Understanding Receivership and Distressed Property Basics in Hong Kong In the intricate landscape of Hong......

Time Drain: The Hidden Hours Lost to Manual Tax Filing Manual tax filing often feels......

Why Tax-Free Retirement Matters for Hong Kong Entrepreneurs Achieving tax-efficient retirement withdrawals is a primary......

Hong Kong's Tax Landscape for PE Firms Hong Kong has long been a premier hub......

Core Features of Hong Kong's Tax Framework Hong Kong's enduring appeal as a global financial......

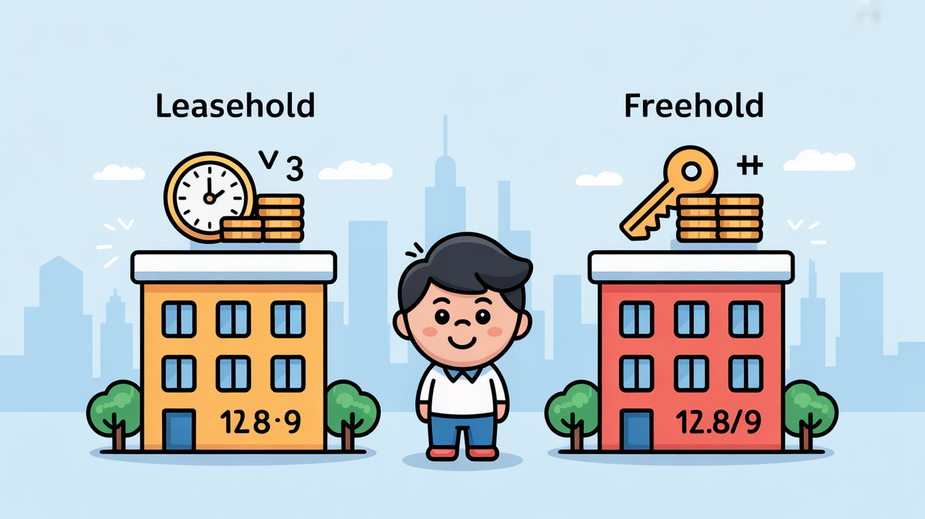

Understanding Hong Kong’s Land Tenure System Navigating the property landscape in Hong Kong necessitates a......

Understanding Hong Kong Tax Audit Triggers: Common Red Flags for the IRD Tax audits in......

Pandemic-Era Tax Policy Shifts in Hong Kong The onset of the COVID-19 pandemic posed significant......

Understanding Hong Kong's Territorial Tax Framework Hong Kong distinguishes itself on the global economic stage......

Understanding Hong Kong's Territorial Tax System Hong Kong operates under a distinctive and generally favorable......

Understanding Hong Kong's Unique Territorial Tax System Hong Kong's enduring prominence as a global financial......

Understanding Cross-Border Donation Tax Frameworks Donating from Hong Kong to Mainland China involves navigating two......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308