Navigating the Hong Kong tax system begins with grasping......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308