Navigating the Cross-Border Tax Challenges for Startups For a burgeoning startup based in the United......

Understanding Hong Kong's Progressive Tax System Navigating the complexities of Hong Kong's salaries tax is......

Understanding Family Offices in the Hong Kong Context In Hong Kong's dynamic financial landscape, comprehending......

MPF Withdrawal Tax Fundamentals Explained Navigating the tax implications of Mandatory Provident Fund (MPF) withdrawals......

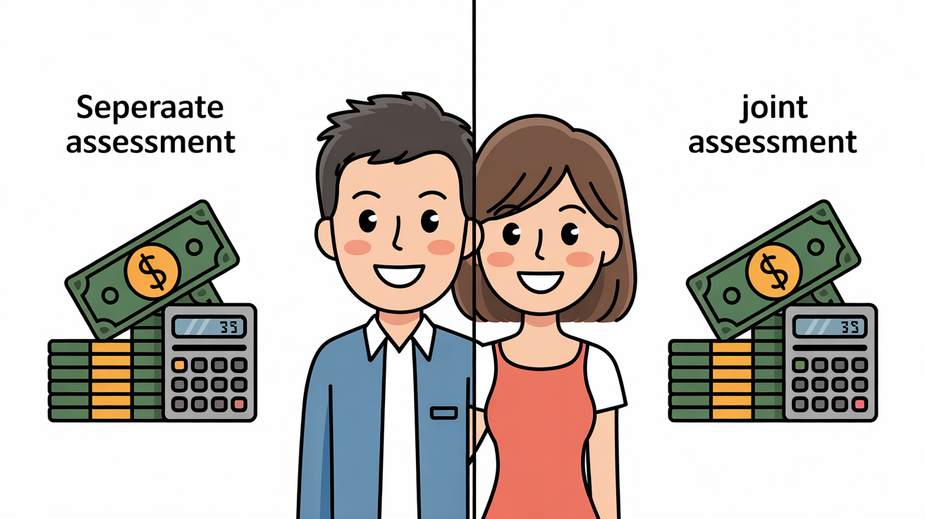

Understanding Salaries Tax for Married Couples in Hong Kong Getting married in Hong Kong signifies......

Navigating BEPS 2.0: Core Pillars and Global Impact The international tax environment is undergoing a......

Navigating Permanent Establishment Thresholds in Hong Kong and Mainland China Understanding when a company establishes......

Why Tax-Free Retirement Matters for Hong Kong Entrepreneurs Achieving tax-efficient retirement withdrawals is a primary......

Navigating the Complexities of Estate Planning for Hong Kong's HNW Families High-net-worth (HNW) families in......

Understanding Double Taxation Treaty Fundamentals in Hong Kong Double Taxation Treaties (DTTs), known in Hong......

Identifying Potential Issues in Hong Kong Tax Assessments Reviewing a tax assessment carefully is a......

The Legal Position of Unmarried Couples in Hong Kong Succession Law Navigating the complexities of......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308